The weekend was dominated by the escalating conflict in the Middle East between Iran and Israel (as well as the heart-breaking tragedy in Bondi Junction. My thoughts go out to anyone affected).

Now, I’m no expert on geo-politics so I’m not going to pretend I know what’s going on.

But probably the piece of commentary that resonated with me most was this cartoon:

| |

| Source: Wall Street Silver |

A bit cynical maybe, but as I’ll show you shortly, there’s a lot to be cynical about in our current system – and only one way to exit it.

Anyway, only one major financial market was open during the skirmish.

It fell hard when the news first broke. It’s since found some support, 5% lower, but it could be a prelude to the market opening this week.

I advise being careful and not to get too reactive on such news.

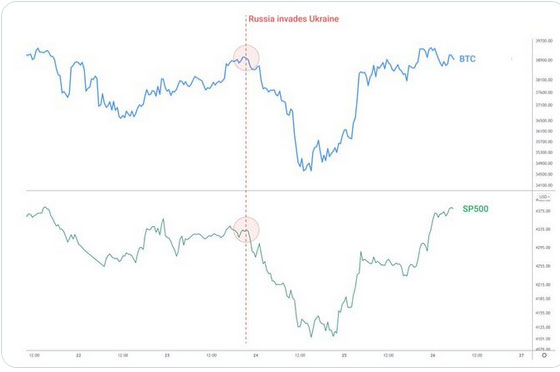

Check out this chart for example:

| |

| Source: Willy Woo |

It shows the chart of both Bitcoin and the S&P 500 after news of the Russian-Ukraine invasion.

As you can see, the swift initial falls were quickly reversed.

The thing is, for people who understand this market properly, this was the completely wrong reaction!

People still think it’s a risk asset when the truth is it’s a safe haven. It just goes to prove how early we still are.

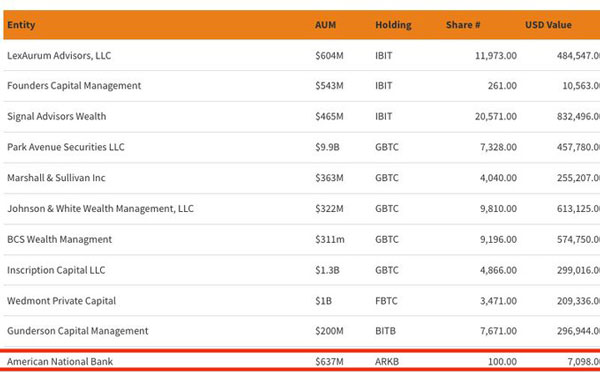

In fact, some major financial players have already spent the past two months adding this asset as a risk hedge.

A US$6 billion subsidiary of the Royal Bank of Canada now owns it.

As does a US$3.6 billion investment firm serving 25 states in America.

In fact, it’s just came to light that around 25 Wall Street firms with a combined US$15 billion under management are all owners of this ‘exotic’ asset.

And it’s likely this figure will rise over the rest of April and May as statutory 13F filings are slowly released.

So, what are they buying?

And what do they know that you don’t?

But first, let me ask you a question…

Are you a super user?

Well, are you?

If you don’t know what I’m talking about, it’s likely you’re not. In fact, you’re not.

It’s a special status reserved only for the financial elite.

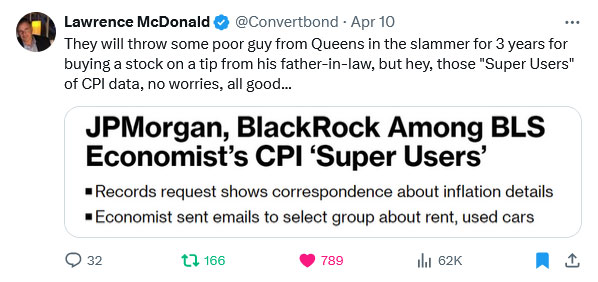

You see, it was revealed last week that Blackrock, JP Morgan, and several big-name hedge funds were all given insider inflation data from the Bureau of Labor Statistics before it was released publicly on Wednesday.

