There’s been a lot of focus over recent years on health and medication.

However, if you want a long, healthy — and wealthy — life, the key is in the location…

The value of productive, well-located residential land is enduring.

Something Fred Harrison knew too well when he titled his 1983 publication — when predicting the 1990s downturn — The Power in the Land.

Maybe better termed, ‘The power in the land and its location’.

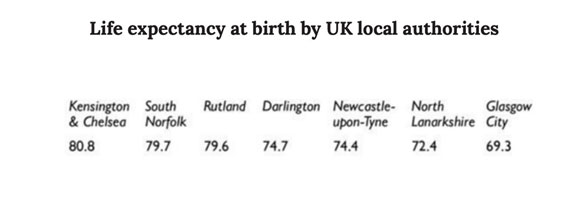

It’s important you understand this concept, because the price we pay for well-located real estate represents, quite literally, life and death.

Those that monopolise the best locations secure the difference between a healthy long life or an early death.

The price gap between rich and poor locations determines the length of a person’s lifespan.

For example, if you live in London surrounded by the best amenities — hospitals, high-paying jobs, education, lush parkland, fantastic transport facilities etc — with housing equity some four times that of the UK’s northern regions, your average lifespan will be around 80 years.

But the further away from London you progress — into the poorer northern regions that are not as well facilitated — the worse your chances of a long healthy life become!

|

|

| Source: ‘Ricardo’s Law — House Prices and the Greatest Tax Clawback Scam’ by Fred Harrison |

Similar trends have been evidenced by Michael Marmot (director of the Institute of Health Equity at University College London).

In the ABC Boyer Lectures in 2016, he pointed out the following:

‘I had been studying health inequalities in Baltimore.

‘In the poor part life expectancy for men was 63 years.

‘In the richest part it was 83 years.

‘A twenty-year gap in one city.

‘If you live in the richest part of Baltimore and want to see what it is like to live in a place with male life expectancy 63, you could fly to Ethiopia…or you could travel just a few miles.

‘Life expectancy for men in the poorest part of Baltimore is the same as Ethiopia, two years shorter than the Indian average.’

I’m trying to emphasise here that a well-located property is not an asset that you should consider buying low and selling high.

If you buy well, you will always have someone willing to pay more to secure your site in the bull phases of the property market.

Better still — buy land with the right zoning, and you have the further advantage of being able to increase the income of that site through astute property development at certain advantageous points within the cycle.

The increased rental income from your development will pay down your loan.

It will give you cash flow. And you can be assured that the locational value of the site will continue to appreciate by more than you will ever earn as a wage slave.

You don’t need to limit your investments to residential land…

Warren Buffett has countered gold bugs over the years with a similar understanding of land’s enduring qualities.

In 2011, he suggested to investors that they put their wealth into the equivalent value of farmland (instead of gold).

‘A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops — and will continue to produce that valuable bounty, whatever the currency may be.

‘Exxon Mobil (XOM) will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and remember, you get 16 Exxons).

‘The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond. ‘

(2011 annual letter for Berkshire Hathaway shareholders)

That alone should give you some idea why Bill Gates quietly snatched up more than 242,000 acres of farmland spanning 18 states. (As well as a stake in 25,000 acres of transitional land on the west of Phoenix, Arizona, which will be turned into a new suburb I might add.)

Monopolise land — and its natural resources, absent of significant land taxation (as promoted by the economist Henry George) — you also monopolise and control the wealth it generates and the people it shelters and feeds.

Gates now has the title of the US’ biggest private farmland owner.

There are many spokes to Gates’s investment portfolio.

Including attempts to re-engineer the climate by spraying dust into the atmosphere to block the sun (it’s called ‘sun-dimming technology’, you can read about it here).

And of course, his desire to wean the population off depending on animals for food with the creation of fake meat and dairy products from plants (soy). (See ‘better than meat’, ‘impossible food’ and ‘lab cultured breast milk’.)

You can come to your own conclusions regarding the agenda behind it.

But the timeless truth remains.

ALL his investments depend on the location and resources of quality land!

It’s the value of location that keeps the cycle turning — ultimately taking us to a land cycle peak around 2026.

There are many ways smaller investors can benefit from the cycle, if they make sure the underlying investment is always driven by a demand for quality, well-located real estate.

A subscription to Cycles, Trends & Forecasts shows you how.

Best Wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor