The Vulcan Energy Resources Ltd’s [ASX:VUL] share price is up 4% at time of writing after announcing a ‘world-first’ lithium traceability solution with Circulor.

Key points and VUL share price reaction

Vulcan today announced that it’s partnering with traceability-as-a-service company Circulor to establish full lithium traceability and CO2 measurement across the European lithium-ion battery and electric vehicle supply chain.

According to the release, this will be a world-first for the lithium sector.

Circulor’s software allows customers to track raw materials through supply chains to demonstrate responsible sourcing and sustainability.

The move targets the latest European Commission Battery Regulation proposed in December 2020, which emphasised the sustainability, traceability, and transparency of raw battery materials.

At midday trade, the Vulcan Energy share price was trading at $6.6 per share, up 4.4%.

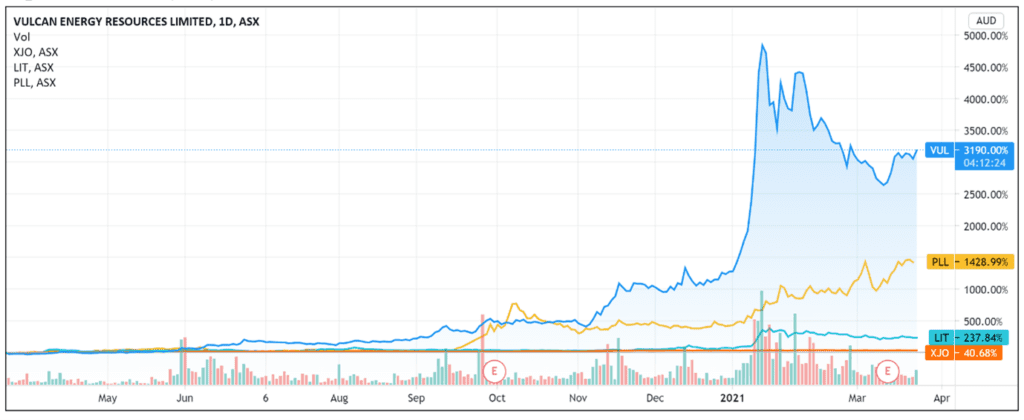

While VUL shares are down 3% over one month, the shares are up 130% YTD and up 3,900% over one year.

Circulor tracks raw materials from the source all the way to the finished product.

Three Ways to Invest in the Renewable Energy Boom

Customers can secure deliveries, manage payments, and check provenance of their raw materials using Circulor’s platform.

According to Vulcan Energy’s release, Circulor permits customers to track their raw materials and CO2 emissions by applying blockchain, artificial intelligence, machine learning, facial recognition, and other technologies.

This is important for reputational protection, proof of compliance with guidelines (especially for firms dealing with EU regulations), dynamic carbon tracking, and reducing due diligence, auditing and reporting costs.

Vulcan Energy will implement Circulor’s service for Vulcan’s future lithium supply contracts with European OEMs (original equipment manufacturers).

Circulor and Vulcan will work together to prepare Vulcan for full traceability of Vulcan’s Zero Carbon Lithium product in 2024.

Vulcan Energy share price outlook

Today’s ASX announcement follows the company’s update last Tuesday that it has appointed Julia Poliscanova, senior director of the European Union’s transport and environment, as a special adviser to its board.

Poliscanova specialises in EU energy policy and previously served the mayor of London as a senior EU policy officer.

Vulcan Energy is certainly focusing on penetrating the European market with its lithium products.

As an example, European stalwart Volkswagen is targeting about 50% of its total sales by 2030 to come from all-electric vehicles.

To meet that target, the automaker plans to build six battery factories.

And as reported this month by Germany paper Deutsche Welle, the EU expects European companies to generate millions of new jobs as factories ramp up production of lithium-ion batteries needed for electric vehicles.

Planned giga-factories across Europe are expected to produce 7–8 million batteries per annum.

According to EU Commission Vice President Maros Sefcovic, the EU is ‘now set to become the second-largest battery cell producer in the world, behind China.’

The price of lithium is up over the last few weeks too.

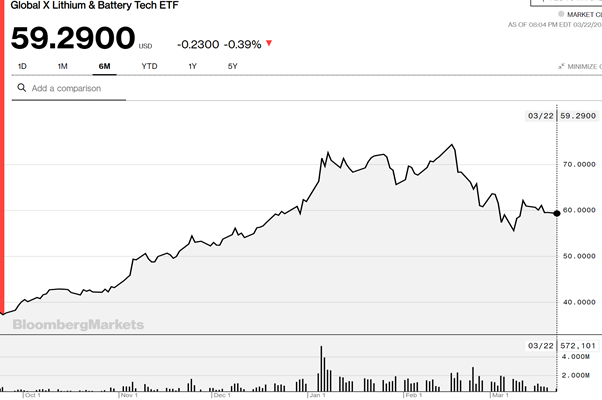

And, according to Bloomberg, the US GlobalX Lithium and Battery Tech ETF is up over the last six months.

This is all positioning well so far for Vulcan Energy’s goal to ‘supply the lithium-ion battery and electric vehicle market in Europe.’

However, expanding markets attract a lot entrants, so the competition to capture the lithium-ion battery supply market will only heat up.

Investors will want to see continued positive updates from Vulcan as it seeks to establish itself as a long-term player in Europe’s electric vehicle transition.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend this free report.

If you’re keen for more reading, then this report on energy disruption is also a great read. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

P.S: Energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom. Download your free report now.

Comments