We examine Altium Ltd’s [ASX:ALU] share price outlook after recent ASX tech sell-off.

The last few months have not been kind to Altium and its share price.

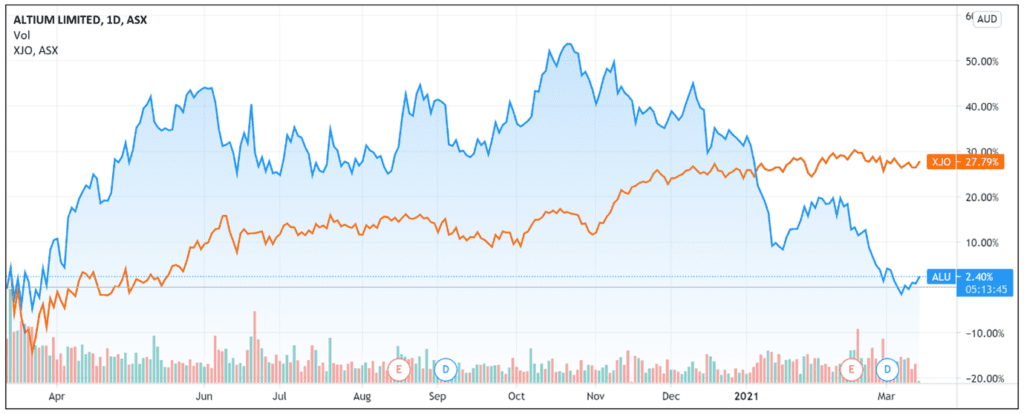

At time of writing, the ALU share price is down 22% YTD and shed 13% in the last month.

Altium is also trading down from its 52-week high of $40.21, a 34% reduction.

Compared to the ASX 200 [XJO] benchmark, Altium shares are down 25%.

ASX rotation into value

The Altium share price drop coincided with a larger tech sell-off recently as investors cycled out of growth stocks amid inflation and interest rate fears and rising bond yields.

For instance, the ASX growth starlet Afterpay Ltd [ASX:APT] saw its shares drop almost a third from a 52-week high of $160.05, achieved on 11 February.

This week also saw for the first time ‘since 1993 that the Dow rose and closed within 1% of a record, while the tech-heavy gauge was down more than 10% from its high’, according to Bloomberg.

And according to S&P Global, the S&P/ASX All Technology Index is currently down 9% while the S&P/ASX 200 Value Index is currently up 6%.

Altium valuation

Altium’s net profits are on the low side compared to a market capitalisation of $3.42 billion.

This means that Altium currently trades with a stretched P/E TTM (trailing 12 months) of a heady 108 and annual revenue TTM of 230.9 million.

In comparison, Altium’s ASX tech sector peer Appen Ltd [ASX:APX] has a P/E TTM of 42 with annual revenue TTM of $599.8 million and a market capitalisation of $2.13 billion.

Fellow ASX software company TechnologyOne Ltd [ASX:TNE] has a P/E TTM of 45.5.

Altium’s half-year results

In its latest ASX results release, Altium reported a 4% decline in revenue, totalling $80 million.

Half-year profit after income tax from continuing operations was down 12.1% to a moderate $16.6 million.

The company reported a 12% bump in its subscriber base, now totalling 52,157, with Altium stating that ‘renewals remain resilient through COVID and strengthened by pivot to cloud.’

Altium did declare an interim dividend of 19 cents per share for the half-year ending 31 December.

What next for the ALU Share Price?

With larger inflation fears permeating the market and a rotation out of growth stocks with large market capitalisations but small comparable profits, investors may currently have a mixed outlook for Altium shares.

Certainly, its latest half-year results disappointed investors and demonstrated that Altium still has a while yet to scale its products.

While Altium’s latest results did not quite impress investors, its latest release did hint at how the company can brighten investors’ mood.

In the half-year release, ALU reported that its Altium 365 product launched last May now has more than 9,300 active users, up 83%.

Active accounts are also up 69% to total 4,400.

This represents a ‘hard pivot to cloud’, according to Altium’s release.

This follows news that Altium is collaborating with Amazon’s AWS to host Altium 365.

In a competitive sector, companies must always seek to innovate and add to their product offerings.

As a tech stock, strong YoY growth in sign-ups for its Altium 365 product may reinvigorate investor interest.

What are analysts saying about Altium?

Aberdeen Standard Investments’ Michelle Lopez thought ALU shares could be a buy but only on a three-year view.

Speaking to Livewire Markets, Ms Lopez noted that, according to her, investors need to realise that Altium are ‘world leaders’.

She pointed out that Altium’s printed circuit boards ‘basically go into every industry.’

Ms Lopez concluded that Altium is still expanding into its addressable market and there is room for its software to be ’embedded even more than it already is.’

However, Monash Investors’ Simon Shields deemed Altium stock a sell.

He revealed that Monash Investors dropped the stock last October because Altium was ‘struggling to meet its targets‘ and ‘it certainly continued to struggle to meet its targets.’

While Mr Shields admitted the high expectations placed on the company, he nonetheless believes Altium’s struggle to execute and meet these expectations is a ‘red flag.’

With market volatility and global uncertainty about inflation and bond yields, it can be tough to know where and how to put your money to good use.

However, our very own Greg Canavan’s been investing for 20 years and he thinks the time to enter the market is now.

He doesn’t look at small-caps, cryptos, or hyper growth stocks.

Instead, he thinks the time is ripe to invest in good old-fashioned fundamentals and healthy balance sheets.

If you want to find out more, check out the following link.

Regards,

Lachlann Tierney

For Money Morning

Comments