The coronavirus is set to dominate headlines and financial markets this week.

Overnight most major markets fell as a wave of panic set in.

The Dow Jones fell 427 points (or 1.47%), UK and German markets both fell by over 2%, and while the Chinese market itself remains closed, the China A50 futures are down 5.5% — suggesting steep falls when they do open this week.

The knee-jerk reaction means this could be very bad.

So, in the short term, expect the falls to continue until we know more about how far this virus has spread and what the implications could be.

But in the long term (as I’ll show you at the end of today’s piece), the result could be surprisingly good for markets.

In a strange way, the falls today have nothing to do with coronavirus.

My feeling is that markets were looking for an excuse to sell-off anyway, and the coronavirus was just as good a reason as any.

A convenient scapegoat.

If it wasn’t this, it would’ve been something else…

The ‘reason’ could have been anything

The fact is, no market goes up in a straight line. And let’s be honest, the behaviour of the major indices has been pretty parabolic of late.

A correction is long overdue.

And when Presidential impeachments, US–China trade wars, and the threat of actual war with Iran can’t seem to move markets these days, the coronavirus has turned out to be the kind of left-field idea that has done the job.

After all, not even central bankers can do anything about a global pandemic!

We’ll see how the Aussie market fares today.

But such volatility could give you the chance to make some money if you can read this situation right.

It might appear a bit heartless to even think about how to make money from such negative events, but that’s what the markets are.

They’re not immoral, they’re amoral.

They simply respond to ‘what is’.

The amazing thing about investing is that everything that happens in the world — every action, reaction, expected outcome and associated probability — boils down to a single digit, a number.

Tens of thousands of individual binary decisions, made with individual thought processes, combine to create the final outcome through the simple act of buying or selling.

The point is this…

The coronavirus is just another data point for you as an investor to consider.

Sure, as a human, you might have other motivations to consider here. Like keeping yourself and your family safe…

But the market has a neutral focus on one thing only — making money.

With that in mind, here are some thoughts on which areas you should watch…

Risk-off for the next few weeks

As I said, the knee-jerk reaction so far has been one of fear.

And when markets are fearful, they look to safe haven assets like bonds and gold.

Indeed, gold bucked the trend overnight and shot up over 1% at one point before settling up 0.55%.

Ignoring the short-term emotional response, there’s also the possibility that this virus will cause a huge dent to Chinese economic growth.

If that tips the world into recession, there’s the argument a ‘gold as a safe haven’ play could be a smart one too.

Which brings us to Australian stocks…

Obviously, we have huge trade with China. If they go into lockdown and this virus ends up being as bad as some say it could be, then we will feel it.

Reports today estimate it could hit our economy by $2.3 billion as Chinese tourists and students stay at home.

Airline companies like Qantas Airways Ltd [ASX:QAN] and Virgin Australia Holdings Ltd [ASX:VAH] might also feel some effects, though funnily enough, the cheaper oil prices caused by this crisis might balance those effects out.

There were even some reports saying Chinese restaurants were empty, which could have a flow-on effect onto Aussie wine companies like Treasury Wine Estates Ltd [ASX:TWE]. Though, I don’t necessarily buy that narrative.

If the end of the world was coming, I’d probably start emptying my wine cellar pronto!

And it’s not all bad news…

Certain biotech stocks with products and research in the right areas might start moving higher as investors realise the extreme value they have in certain circumstances.

An interesting small-cap I came across is Biotron Ltd [ASX:BIT].

Its shares surged 40% on Wednesday.

Apparently, the company filed a patent for a coronavirus treatment as recently as December 2019 (before the crisis hit) and some eagle-eyed investors picked up on it.

Though be careful here as the company made no mention of it when asked to explain the surge, so it might just be investor hype.

And broadly speaking, remember this…

[conversion type=”in_post”]

Diseases are bullish

It’s easy to get caught up in any panic and the media love a bit of sensationalism.

But if you’re a long-term investor, it pays to keep your head.

In my experience, the best way to play such moments is to ignore them and stick to your long-term plans.

And history suggests that markets will bounce back from this hard.

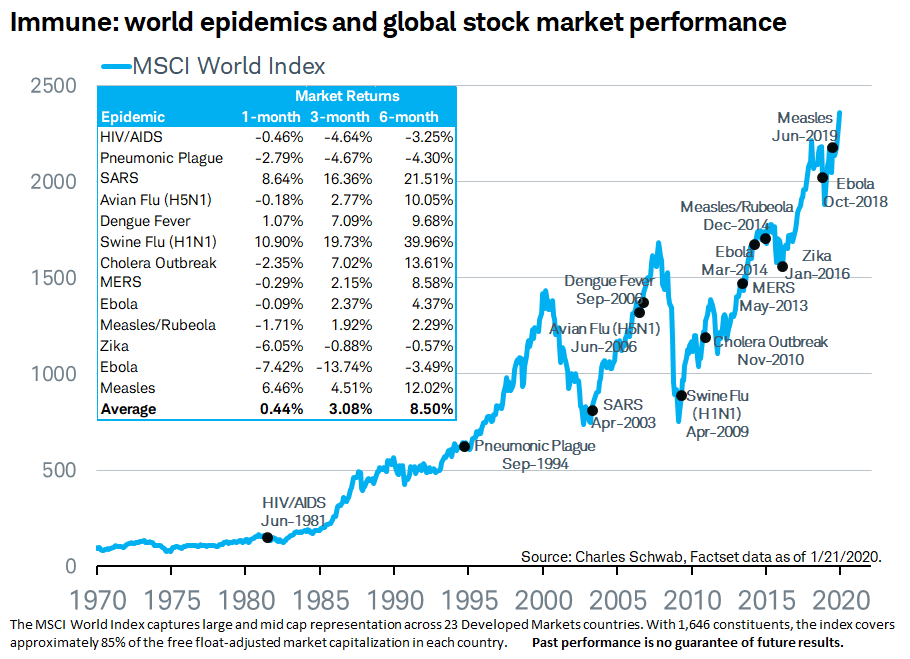

Check out this chart:

|

|

| Source: MSCI |

Within six months of the SARS epidemic in 2003, markets had jumped 21.51%. The average gain after six months is 8.5%.

It appears, as is usually the case, short-term panics are buying opportunities for the brave.

To be clear, I don’t mean to downplay the situation here. Like you, I’ll be watching this carefully, and with a little bit of worry.

But here’s hoping it gets sorted out sooner rather than later.

If it does, history suggests now is not the time to panic. Financially or any other way…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX, in particular small-cap stocks. Learn all about it here.

Comments