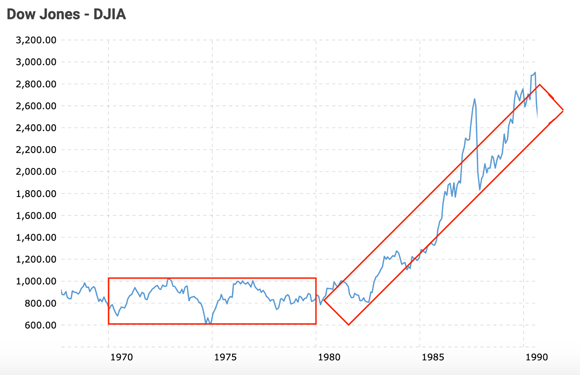

Here’s an easy question for you, ‘which decade was better for shares…the 1920s or 1930s?’ How about the 1970s or 1980s?

|

|

| Source: Macro Trends |

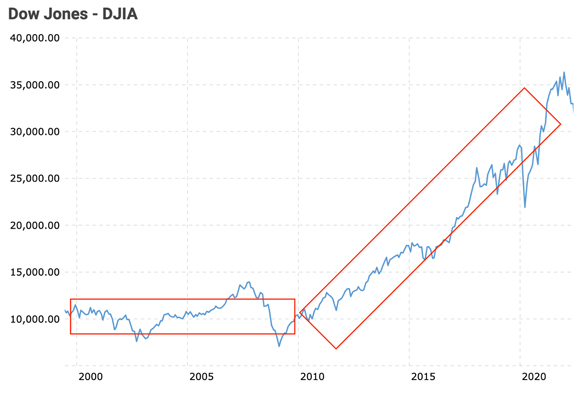

One more, the 2000s or 2010s?

|

|

| Source: Macro Trends |

No two decades in the market are ever the same.

Why?

The drivers that created a period of under or over-performance are in a constant state of change. Nothing in markets remains static. Unloved sectors suddenly find investor favour. Cheap stocks become expensive. What was once hot, becomes cold.

Judging by the positive market action so far in 2023, my gut feeling tells me investors are banking on the 2020s rhyming with the 2010s. This optimism is not supported by history.

The 2010s were a winning decade for paper assets. Tech stocks. Junk Bonds. Cryptos. Anything that looked good on paper (and, backed only by paper) captured investor imaginations. An abundance of cheap money helped finance fanciful dreams.

The 2020s are going to be an entirely different decade. Unloved ‘hard’ assets — precious metals and commodities — are setting themselves up to be the standout performers of this decade.

Why?

Because the consequences of the idiocy — ultra-low rates, money printing and the demonisation of fossil fuels — that drove the value of paper assets up in the 2010s are going to make themselves known in the 2020s.

Recent issues of The Gowdie Advisory have looked at the history of markets to show why the conditions of our recent past are unlikely to be repeated in the future.

Here are some edited extracts…

‘What could fuel another spike in inflation?

‘When attempting to define the future, it’s instructive to look at past patterns.

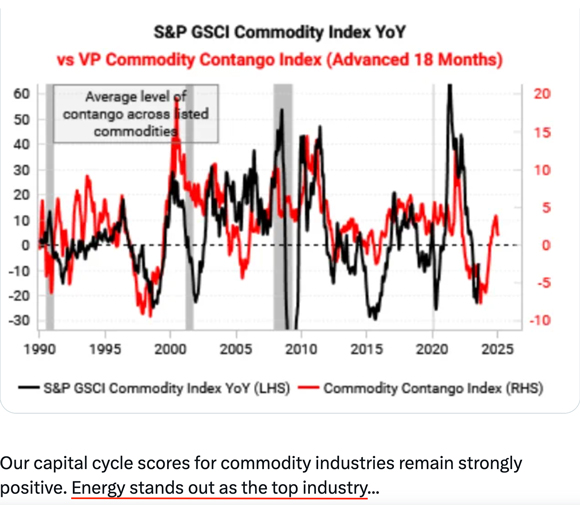

‘In a recent update to clients, research firm, Variant Perception, looked at the correlation of the firm’s proprietary Commodity Contango Index (advanced 18 months) to the pricing of the Commodity Index.

‘For reference purposes…

‘“Contango is a situation where the futures price of a commodity is higher than the spot price. Contango usually occurs when an asset’s price is expected to rise over time. That results in an upward-sloping forward curve.”

Investopedia

‘Where the red line (Contango Index) goes, the black line (commodity prices) tends to follow.

‘In looking 18 months ahead, the red line (the futures price of commodities) indicates higher costs are coming.

‘The commentary beneath the chart states, that within the commodity complex, “Energy stands out as the top industry…”

|

|

| Source: Variant Perception |

‘In recent weeks there has been a steady uptick in oil prices…with West Texas Intermediate (WTI) going from US$68 on 1 June 2023 to around US$83 today.

‘Cycles rotate from UP to DOWN

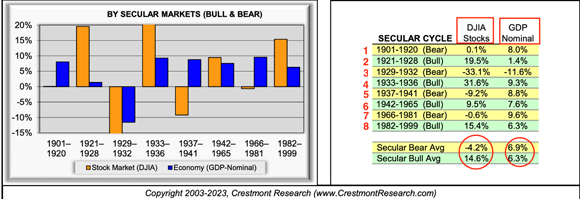

‘…even when economic output, over the long term, remains relatively stable, the performance of the Dow Jones Index varies quite considerably…

|

|

| Source: Crestmont Research |

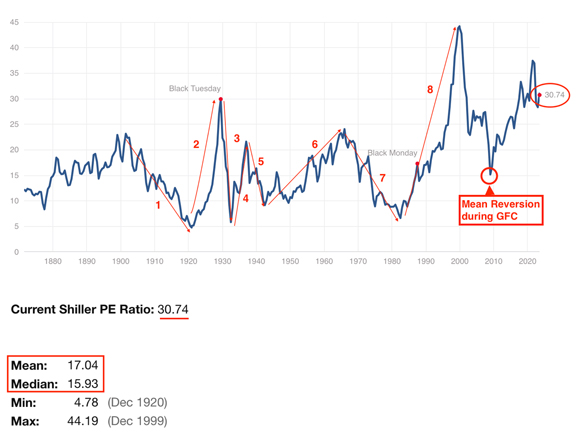

‘For the ease of this exercise, I’ve numbered each period 1 to 8.

‘The first two periods were complete contrasts in the Dow’s performance relative to GDP.

‘In Period 1, the US economy grew at 8% per annum, however, the Dow managed to eke out a paltry 0.1% per annum.

‘Yet, in Period 2, with GDP growth at a pedestrian 1.4% per annum, the Dow raced ahead…pumping out a stellar 19.5% per annum.

‘Why the polar opposite outcomes?

‘The answer to that question can be found in the Shiller PE (Price to Earnings) Ratio.

‘The numbered troughs and peaks align with the timeframes of Secular Cycle periods.

|

|

| Source: Multpl |

‘The median PE for the US market (calculated from 150 years of data points) is around 16 times.

‘However, there are times when investors conspire to push the multiple higher or lower.

‘Investor outlook and the emotions attached to that outlook (be it for the good or bad times to never end) heavily influence the movement (in both directions) of the multiple.

‘Why share investors should be really worried

‘Over the long, long term, shares do deliver superior performance.

‘However, not every decade is a winner for share investors.

‘Some decades, like the Roaring Twenties and the post-2010–21 period, can “shoot the lights out” for investors.

‘However, there are decades when markets just shoot you down.

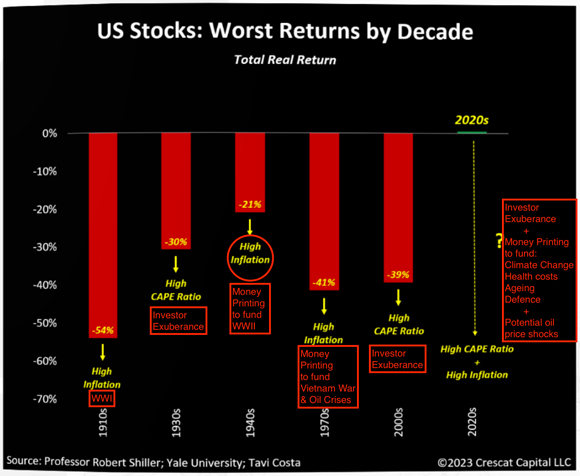

‘This graph shows the “Worst Returns by Decades” and what caused markets to behave so badly.

|

|

| Source: Crescat Capital |

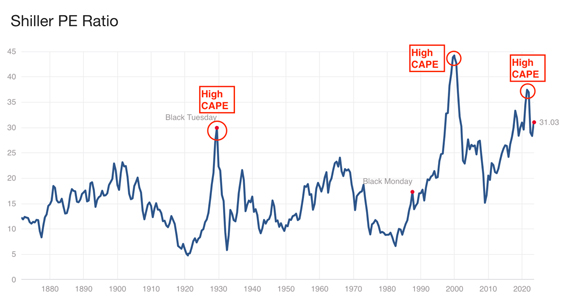

‘The market has TWO Achilles Heels:

1. High inflation — caused by governments running much higher budget deficits to fund war efforts.

OR

2. Starting the decade with a High CAPE (cyclical adjusted PE) ratio

|

|

| Source: Multpl.com |

‘Previous ‘worst decades’ have resulted from exposure to one or the other Achilles Heel.

‘This decade we start with…BOTH.

‘High inflation AND High CAPE.

‘Governments, faced with either default or print, are going to print.

‘The vilification of fossil fuels has all but locked in a decade of oil crises (like the 1970s).

‘And, as the above CAPE chart shows, the rotation from a HIGH to a LOW multiple on corporate earnings has been happening (to varying degrees) for 150 years. Why won’t it happen again?’

In the coming months, I expect paper assets to pass the ‘asset of the decade’ baton to hard assets…it’ll come in the form of a market downturn few are expecting.

Shares are likely to spend this decade (or, even longer) treading water while last decade’s unloved assets suddenly find favour.

The focus will shift to those boring investments of…gold, silver and gold miners.

And, as we know, the way to create wealth is to buy BEFORE an asset becomes the hot topic at BBQs.

Brian Chu, editor of The Australian Gold Report and founder of The Australian Gold Fund, knows this sector inside and out.

Brian’s knowledge of and passion for the precious metals sector is second-to-none.

His forensic analysis of precious metal trends and the gold mining sector is why, over the past seven years, Brian’s private family fund has tripled the return of the ASX Gold Index.

We are on the cusp of a seismic shift in investor sentiment…much like the optimistic 1920s gave way to a more pessimistic 1930s.

In these periods of heightened nervousness and uncertainty, people want to hold onto tangible assets.

You’ll hear more from Brian Chu later this week. Stay tuned…

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia