In the 2011 film We Need to Talk About Kevin, a mother grapples with a disturbing realisation about her son.

Today, investors will soon face their own uncomfortable conversation about two Kevins. They could ultimately reshape the global economy.

Last week, President Trump told the Wall Street Journal that his two leading candidates for Fed Chair are Kevin Hassett and Kevin Warsh.

‘The two Kevins are great,’ Trump said.

Great for whom, exactly?

The bond market is getting nervous. And if you hold any assets, especially long-term assets, you should be paying attention.

Make Rates Great Again

Hassett, currently the director of the National Economic Council under Trump, was seen as the favourite. He’s also a strong supporter of Trump.

Prediction markets had given him good odds. Though, that’s now shifting following reports of internal rifts within the Trump team on the pick.

Source: Kalshi

[Click to open in a new window]

The concern? He’s seen as too close to Trump. A ‘yes man’.

Wall Street banks have already warned Treasury officials about picking Hassett. They fear he could agitate for indiscriminate rate cuts even if inflation continues to run above the Fed’s inflation target.

And though Warsh would be seen as the steady pair of hands, Trump will likely lean on whoever wins for aggressive cuts.

This isn’t idle speculation. We already have a preview of Trump’s economic thinking, courtesy of Fed Governor Stephen Miran’s speech on Monday.

Mr Miran has often been the ideological vanguard of Trump’s moves. As we saw in his crusading report, justifying tariffs.

Since Trump appointed him to the Fed, Miran has been busy backing the President’s social media outbursts with one-sided economic analysis.

In his speech, Miran argued that inflation is essentially beaten. His case? Housing inflation reflects supply-demand imbalances from 2022, not today.

Anything else, he argues, reflects short-term distortions in the data. Once you strip out housing inflation and all the rest, he thinks inflation is closer to 2.3%.

‘Keeping policy unnecessarily tight because of an imbalance from 2022 will lead to job losses,’ Miran argued.

This tees up Trump’s man at the Fed the intellectual justification to cut rates, and fast.

The timing isn’t coincidental. With the 2026 midterms looming, a juiced economy would be politically convenient for Trump.

But those cuts could backfire.

The Vigilantes Are Watching

Bill Gross, the legendary Bond King, isn’t mincing words.

‘Investors wake up!’ he warned on X after Trump threatened J Powell’s job earlier this year.

Gross has already shifted to a more defensive position, focusing on cash and cheap value stocks with 4–5% dividend yields. That’s a big move for someone known as the ‘bond king’.

Gross fears that a Trump-friendly Fed chair could sway the committee toward aggressive cuts. The result?

‘Bond markets will increasingly go curve positive, the dollar will weaken, and inflation will likely move to a 3% centre.’

In plain English, that means long-term bond yields could spike as investors demand higher returns to compensate for the risk of inflation.

Bond market giants can force the government’s hand more than many investors realise.

In fact, we’ve seen this movie before.

In September 2022, UK Prime Minister Liz Truss announced £45 billion in unfunded tax cuts. The bond market revolted. UK yields spiked. The pound collapsed. Pension funds nearly imploded — and Truss was gone within 45 days.

Still, the US isn’t the UK. The dollar is the world’s reserve currency. But that privilege isn’t unlimited.

As Macquarie strategist Viktor Shvets put it: ‘The Fed’s independence is already de facto impaired.’

The damage may already be done.

What This Could Mean For You

If we see a Trump ‘yes man’, short-term US rate cuts might juice American stocks higher. But they could also send long-term bond yields flying. That ripples straight to our shores.

Higher yields put pressure on stock markets.

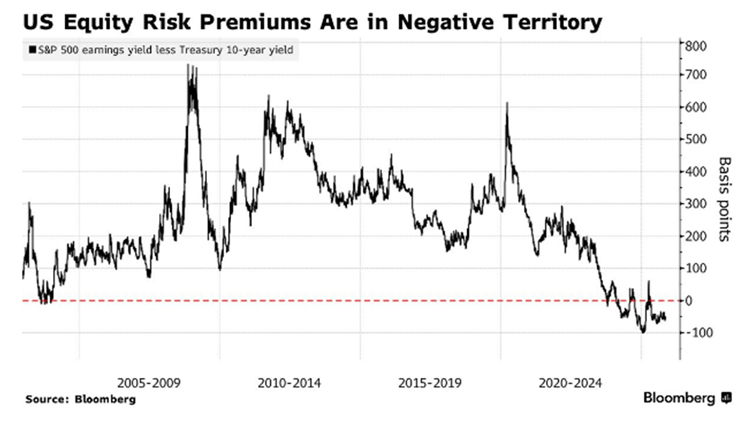

Why buy (relatively) risky stocks when safer bonds are offering high returns? This trade-off is viewed through what is known as the ‘equity risk premium’.

This ‘premium’ is the extra return investors expect from shares compared to the ‘safe’ return from government bonds.

When bond yields rise, that safe return becomes more attractive, shrinking the premium and putting pressure on share prices as investors sell stocks and buy bonds.

That risk premium is now negative, meaning shares are paying less than ‘risk-free’ bonds. That typically signals extreme optimism or distorted pricing, as investors are not demanding that their risky stocks provide higher returns.

Source: Bloomberg

[Click to open in a new window]

These bond issues could also flow into our mortgage and housing woes.

Australian government bonds tend to track US Treasuries. So, if American long-term yields spike, expect our 10-year yields to follow. That means higher mortgage rates here, regardless of what the RBA does.

A weaker US dollar could also push the Aussie dollar higher. That could squeeze our exporters and resource stocks just as they’re banking on strong commodity demand.

Gold and silver are worth watching. They’re already flirting with record highs again as investors hedge against monetary chaos. If confidence in the Fed’s independence erodes further, that safe-haven bid could intensify.

For now, equity markets seem content to ignore these risks. US markets continue to flirt with all-time highs as the TACO (Trump always chickens out), play comes back into the fore.

But on Fed independence, Trump has been remarkably consistent. He wants lower rates, and he’s about to pick someone who agrees. He may not chicken out. And his new Fed Chair might not either.

Jerome Powell’s term expires in May. Whoever replaces him will likely inherit an economy still running above-target inflation, a labour market showing cracks, and a president demanding cheap money.

The bond market will be watching every appointment, every speech, every hint of political interference.

We really do need to talk about the Kevins.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments