In today’s Money Morning…they saved the economy with record-breaking stimulus…toothless Fed can’t, or won’t, make the hard decisions…Delta blues — how bad are they?…and more…

The big news from the US overnight is that the S&P 500 and Dow Jones are breaking all-time highs once more. And the NASDAQ isn’t far behind either.

Tech stocks in particular delivered some mixed performances. There was a range of expected and unexpected earnings results churning the markets.

All beating to the drum of strong economic growth.

Which is why, in my opinion, the bigger story isn’t the markets, but the economy as a whole. Because according to the official GDP data, the US economy is now bigger than it was pre-pandemic…

The US managed to deliver US$19.4 trillion in GDP from April to June.

A definitive increase from the US$19.2 trillion in the fourth quarter of 2019. Right before COVID slammed the breaks on the optimistic outlook.

Clearly, the Fed and the US government did what they needed to do.

They saved the economy with record-breaking stimulus.

But now, with GDP back on track, the real question is, why haven’t they stopped?

Toothless Fed can’t, or won’t, make the hard decisions

Now, I’ve spoken at lengths about my grievances with the Fed and Powell.

It’s no secret that I think they’re guiding the US markets down a dark road. And when they reach their inevitable destination, my fear is that they will drag down other markets, like Australia’s, with them.

With this latest data, though, I hope you can see what I see…

Because it seems clear as day to me that the Fed can’t, or won’t, make the hard decision it needs to. Which, truth be told, may be the need for a healthy cooling off of the economy.

Does that mean I’m wishing a recession on the US?

No, absolutely not.

All I’m saying is that modern politicians and modern monetary policy makers are terrified of a slowdown. They are so infatuated with the need for growth, that they can’t fathom a modest correction or downturn.

That was made evidently clear this week when Jerome Powell signalled that the Fed isn’t ready to taper yet. Citing ongoing concerns about the Fed’s goals for ‘maximum employment’ as the reason.

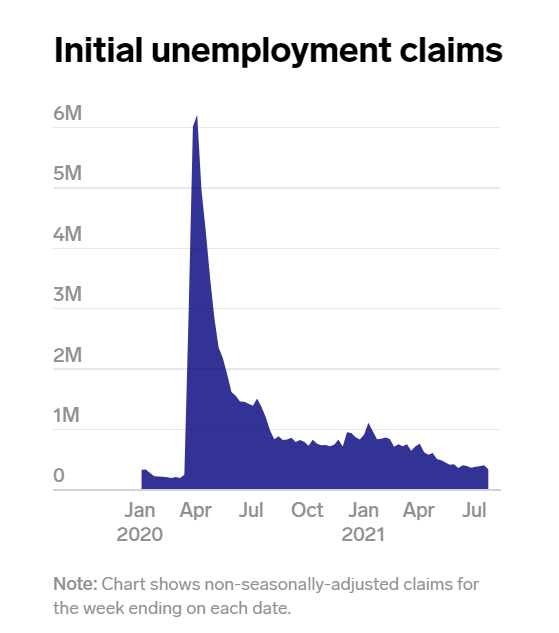

Despite the fact that unemployment claims in the US have been steadily falling since the start of 2021:

|

|

| Source: Business Insider/US Employment and Training Administration |

If I had to relate this situation to an analogy, it would be the opposite of the classic ‘throwing the baby out with the bathwater’. The Fed is so worried about the baby (US economy), they’re going to drown it with too much stimulus (water), rather than deliver an appropriate response…

Which may mean higher asset prices, all-time market highs, and more for a while longer. Which is fantastic if you’re an investor in the short term. But the long-term impact on the economy as a whole has to be a factor.

Because at this point, the US economy is addicted to stimulus. And at some point, that just isn’t sustainable. Truth be told, we probably passed that point months ago.

Critics of my train of thought, though, will of course point to the new bogeyman: the Delta strain.

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

Delta blues — how bad are they?

Don’t get me wrong, this Delta strain is clearly bad news.

Here in Australia, we’re seeing just how grim it can be, as Sydney struggles to get it under control. And in the US, where the vaccine rollout was going strong, it has started to rear its head as well.

But I am sceptical that Delta has the capacity to be as bad as the first wave of COVID.

Not only because we now have vaccines, but also because we are better prepared. People are used to dealing with this pandemic by now, for the most part. And while economically it may claim a few more businesses, I’d wager that any that have survived up to now can probably survive Delta too.

I’ll admit, though, that’s just speculation on my part. Because honestly, no one knows how this new wave of cases will pan out in a week, a month, or even a year.

Again, my primary concern is what the Fed and other central bankers are doing to economies…continuing to prop them up when the darkest days of this pandemic look to be behind us.

And it is for this reason that we’ve spent so much time this year telling you about investment alternatives. Ways to diversify your wealth away from cash, equities, and other assets at the whim of monetary policy madness.

Because whether you’re an enthusiast of traditional hedges like gold or silver, or newer alternatives like crypto, now seems like a good time to get involved.

Does that mean you should give up on stocks altogether?

Absolutely not.

Because like I said, in the short term there still looks to be a lot of gains left on the table. Likewise, long term I think the outlook is extremely promising, with a plethora of exciting new industries and developments on the way. Many of which have been advanced thanks to this pandemic-led response.

It is the mid-term outlook that concerns me, though.

Only time will tell what awaits us. And then, we shall see how history will judge the decisions of central bankers like Jerome Powell.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.