It’s reported they were on a special email list called ‘Super Users.’

I can’t begin to tell you how corrupt this is.

Inflation data has the power to move trillions of dollars’ worth of investments.

So, any advance warning gives you an unbelievable trading edge.

How is this not insider trading?

As one person I follow tweeted:

| |

| Source: X.com |

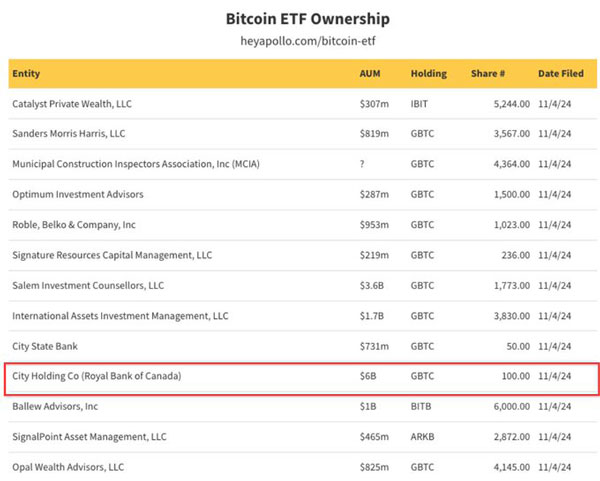

It just goes to show how lopsided the current monetary system is.

You’re either inside or outside the inner circle – and I can assure you we’re not in the insider club.

This barely concealed corruption has flow-on effects down the system.

As the old saying goes, the fish rots from the head.

Don’t forget this troubling story that was conveniently brushed under the carpet in 2021:

| |

| Source: New York Times |

If the ‘guardians’ of the financial system are front running their own decisions, what do you think the rest of the industry is going to do?

Anyway, that’s the system we live in right now.

But perhaps over time things can change.

One asset certainly has the potential to help ring in a fairer system.

And that brings me to what a swathe of financial institutions and banks in the US are starting to buy…

Banks start to buy bitcoin

In an ironic twist, the US banking scare of last year was caused by banks having too much government debt on their books.

As interest rates rose, the value of this debt fell fast. Resulting in bank runs and other issues.

Remember the world’s pristine asset – US government debt – was the cause of this drama.

Which is maybe why certain banks and financial institutions in the US are starting to hedge their bets by buying Bitcoin.

Maybe they’re starting to distrust the system as much as I do!

You see, those regulatory filings I talked about at the start have started to reveal some interesting buyers of the new Bitcoin ETFs recently.

Check it out:

| |

| |

| Source: Apollo |

TD Bank – a US$102 billion bank – even had an advert on TV recently spruiking their new Bitcoin products.

It seems on some level the US finance industry has had a complete rethink on Bitcoin (it’s a shame Aussie banks, and super funds seem to be missing the big picture on this still).

No doubt this sudden interest in Bitcoin has been spurred on by Blackrock’s epiphany last year.

The Larry Fink headed financial behemoth was instrumental in getting the new spot Bitcoin ETFs to market.

So far, demand for them has been through the roof.

And it seems Larry isn’t finished there. He recently said on national TV that the ETFs were ‘stepping stones to a world of tokenised assets’.

In case I’m not being blunt enough here, it’s clear there’s been a complete 180 by some serious players that hated crypto for years.

But now they’re positively embracing it!

What’s changed?

And what do they know that you don’t?

A special presentation – Happening at 1PM today

I’ve been in crypto for a decade now.

This is as bullish a set-up as I’ve ever seen.

An event in just five days could be the catalyst for more big moves in the crypto market over the rest of 2024 and into 2025.

I want to help you find opportunities to capitalise on it.

For the chance of making good financial returns of course.

But also to help steer us toward a world without ‘super users’ or insider access.

Bitcoin represents the chance of a financial level playing field.

Which is all any true, free-market individual can ask for.

I’m giving a full presentation today on what’s going on and why it’s shaping up to be a cracker of a year.

And the current dip in the price of Bitcoin and the wider crypto market on geopolitical concerns could be the ideal dip to start buying.

Sign up here to get access to that.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader