In today’s Money Morning…the signal…the misconception…the RBA itself…and more…

Today I want to talk to you about interest rates. This has been a big topic of late, but I believe we’re just getting started in what could be a huge structural shift in the economy.

The problem is most don’t understand the mechanics of how this works.

Which means a lot of investors tend to overreact — or underreact — to certain headlines. I don’t want you to do that.

So today, I want to peel back the curtains a bit on what really matters with interest rate decisions…

The signal

You may have noticed the recent talk of global interest rates beginning to rise. An early sign of this shift was New Zealand raising their rates in October.

New Zealand have managed through the pandemic relatively well, not enduring the severity of lockdowns that we have had here in Australia. On top of that, our friends across the Tasman have managed to escape China’s anger and the trade war that Australia finds itself in the middle of.

This puts New Zealand in a relatively strong economic position and in a need to raise interest rates before most of the world.

Australia and New Zealand watch each other closely for economic indicators and interest rate expectations.

It’s worth noting, though, that the New Zealand rate decision wasn’t unanticipated. In fact, the market began pricing in a potential rate rise to occur a month earlier.

Now, as the stronger economies go first in raising rates, obviously the weaker ones will slowly follow. This is an early warning signal that you can pay attention to in your own investing.

As soon as New Zealand raised their interest rate, the spotlight turned to Australia and when we would begin raising ours. It also strengthens the prediction of further rate increases in New Zealand itself.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

The misconception

Here’s an important point I want to make, though.

There’s a misconception in the investing world that central banks make policy and interest rate decisions and then the market reacts. This is only partially true. The reality is more complex.

A big part of a central bank’s role is to guide the market. That’s why a huge part of Federal Reserve (the Fed) Chairman Jerome Powell’s and Reserve Bank of Australia (RBA) Governor Philip Lowe’s role is talking.

Them, along with all the other board members. This is also why the Fed has been issuing their dot plot, which is a chart showing the interest rate path guesses of each board member.

Spoiler alert: it is not very useful at predicting the future. However, I believe its main role is to create a sense of predictability and the illusion that the Fed actually knows what’s going on.

Being predictable is something former Fed Chair Janet Yellen was criticised for, for seriously messing up. In March 2013, Yellen was asked a question about how long it would take after the Fed ceased their asset purchase program until it started raising rates. Yellen stepped right into a trap and answered honestly with ‘something on the order of around six months’.

The answer was unexpected, and the markets had a mini-meltdown. This was only a few months after the previous Fed leader Bernanke had sparked the famous taper tantrum of 2013. So Yellen should’ve known that she needed to approach the topic carefully.

Yellen made two mistakes here.

Firstly, she didn’t properly guide the market to this point. The Fed uses a constant stream of commentary from all the board members to slowly shift their stance and the market’s expectations. It’s usually very well-orchestrated.

Secondly, she was completely wrong. And now let me clarify, the Fed despite all of its forecasting doesn’t have a crystal ball and pretty much is constantly making incorrect predictions.

This isn’t why Yellen was completely wrong. She was completely wrong because she ignored what the market was telling her. Her statement went completely against the interest rate expectations that the market had priced in.

And this is where a big part of the misconception comes in. It is not just the Fed’s job to lead the market, but it’s also their job to follow the market.

But what about here in Australia?

The RBA Itself

Now, I know there’s a lot of commentary already floating around about the RBA’s decision last week, so I won’t dwell on it for too long.

If you missed it, last week the RBA left interest rates unchanged, but importantly they dropped a yield target on April 2024 bonds.

This decision is a big one for those with a mortgage, as it was a big part of what was allowing banks to offer such cheap two- and three-year fixed interest rates.

In the minutes that were released last Friday, the RBA tried to guide the market further. And there’s one paragraph that I think is a key to understanding this future guidance.

‘The rapid increase in vaccinations, particularly in states with outbreaks of the Delta variant of COVID-19, would see restrictions on activity eased sooner than previously expected.’

AND:

‘The economy was expected to have returned to its pre-Delta path by the second half of 2022.’

You can read the full RBA meeting minutes here.

Now, the RBA had previously said they wouldn’t raise rates until 2024. Governor Lowe has softened that stance by saying that rates might go up in 2023 and that there is ‘genuine uncertainty’ as to the timing of future rate changes.

The minutes and Lowe’s comments show a small shift. A small shift that won’t spook the market.

But don’t be surprised if we see a steady procession of small shifts from the RBA, and we’re soon talking about interest rates rising late 2022.

After all, this is what the market is telling the RBA is going to happen.

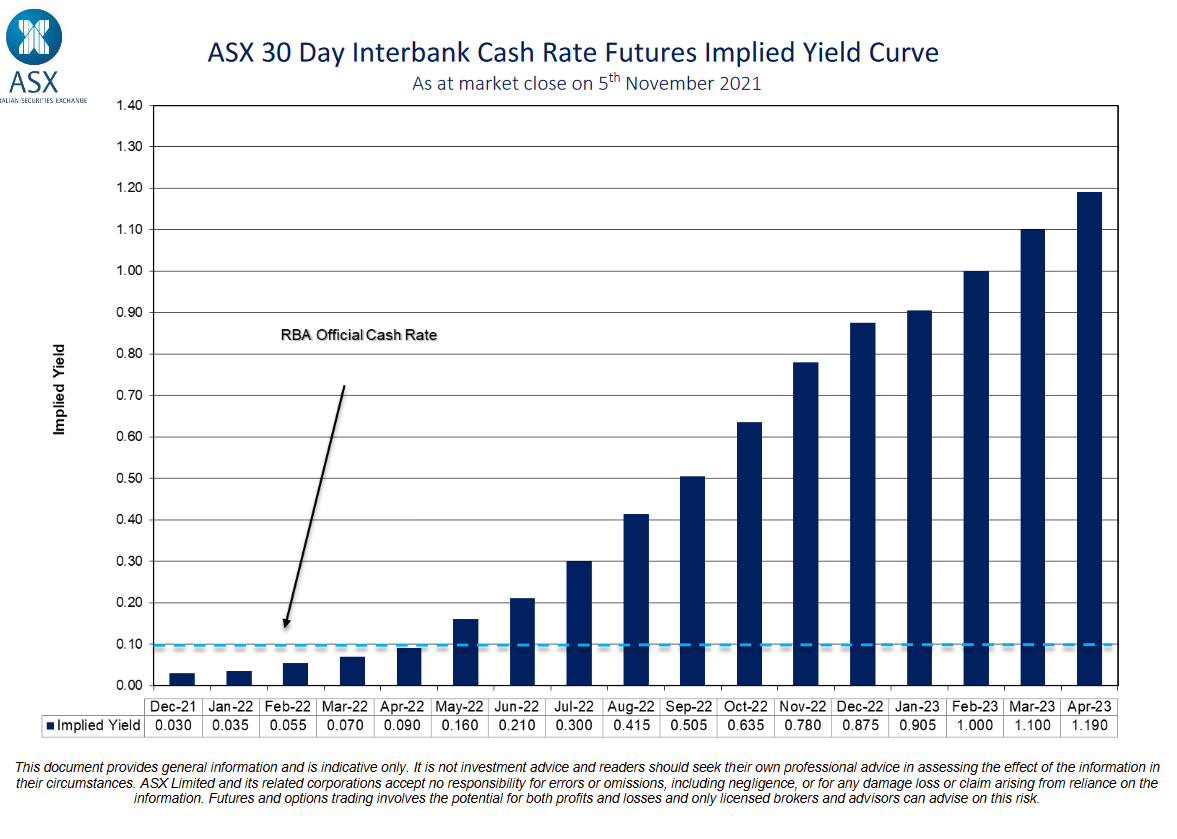

Check out this chart from the ASX which shows how the market is pricing the future path of interest rate decisions in Australia:

|

|

| Source: ASX |

The future is unknown, but there are always plenty of clues.

And perhaps nothing will move markets as much as interest rate expectations in the months ahead.

Regards,

Izaac Ronay,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here