In today’s Money Morning…the first of many?…how the Bitcoin Bond works…why every fixed-income investor may get bitcoin…and more…

Dear {% if user.firstname == blank %}Reader{% else %}{{user.firstname}}{% endif %},

If you’d told me a year ago that a country was about to raise US$1 billion using Bitcoin [BTC], to fund the creation of a ‘Bitcoin City’, complete with a volcano-powered bitcoin mining facility…

Well, even I — a Bitcoin diehard — might’ve thought you were a little crazy!

And yet this is what happened in El Salvador this week.

Though the mainstream will still think this is all nuts, it actually makes perfect sense when you unpack it.

And according to one 30-year bond market veteran, it could be the start of an epic infiltration of bitcoin into the US$128 trillion world of fixed income.

Let me explain…

The first of many?

At a raucous Bitcoin Conference last week, the 40-year-old President of El Salvador, Nayib Bukele, used the example of Ancient Greece when he announced plans to build the world’s first Bitcoin City.

In the coastal town of Mizata in El Salvador, he told the international crowd:

‘Residential areas, commercial areas, services, museums, entertainment, bars, restaurants, airport, port, rail — everything devoted to Bitcoin.’

Adding:

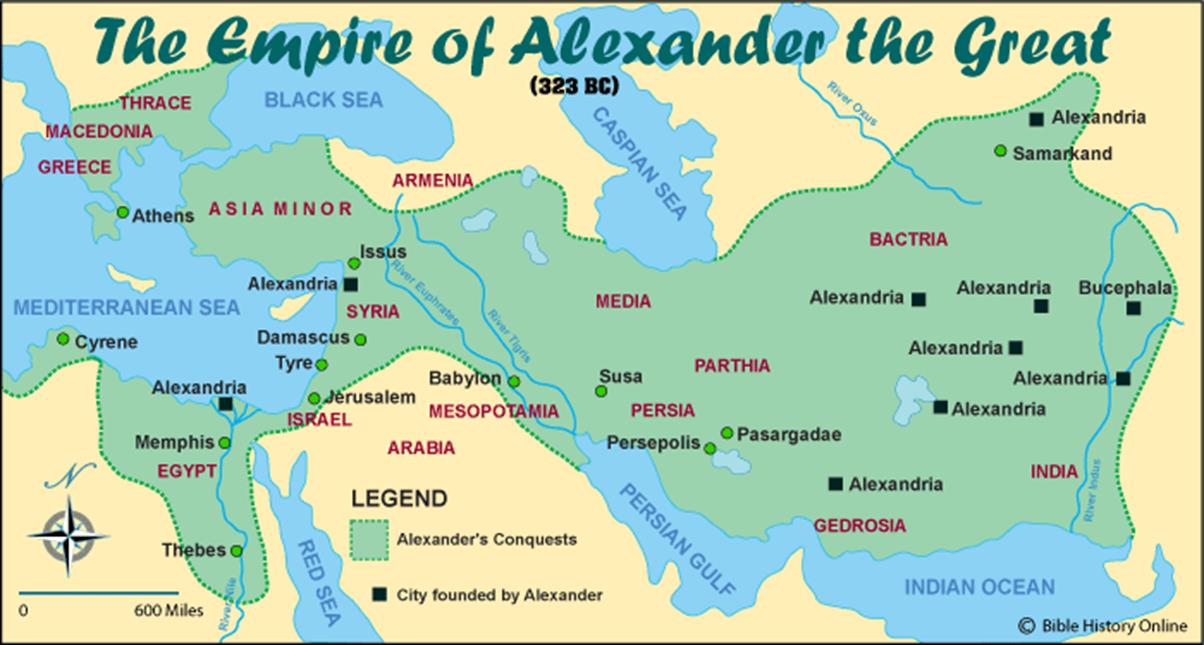

‘If you want Bitcoin to spread over the world, we should build some Alexandrias.’

That line was a nod to Alexander the Great’s conquests over much of Eastern Europe and the Middle East, almost 2,400 years ago.

|

|

| Source: Bible History |

As you can see, the great Alexander was very fond of naming cities after himself!

But back to bitcoin…

The proposed Bitcoin City will be constructed from scratch and promises to have virtually no taxes in an effort to attract crypto capital.

The initial construction will be funded by a special ‘Bitcoin Bond’, created by the well-known Blockstream company.

This ‘Bitcoin Bond’ certainly got the attention of the world’s financial media, and you can watch a sceptical Bloomberg reporter quiz Blockstream Chief Strategy Officer Samson Mow here for some further insights.

But this is basically how it works…

How the Bitcoin Bond works

The bond is looking to raise US$1 billion for El Salvador and is to be paid back over 10 years.

The coupon (or interest rate) is 6.5% per annum paid annually. This is less than around the 13% El Salvador’s normal ‘US dollar bonds’ are usually priced at.

So, at face value, this looks like a worse deal for investors.

But this is where the bitcoin part comes in…

You see, $500 million of this bond will be used to buy and hold bitcoin.

The other $500 million will be used to fund Bitcoin City infrastructure, including the construction of a volcano-powered mining facility near the proposed site. That will create a perpetual income stream in bitcoin to El Salvador.

This is the kicker for bond investors…

After five years, bond holders will share in 50% of any bitcoin gains. That makes the bond a very unique concept in the boring world of bonds.

Typical bonds naturally have capped upside but unlimited risk.

So the investor gets their interest payment if things go right, but none of the upside. And if things go wrong, and the borrower defaults, they lose their money.

The Bitcoin Bond is different…

It combines a relatively high interest payment but also provides substantial upside if bitcoin appreciates in value.

Though, it remains to be seen if traditional finance will get behind this given the perceived risks of bitcoin.

But if the bond is a success, it has big ramifications for the bitcoin price, as Samson Mow explained:

‘Once 10 such bonds were issued, $5 billion (€4.4 billion) in Bitcoin would be taken off the market for several years, Mow said. “And if you get 10 more countries to do these bonds, that’s half of bitcoin’s market cap right there”.’

The world will be watching the success or failure of this bond offering very carefully.

And one Canadian bond market veteran thinks this is the start of an epic shift…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Why every fixed-income investor may get bitcoin

Greg Foss is not your typical blindly enthusiastic millennial crypto investor.

He’s a 60-year-old baby boomer with a three-decade record of investing in the staid fixed-income (bond) markets.

He wrote this very interesting piece on bitcoin and its relationship with bonds as a hedge — or risk tool.

You should read the article in full, but the main quote I want to leave you with today is this:

‘Money has always been a technology for storing the value of presently expended time/energy/work for future consumption. (h/t Ross Stevens, NYDIG). In that light, I believe that Bitcoin offers my generation, as well as my children’s generation, the best opportunity to escape the certainty of fiat currency debasing.

‘The reasons are only mathematical. Every fixed income investor needs to own bitcoin to hedge against the inherent risks of the current credit environment.

‘Many investors are still focused on the threats of inflation. I believe that credit concerns are likely to overwhelm inflation concerns in this next cycle and that Bitcoin offers the best insurance against this impending risk.’

If he’s right, every bond in the future will include some aspect of bitcoin to hedge against that credit risk Foss discusses.

The Bitcoin Bond could provide the framework.

That’s a US$128 trillion industry we’re talking about.

What would that mean for the bitcoin price?

It’s worth thinking about…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.