Canada has just put a two-year ban on foreigners purchasing residential property.

It comes off the back of an election promise by Prime Minister Trudeau.

‘The desirability of Canadian homes is attracting profiteers, wealthy corporations, and foreign investors…

‘This is leading to a real problem of underused and vacant housing, rampant speculation, and skyrocketing prices. Homes are for people, not investors.’

There are a few exceptions to the Canadian rule.

Permanent residents and refugees, for example, are exempt from the ban. And in some states, the law is restricted to the bigger cities rather than regional areas.

But why mention it here?

Well, Australia and Canada have a lot in common.

They’re two moderately populated, wealthy countries with economies that are dependent on resources exports.

They both also attract plenty of Asian investment in their real estate markets.

For this reason, the property cycle in both regions has correlated quite closely in recent years.

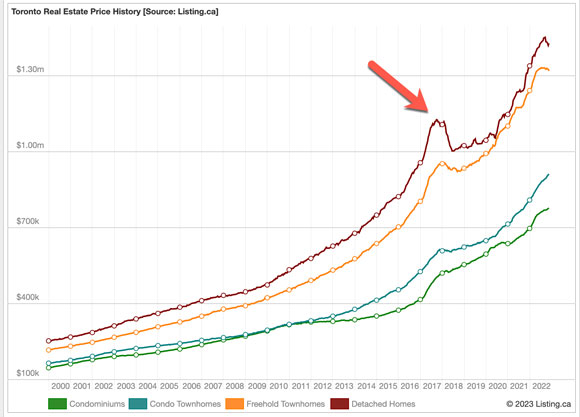

As an example, in both Canada and Australia, property prices roared in the first half of this current cycle to reach a peak in 2017 before undergoing quite a significant downturn in 2018 — a fall that was witnessed most prominently in the bigger cities, such as Toronto.

See the chart below:

|

|

| Source: toronto.listing.ca |

Similarly, the recent decline from the peak in Canada that was reached 12 months ago has been on a scale not seen since the GFC, with prices down 9% nationally.

In Australia, national values have dropped by 8% since their peak at the beginning of 2022.

Still, the Canadian ban has pulled in a lot of speculation from the mainstream that it will encourage Asian investors to target Australian real estate in preference, putting stress on local markets.

That’s also coming off the back of China opening its borders and the prospect of a flood of students, immigrants, and tourists eyeing up Australian property, perhaps also giving a boost to turnover in the relatively affordable regions of Perth, Adelaide, and Darwin, for example.

The thing that was missed, however, is that foreign investment in Canadian real estate had already fallen significantly prior to the ban!

Down from a high of 9% of residential sales in June 2016 to about 1% in June 2022.

This was due to laws implemented by regional governments in recent years.

In Ontario, for example, the government had already raised a ‘real estate speculation tax’ for offshore buyers from 20% to 25%, while British Columbia enacted a 20% tax on international home buyers.

Therefore, considering offshore buyers now only account for such a small percentage of the Canadian market, why the ban?

From The New York Times:

‘By mid-2022, prices across Canada had already begun to recede. But in June, without fanfare, the prohibition on foreign buyers was signed into law. In fact, it had gone largely undetected, even by many real estate professionals.

‘“This was one line in a document,” said Julie Côté, senior manager of the real estate taxation practice for non-residents at the FL Fuller Landau accounting firm in Montreal. “Then, silence. They never let the world know this was actually happening…”

‘“Trying to get information from the government about this has been a hell of a task,” Ms. Côté said.

‘That may be because the law has stirred accusations of xenophobia. As immigration numbers hit all-time highs in Canada — census data released in October revealed that immigrants now make up 23 percent of the population, with the vast majority coming from India and China…

‘Non-Canadians “got a lot of blame for the housing crisis, and it was a big issue politically,” said Brendon Ogmundson, chief economist of the British Columbia Real Estate Association. “But the pandemic shut off nearly the entire segment of foreign buyers, and prices still hit an all-time high”.’

Indeed.

In truth, measures such as this only tinker at the edges of issues of housing unaffordability.

They’re popularist, and banning foreign investment is low-hanging fruit for governments under pressure to look as if they’re doing something to help first home buyers.

After all, who isn’t going to give a virtue signalling nod to Trudeau’s quip that ‘Homes are for people, not investors’?

Note that 42 members of Trudeau’s party own rental or investment real estate assets, such as rental or investment properties, real estate holding companies, vacant land, recreational properties, or income from or significant interests in real estate brokerages.

It’s fair to say that, similar to our own political climate, little is going to be done to really stem speculation in real estate — or trigger a crash.

There’s too much vested interest.

Even so, it’s no surprise to see the media rally behind calls for a similar ban to be implemented here.

From news.com.au:

‘Australians are calling for the government to follow in the footsteps of Canada after the North American country introduced a controversial ban on foreigners buying properties…

‘On Sunday, the ban took effect, and has been met with a slew of enthusiasm from Australians also caught in the throes of a housing crisis.

