Markets have staged a mini comeback in recent days.

Yesterday the ASX All Ordinaries Index — the main index of Australian listed stocks — surged 7%.

Today that looks set to continue with overnight gains on Wall Street feeding into a more positive investor mood.

Though I did read one snarky comment on Twitter saying:

‘Markets rise on news they aren’t falling.’

Clearly not all are convinced the good times are back yet…

The Aussie market gains were in large part due to the announcement of a whopping $130 billion government wage protection scheme.

The ‘Job Keeper’ program.

This unprecedented response was clearly a positive for markets. And as I’ll explain shortly, such stimulus historically results in sustained stock market gains. But maybe not this time.

The big question for you as an investor now is this:

Is this the bottom?

Is it time to take the plunge and load up on ‘cheap’ stocks?

Or are stock markets going to fall further?

Is the economy so royally stuffed that the six-month ‘Job Keeper’ hiatus is merely a time bomb set to explode later on?

The only person I know who called this crash accurately

Unfortunately, none of us have a crystal ball.

But we have the next best thing…an opinionated Queenslander!

Tomorrow my colleague Vern Gowdie will give you his take on the economy. And you should pay close attention.

Because, although I poke a bit of fun at him, Vern was the only person I know who called this crash accurately.

Of course, he didn’t know there was a global pandemic around the corner.

But what he did know was that the markets were standing on a precipice. And any falls would be a lot more dramatic than people realised.

He’s spent years working out how the dominoes are going to fall. But few listened to him.

I remember him putting out a report back in January this year saying he expected the ASX to fall 65%. People wrote in to us saying he was ‘crazy’, a ‘doomsayer’, and worse things I can’t put in print…

Well, so far, we’re down 40% just three months later.

Vern’s not looking so nuts after all…

Anyway, the good news is he’s going to give you his latest thoughts on our economic predicament over the next few days, starting tomorrow. I’d advise you to tune in.

[Editor’s note: If you can’t wait for that, you can watch this short video interview with Vern and our ex-publisher Dan Denning straight away.]

For the rest of today I want to give you my thoughts on the pressing question we’re all thinking about: Buy now, or buy later?

The old playbook BUY

Most market crashes follow a predictable pattern…

Something bad happens — a trigger point unravels years of excess.

Markets crash.

People panic.

Governments react to the panic. Problems are then swept under the carpet or saddled onto unwitting donkeys.

Eventually, a recovery begins…and Warren Buffett usually makes another billion or two.

That’s the modern experience of markets stretching back to the ‘80s.

The Fed has your back is the underlying message drummed into investors over the decades.

Right now, I can see a lot of retail investors are indeed nose deep in this playbook thinking the time to plunge back into the market is at hand.

Personally, I’ve started getting calls from old friends asking what stocks to buy.

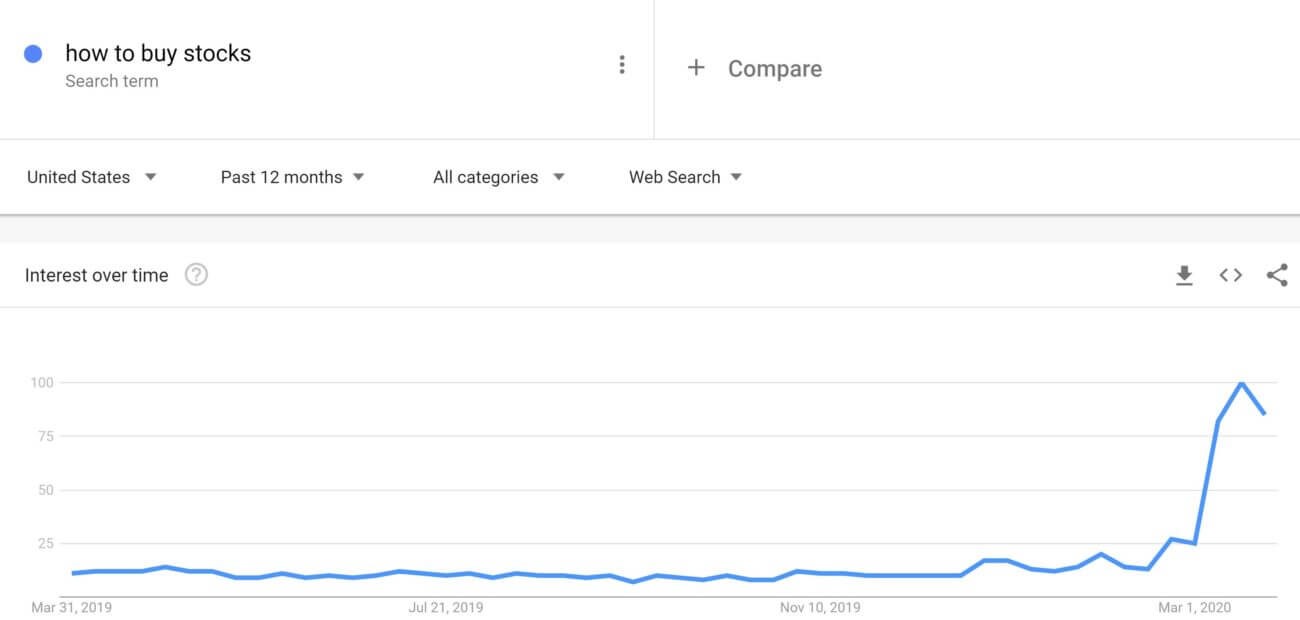

Data from Google Trends suggests a surge in searches for ‘Dow Jones’ and ‘how to buy stocks’ lately.

|

|

| Source: Google Trends |

The contrarian in me worries about this.

