In its latest report, online booking platform Webjet [ASX:WEB] said economic headwinds aren’t slowing down travel yet.

The company, which operates B2C and B2B businesses within the international travel industry, showed improvement across the entire group.

While opening down with the market, Webjet pushed past the weak day on the market to be up 1%, trading at $6.68 per share.

Webjet followed the sector in the market-wide sell-off in October, which dampened investor interest in travel outfits. The company’s shares are down over 15% from their July highs but are now gaining momentum.

In the past 12 months, the share price is up 10.6% as it delivers on its transformation strategy, which brought in new acquisitions to spur growth.

Webjet will be watching out for headwinds and geopolitical risks that could dampen travel plans, but for now, let’s explore the latest results.

Source: TradingView

Webjet 1H24 Results

Webjet said that total transaction value (TTV), revenue, and earnings were well ahead of the same period last year despite ongoing issues with capacity in air travel.

The trend of ‘revenge travel’ seems to continue, meaning families unable to head abroad during the pandemic are now travelling.

For Webjet, that meant a 27% increase in bookings from 1H23. That’s now 50% higher than pre-pandemic levels.

For the six months ending 30 September, Webjet reported a 39% rise in revenue to $244.5 million. This translated into an underlying EBITDA of $102.1 million, up 41% from last year.

The lion’s share of these gains was from the company’s WebBeds business, a B2B marketplace of hotel and tourism operators that connects with wholesale offerings.

WebBeds saw strong volumes worldwide, with bookings up 50% and EBITDA margins expanding to 43.4%.

This was the strongest performer in the group as its reach extended from its European beginnings to become a global marketplace.

Source: Webjet 1H24 Report

Commenting on the results today, Managing Director John Guscic pointed to this success, saying:

‘Bookings, TTV, Revenue and EBITDA for the Group were all materially ahead of the prior period, driven by the outstanding performance of our WebBeds business.

‘WebBeds Bookings, TTV, Revenue and EBITDA were all significantly ahead of both 1H23 and pre-pandemic levels, reflecting the transformation work we undertook when the pandemic hit to capture growth as travel returned.’

These earnings allowed the company to wave goodbye to its heavy pandemic losses and improve margins by 23 basis points to 8.4%.

This helped offset a 39% increase in group expenses, which the company blamed on inflationary pressures.

Looking ahead, the company said it expects similar performance for the second half of the year with a final FY24 EBITDA of $180–190 million.

Sadly, Webjet declined to issue a dividend, saying it will consider one after the FY24 results come out in May 2024.

Outlook for Webjet

The company’s impressive growth shows its current acquisition strategy is playing out. The purchase of Trip Ninja last year has helped bootstrap growth and claim market share.

Webjet says that it will continue to focus on acquisition opportunities in the near future as it attempts to improve site traffic.

But questions whether it can continue to return its margins to their pre-pandemic heyday may hang over the company. Inflation still hangs over the industry like most.

Travellers are showing with their wallets that they’re still keen on travel, but the story isn’t that simple.

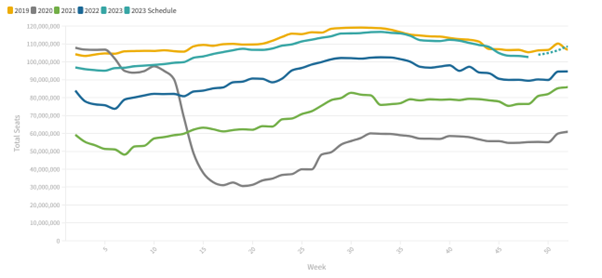

Current flight capacity constraints continue suppressing profits for much of the industry and frustrating travellers. The hope is to reach 2019 capacity numbers by the end of the year.

Source: OAG.com (2019 in yellow vs 2023 in teal)

More travel companies also cite geopolitical risks in their forward-looking statements, showing a concern for what’s happening in the Middle East.

Aside from flights, If WebBeds can continue its remarkable growth, the company could be worth watching. But at this price, it may be more of a wait-and-see approach.

Economic headwinds could pressure more households to forgo their dreams of travel abroad for now and dent the company’s future growth.

Is growth the thing to look for?

With the stressful state of the market, growth isn’t many people’s priority.

But despite the ASX 200 benchmark being down -1.53% for the year, people are still making money.

That income is from dividend companies that don’t require you to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily