The Vulcan Energy Resources Ltd [ASX: VUL] was admitted to the Global Battery Alliance today, a partnership working on a sustainable battery value chain.

Vulcan Energy Resources Ltd [ASX: VUL] share price is up as much as 3.7% in early trade. However, a flip in sentiment saw the Vulcan Energy share price fall in afternoon trade, down 1% at 3:00pm.

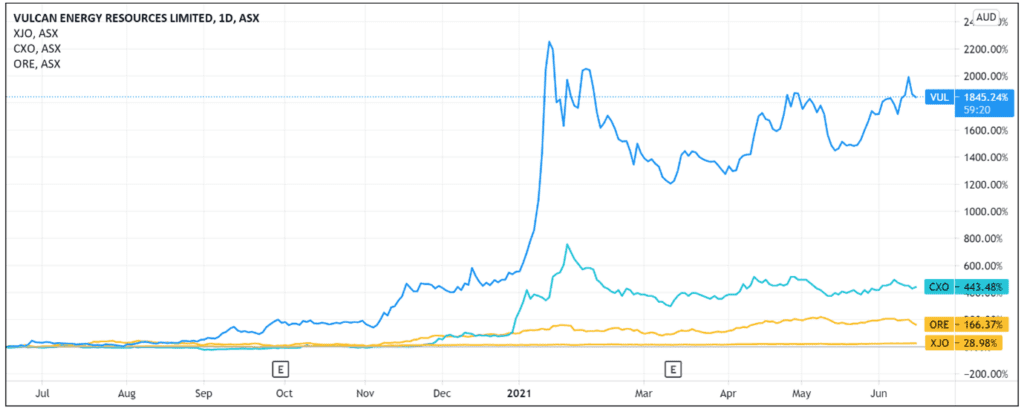

While today’s announcement was tepidly received, Vulcan is one of the best performing lithium explorers on the ASX over the last year.

VUL shares are up nearly 200% year to date and up 1,700% over the last 12 months.

Vulcan joins Battery Alliance

Vulcan Energy has today been accepted as a member of the Global Battery Alliance (GBA).

The GBA is an umbrella partnership of 70 members working on a sustainable global battery value chain.

For context, some of GBA’s members include BMW Group, BP, Google, Renault Group, LG Chem, Volkswagen Group, and Volvo Group.

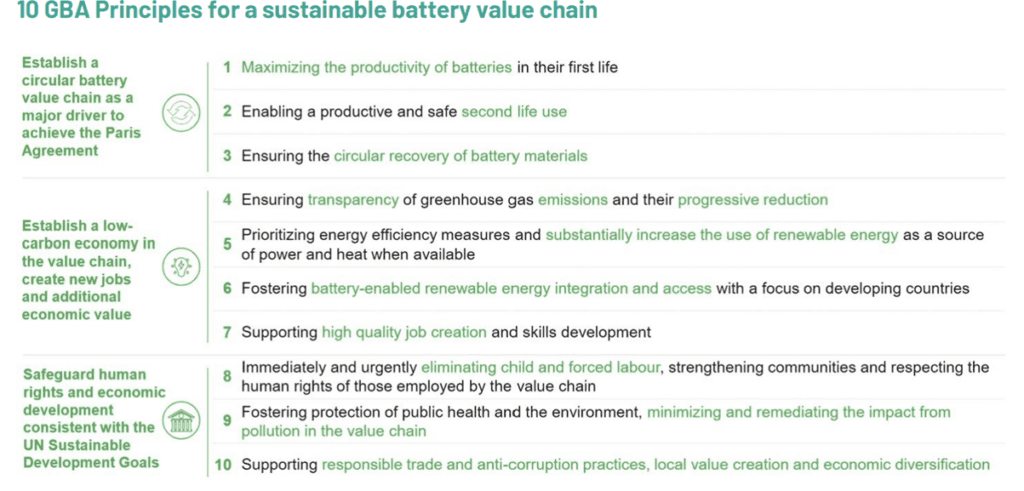

Members aim to adhere to the alliance’s 10 guiding principles, which are outlined below.

What is most interesting about GBA is its effort to develop a Battery Passport.

According to GBA, the passport is a potential solution for securely sharing information and data to ‘prove responsibility and sustainability to consumers with a quality seal.’

The passport could create a framework for identifying batteries that are ‘best and worst in class.’

It will be interesting to see whether such a battery passport becomes a commercial moat for those who hold it.

Vulcan Energy Managing Director Dr Francis Wedin had this to say regarding VUL’s admission to GBA:

‘Vulcan is pleased to join the major industry, public institution and NGO members who form the Global Battery Alliance.

‘Our goal is lithium production for the battery market with net zero greenhouse gas emissions, through our ZERO CARBON LITHIUM Project, but also by driving systemic change across the industry.

‘As a member of the GBA, we look forward to working with our fellow members to shape this agenda at this critical juncture in Earth’s history as we aim to fundamentally change transportation and energy for the better.’

VUL Share Price ASX outlook

VUL isn’t the only lithium producer joining battery alliances.

Last July, Core Lithium Ltd [ASX:CXO] joined the European Battery Alliance (EBA250). When the news was announced, EBA250 Manager Thore Sekkenes commented:

‘In Australia, there is a lot of expertise when it comes to Lithium, and thus it is of crucial importance for us to build the bridge between Europe and Australia.

‘We want to actively collaborate with Australian companies, like Core Lithium, willing to establish progressive trade relationships here.’

The alliances indicate the good standing Australian lithium producers enjoy on the world stage. Bullish investors may take these alliances as affirmations of CXO and VUL’s growth strategies.

However, it is yet to be seen how the likes of Vulcan and Core Lithium can turn these memberships into commercial advantages and whether these alliances are even intended to have a commercial angle.

Nonetheless, Vulcan’s admission to the GBA highlights that lithium stocks are hot right now.

More governments are embracing greener energy, and legacy automakers like Volkswagen are eyeing off Tesla’s EV crown.

All this contributed to a run-up in the price of lithium itself and lithium stocks.

So, if you’re interested in finding out more about lithium stock investment opportunities, then make sure to check out this free report.

It reveals three stocks that could surge on the back of renewed demand for lithium in 2021.

It is free to download right now.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report