‘“Fantastic! A policy we need in Australia — also the punitive taxes on empty homes and full-time AirBNBs,” one person wrote on social media.

‘Rental markets are the tightest they’ve been in years and comes as Australia’s median weekly rent now sits at $520 for houses and $460 for units…’

Many Australians think that foreign investment in residential property is a prime reason prices are so high in the capitals.

Let’s drill it down.

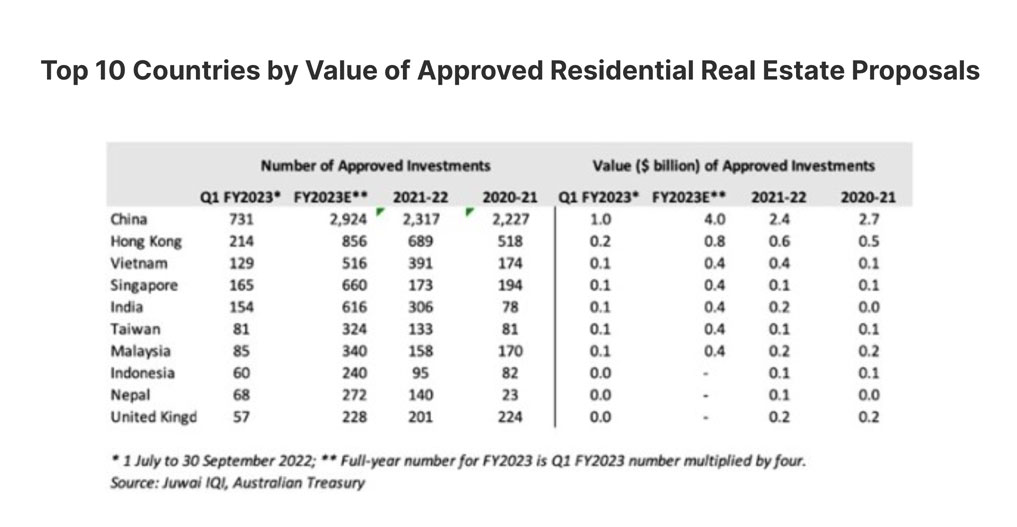

The latest data from the Foreign Investment Review Board shows mainland Chinese and Hong Kong investment in residential real estate tops the charts in Australia, with five times more money approved for investment in Australian houses and apartments as the next country (which is Vietnam).

‘“When you calculate it by the number of investments made instead of value, Mainland China and Hong Kong account for more than seven times the number of approved residential real estate investments as the next-ranked country,” commented Daniel Ho, Juwai IQI Co-Founder and Group Managing Director.’

|

|

| Source: The Property Tribune |

However, to put this into context, offshore buyers are mostly restricted to purchasing new property (the motivation being to increase stock and thus bring down rents and prices).

And further data compiled by NAB in the March quarter of 2021 showed foreign investors made up only 3.7% of new home sales and 2.2% of established homes.

A tiny percentage.

In short, even if a ban were implemented here, it couldn’t stop this current cycle or a potential market turnaround this year.

The level of foreign investment is not significant enough.

This is why we continued to see prices skyrocket despite borders being slammed shut in 2020/21 due to the pandemic and foreign investment plummeting to record lows through the period.

The reason land values continued to boom under such circumstances is because the local market is encouraged to speculate in real estate due to tax policies that allow them to keep the enormous capital gains that can be generated in the boom phases of the cycle.

Add to that record low rates and massive government stimulus, and it was inevitable that land prices in the areas where the money flowed would collect the gains.

Let’s not forget, land values are not borne from any productive activity undertaken by the owner who (as the classical economist John Stewart Mill termed it) ‘grows rich in their sleep without working, risking or economising’.

Rather, the value of land reflects its surrounds, growing primarily through increased demand generated by government-funded infrastructure, lending rates, and tax policies that encourage speculation (low capital gains, taxes, etc.).

Rising land values yield a special type of unearned income known as ‘economic rent’.

As a broad measure, land prices can be calculated by multiplying current rents by 20-plus years. This is known as the capitalisation rate.

It’s speculation induced by the capitalisation of the rental value of land into a tradable commodity that drives the boom-bust volatility of the real estate cycle. And right now, the level of foreign investment is negligible in the grand scheme of things.

Having said this, immigration will certainly play a part. It’s rocketing to record levels.

Money will flow into the country that will not be picked up in existing lending data.

The gains to land prices and rents will be most evident in the areas where the population flows. The regions where the available land has already been built out — capital city suburbs and the bigger regional markets.

This will assist in driving markets through 2023.

But don’t be pulled into the chatter via social and mainstream media. Foreign ban or not, the cycle in both Canada and Australia will not be disrupted.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor

Comments