The Vulcan Energy Resources Ltd’s [ASX:VUL] share price is up 3% today on news its direct lithium extraction pilot plant is operational.

VUL shares were up as much as 4.7% in early trade.

The market’s positive reaction to Vulcan’s announcement continues the company’s strong recent performance.

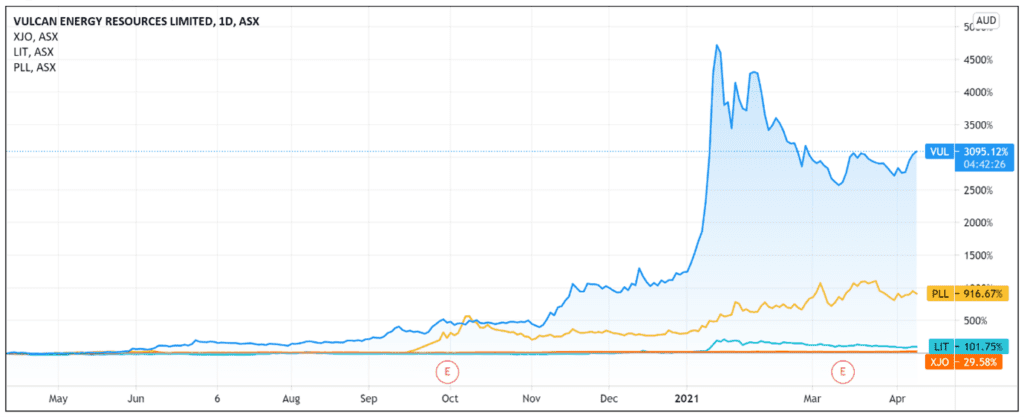

VUL shares are up 135% year-to-date and up a heady 3,000% over the last 12 months.

Vulcan pilot plant now operational

Vulcan today announced that its pilot plant to demonstrate direct lithium extraction from geothermal brine in the Upper Rhine Valley is now operational.

The company revealed that it is using the live geothermal brine from existing wells for DLE and brine chemistry test work.

Vulcan reported that its team is now focused on ‘demonstrating pre-treatment and DLE processes, as well as durability of the process over hundreds of cycles, which will feed into its Definitive Feasibility Study.’

The company is working with suppliers like DuPont to test DLE products ‘similar to those already used commercially in the lithium industry.’

Vulcan Managing Director Dr Francis Wedin noted that it took less than six months to design, build, and commission Vulcan’s pilot plant.

According to Dr Wedin, operationalising the plant is a ‘significant milestone’ for the company and it has ‘already started producing crucial data needed for de-risking the lithium extraction process.’

What is direct lithium extraction?

As Reuters noted, growing demand for battery-grade lithium is incentivising efficient production of the white metal as suppliers rush to meet demand and increase production.

DLE methods can selectively remove lithium compounds from geothermal waters and reduce time, production costs, and impact on the environment.

The DLE method is used by the likes of privately held Lilac Solutions and Standard Lithium as well as Cornish Lithium.

Oilfield services firm Schlumberger’s New Energy division also announced last month that it will launch a DLE plant in Nevada, US.

Schlumberger’s New Energy division invested more than US$15 million in the direct lithium extraction process.

According to Schlumberger’s release, the DLE process can reduce the ‘production time from over a year to weeks.’

Source: Vulcan presentation

Vulcan Energy outlook

It is hardly a secret these days that demand for lithium is up.

With Europe, China, and the US looking to boost the uptake of electric vehicles, lithium suppliers are in turn ramping up production.

CNBC even reported last week that the US is facing a ‘lithium-ion battery shortage’ with increased electric vehicle production.

And all the while, the price of lithium continues to rise.

Source: Fastmarkets

So the commercial landscape is currently looking quite good for lithium stocks like Vulcan.

However, as I’ve covered recently, when there is a clear and urgent demand for a commodity as ample as lithium, expect competition.

With the markets now firmly aware of the expected influx of electric vehicles, lithium suppliers will likely seek competitive points of difference to secure contracts and offtake agreements.

Dr Wedin believes that today’s commencement of the pilot plant’s operation is a ‘critical step towards our strategy of producing lithium hydroxide … for the European battery electric vehicle market.’

Vulcan’s pilot plant becoming operational will still need to be followed by the company designing a larger demonstration plant, which in turn will ‘contribute information towards the DFS.’

I believe that the data from these upcoming projects will go a long way in informing the market’s attitude towards Vulcan’s long-term prospects as a steady producer of lithium for the European battery electric vehicle market.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend this free report.

If you’re keen for more reading, then this report on energy disruption is also a great read. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

Comments