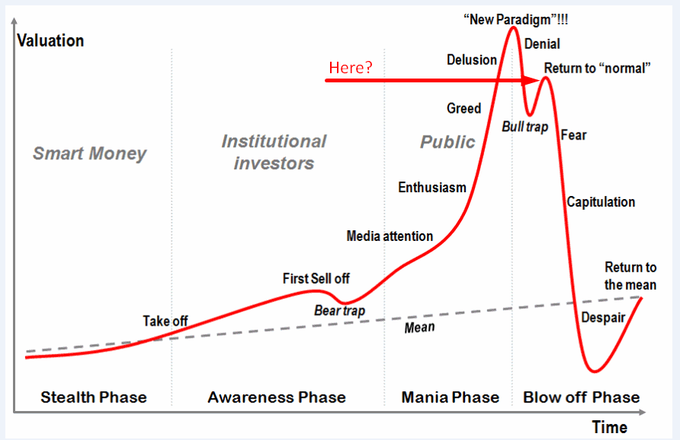

Markets in this situation tend to try and cause most damage to the most amount of people. This could be a classic bull trap as shown below:

|

|

| Source: Twitter @KeithMcCullough |

You can see the initial ‘return to normal’ expectation turns out to be a false move before deeper falls.

And yet…

The fact is, the amount of money being thrown at this thing is frighteningly large.

The old playbook — the one that says the Fed riding in on their white horse to bail out everyone is a buying opportunity — would suggest we won’t get a second wave down.

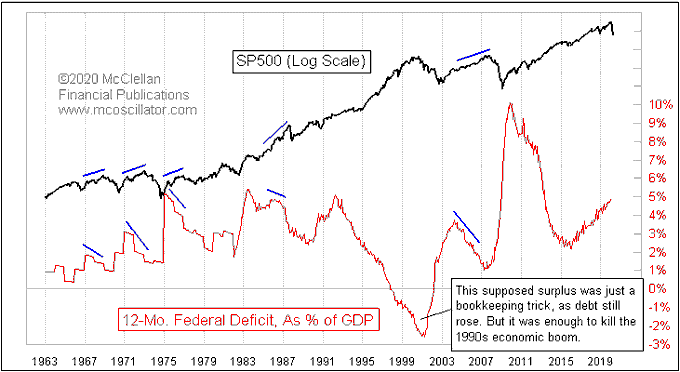

Check out this chart to see why:

|

|

| Source: McClellan Financial Publications |

Rising deficits might be bad for lots of things, but they’re uniformly bullish for stocks. All that freshly printed money has to go somewhere I suppose.

It’s only when someone tries to reduce them later that markets react badly.

So, time to start buying stocks then?

Not so fast…

The difference this time around is that there’s a third factor at play, and it’s got its own agenda…

The third factor and how to account for it

This time we’ve the timeline of the virus to contend with too.

This isn’t malleable to government policy or central bank interventions. And we’re still struggling to find the appropriate response to bring it under control.

It’s a big unknown for investors…

Go too hard and we risk undermining the global economy. Go too soft and this thing will be with us for many more months causing immense economic damage — not to mention the human suffering too.

I’m watching the unfolding situation in the US particularly closely. If this turns into a new epicentre for the virus, then things could still get very ugly in the markets despite the government largesse.

I’m not saying it’ll happen, but it could, and you’ve got to be ready for it.

But it doesn’t mean you shouldn’t start seeking out good long-term investments now. Just be smart about how you do it.

12 months from now we could be looking back at this as a bad dream. Life will be back on its merry way and it could be the investing opportunity of a lifetime.

If you’re of that mindset, my advice is to choose stocks with survival prospects first, companies with solid businesses and proven models.

For instance, you don’t want to invest in a company that‘s struggling for cash. Who wants to be raising more money in an environment like this?

Avoid the speccies with no funding for now. Their time is in raging bull markets, not volatile times like this.

In my experience, large stocks tend to bounce back faster than small stocks. So, look for quality first.

And I say that as someone who runs a small-cap investing service. But it’s the truth, at least as far as market timing goes. Large-caps lead the market, small-caps follow later.

This is not a time to panic. It’s a time for ACTION. Click here to download your free report now.

The converse to this is that you can start to pick up unbelievable value in good small-cap stocks as few others are looking there.

So, if you’re going to put in a bid on a small-cap you like, make it a low-ball bid and let the sellers come to you.

Alternatively, you can do this…

I’m advising my subscribers to dollar cost average — to buy into certain select small stocks by spreading their investment over a few months, rather than investing all at once in a stock — as a smarter way to invest at this time.

In short, don’t be too scared to act. Make sure you have a good investing plan that can deal with anything, and you should come out of this OK.

Good investing,

Ryan Dinse,

Editor, Money Morning

Comments