The Vulcan Energy Resources Ltd [ASX:VUL] share price is relatively flat today after announcing it secured a site for its planned commercial lithium hydroxide plant.

To secure the site, Vulcan signed an agreement with chemical park management company Infraserv.

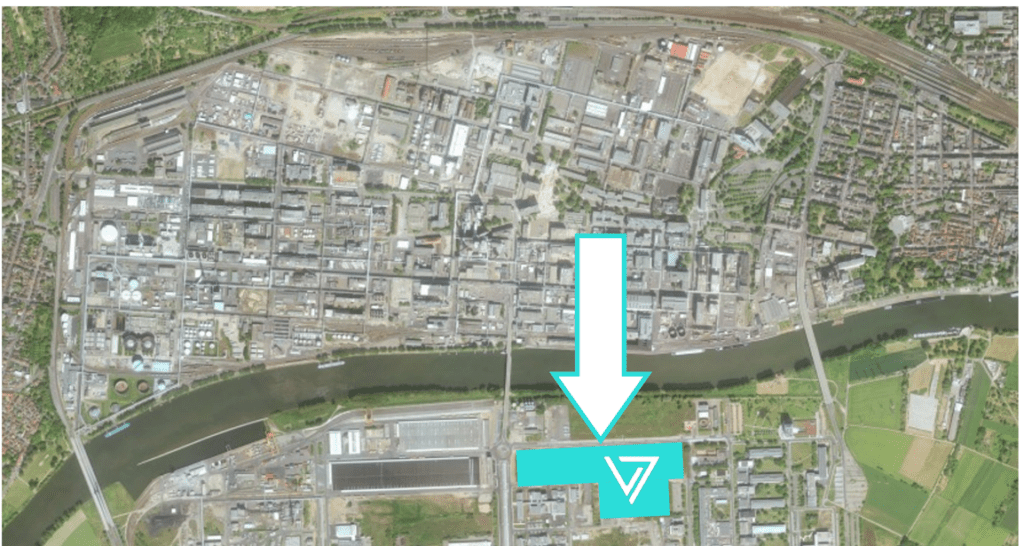

The site lies at the Höchst Chemical Park, located just outside Frankfurt.

The market wasn’t much moved, with Vulcan shares currently trading at $12.82 apiece, down 1%.

The VUL share price is probably cooling off after a hot run this year, having gained over 900% in the last 12 months.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

VUL secures site for commercial lithium hydroxide plant

Vulcan has signed an agreement with Infraserv to secure a site for its planned Central Lithium Plant (CLP) as part of its Zero Carbon Lithium project.

The site’s location, at the Höchst Chemical Park, is one of Europe’s largest chemical sites, hosting more than 22,000 personnel and 90 companies, including Nobian, Clariant, Sanofi, and Celanese.

VUL intends to use the CLP as a processing hub, processing lithium chloride from multiple combined geothermal and lithium sorption plants into lithium hydroxide monohydrate.

The lithium hydroxide monohydrate will then be transported to Vulcan’s European customers in the battery and electric vehicle industry.

Vulcan said this step will ‘dramatically lower the transport footprint of the current lithium supple chain.’

VUL lauded key advantages of the Höchst site, including proximity to Vulcan’s project areas, multiple low-carbon transport modes, and the availability of renewable power onsite.

Source: company presentation

Vulcan Energy share price outlook

Vulcan Managing Director Dr Francis Wedin was excited by today’s development.

‘Securing a site for the Central Lithium Plant is an important step toward the execution of the Zero Carbon Lithium Project.

‘Importantly, the location allows for low carbon transport options from our nearby project areas, as well as renewable energy to power the proposed plant, which underpins our commitment to minimizing our carbon footprint in each step of our process.’

VUL’s update today also follows news of successful production of Vulcan’s first battery-quality lithium hydroxide monohydrate (LHM) from piloting operations.

Vulcan noted it will move forward towards obtaining all the necessary permits in the chemical park for the CLP construction and operation.

The run up in the share price of Vulcan Energy highlights the strong interest and excitement about the lithium industry.

But with so many news items coming out almost daily, it’s hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, governments and private interests alike are converging on electric vehicles and renewable energy.

But if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the US$95 trillion renewable energy boom.

Worth a read.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here