One of Australia’s big four banks the Westpac Banking Corporation [ASX:WBC] has followed suit after its competitors ANZ and NAB last week posted their own results for the last six months.

Both NAB and ANZ plummeted alongside investor and analyst reactions, and now with Westpac’s turn to reveal all, we may see a new insight into macro activity and sentiment.

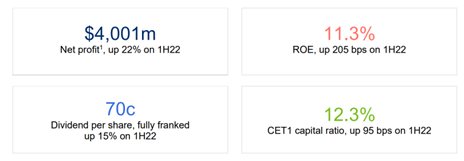

Interestingly, WBC reported an 8% rise in revenue in the half year, and went up by 22% in profit to $4 billion, declaring 70 cents in dividends.

Shareholders appeared impressed with Westpac’s HY2023 result this morning, the stock trading at $21.96 a share after taking a 3% boost earlier in the day.

Year-to-date, the big bank has declined by 6%, is 4% under the sector average, and 11.5% below the market:

Source: TradingView

Westpac bucks big four banking trend with improved half

Earlier on Monday morning, the third of the big four banks laid its interim results out on the table, and the results were positive.

Westpac reported an increase of 8% in its revenue for the half year to 31 March 2023. This increase, which was calculated on the same time last year, had come from $11 billion in revenue for the six-month period.

Of that revenue, $4 billion was taken in profits, another increase of 22% year-on-year for both ordinary activities and as net profit for the period.

Thanks to such a strong result, the bank was able to declare an interim dividend of 70 cents per WBC share to be distributed on 12 May 2023.

Westpac said that it has managed a disciplined cost and margins strategy for banking and mortgage divisions, lifting its return on equity.

This contributed to the increased dividends for the half year and strengthened the group’s balance sheet that included a 12.2% CET1 ratio.

The group net interest margin climbed by five basis points to 1.96%, and operating expenses of $4.9 billion were 7% lower than the same time last year.

However, the bank remains cautious on what appears to be continuing challenging economic headwinds.

CEO of Westpac Peter King stated:

‘We’ve grown in a disciplined way in mortgages, performed well in business and institutional banking and stayed the course on risk management and simplification.

‘We’ve further strengthened our balance sheet with a CET1 ratio of 12.3% and funding and liquidity ratios well above regulatory requirements. Our credit quality remains sound with little change in the level of stressed assets, however we boosted credit impairment provisions this half reflecting the forecast tougher economic outlook.

‘Our balance sheet strength sees us well positioned to support customers to grow and navigate any future economic challenges. Many customers are adjusting to repayment increases and we’re ready to help those who need time to transition.’

Westpac managed to reduce its cost base and brought its expense to income ratio down to 45.9%, reflecting $1 billion in savings since FY2020.

WBC noted that a year has passed since the RBA’s first rate rise and says that it is well positioned to continue assisting customers in these challenging times, with loan portfolios remaining healthy, and many of its mortgage customers ahead of repayments.

Like ANZ and NAB, the bank also warned of increasing mortgage competition in the next half year.

Source: WBC

Are you prepared for the big economic shift?

Australia has serviced 30 years of abundant, robust trade, but that has now been broken.

The change is all around us: the clues and signs are everywhere. Most Australians just don’t know what those signs are pointing to and what it all really means.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has, certainly not the mainstream media.

Australia is going to be looking very different very soon, and so will everyday life…

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime click here to learn more.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia