Travel stock Webjet [ASX:WEB] released strategy presentations on its key business segments on Monday.

WEB shares were somewhat muted, down 2% late on Monday.

Today’s share price movement mirrors its longer performance, with WEB shares down 2% year-to-date:

www.TradingView.com

Webjet’s strategies

Webjet released a slew of strategy day investor presentation on Friday regarding its key business segments, a week after releasing its first half update for FY23.

Some of the general key highlights included:

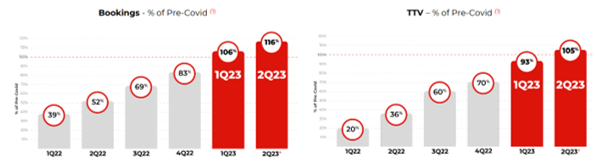

- The company’s OTA International Flight Bookings have gone up 57% during the second quarter of 2023 (having risen 52% in the first quarter).

- Marketing spending at 1.5% of TTV (previously 2% of TTV), with a reduction in paid search advertising while increasing social media, emails, broadcasting, and billboards.

- WEB’s ecommerce segment and domestic hotels were strong during the pandemic.

- WEB’s hotel merchandising has driven higher TTV, rising 56% in the month of August.

- The company says it is well-placed for NDC innovation, with connection to an Air-Hub and several LCC’s through API.

- Competitive pricing tech in use, with data targeting ‘right audience’, ‘right message’, at ‘right time’.

Webjet also touched on its ‘complex’ history of credits over the past 12 months, with rescheduling and cancellations aggravating customers recently.

As a result, there’s a long trail of credits ready to be claimed with international airlines, with each airline having its own set of credit rules. Webjet pointed out that each of these require isolated manual review.

On the issue of frustrated customers, WEB highlighted its upgraded automated ticket change system, allowing customers to access date and time changes to bookings online.

Time will tell of this will have a noticeable impact on customer experience.

Source: WEB

WebBeds segment

WEB has been looking into optimising WebBeds’ business operations, streamling its technology, analytics, reducing costs, and risk mangement processes (ie: credits).

While WebBeds is looking to expand in North America, it currently has a 4% presence in Europe, 3% in APAC, and a mere 1% in the Americas.

Advertisement:

The fourth big ‘shift’ in mining

There have been three major changes to the way the resource sector works in the last century.

Each one birthed some of Australia’s biggest mining companies — like BHP, Rio Tinto and Fortescue…and handed some significant gains to investors.

We’re now witnessing a fourth major shift in this sector…

WebBeds has gained 68% International market share between April to July FY23, and 32% domestic.

WEB will be opening new sales channels, API, and its retail website to the global market in order to boost flexible searching and browsing options for travel agents looking to pair travellers with available hotel rooms.

The company hopes to propel WebBeds to number one in the market, striving for AU$10 billion in TTV and 20% improved efficiency, and a place in the North American market (worth AU$20 billion) by 2025.

Currently, WebBeds is across more than 430,000 hotels in more than 16,000 destinations generating 5.8million in room nights between April and August:

Source: WEB

Outlook for Web

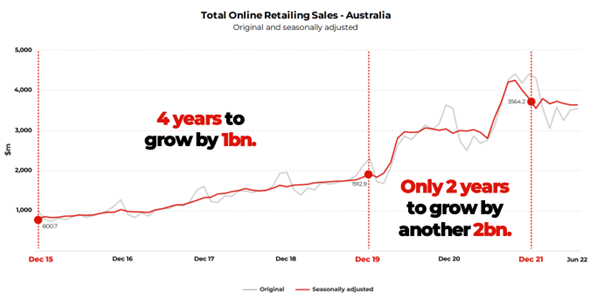

Webjet says that the travel market in Australia and New Zealand is accelerating online bookings, especially with mix-and-match options assisting customers in a volatile environment.

The travel company believes its superior technology and strength of brand will enable it to continue growing market share, particularly as international travel returns to the market.

You, your capital, and your retirement

While travel is back at the forefront of many people’s minds, what never recedes to the background is retirement planning.

And on Thursday, we’re hosting a free event with our trading guru Murray Dawes.

There, Murray will discuss a simple and conservative trading strategy he uses that aims to build capital to the point where you could live off your stock gains each year.

If you are interested to hear more, register your interest for ‘The 30% Nest Egg’ event here.

Regards,

Kiryll Prakapenka,