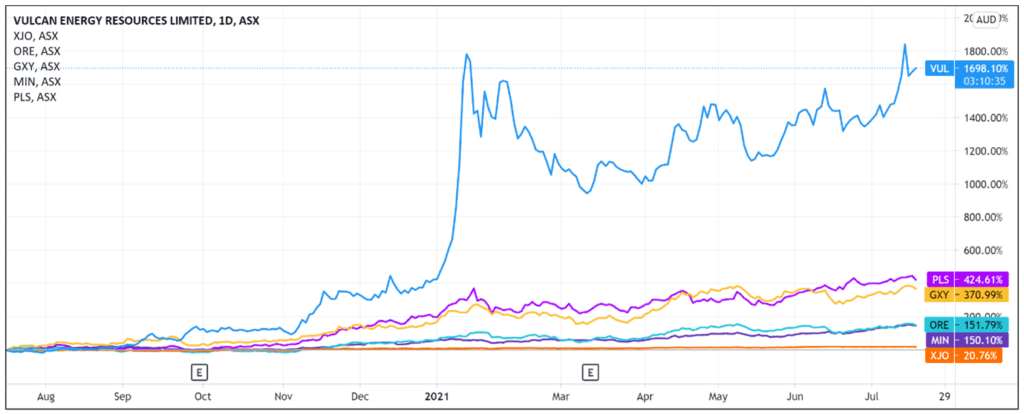

The Vulcan Energy Resources Ltd’s [ASX:VUL] share price spiked in early trade following an offtake term sheet with LG Energy Solution.

LG Energy Solutions (LGES) is the world’s largest producer of lithium-ion batteries for electric vehicles.

The binding offtake will see Vulcan supply LGES battery-grade lithium hydroxide and is the first binding lithium offtake term sheet for VUL’s Zero Carbon Lithium project.

VUL shares gained 9.2% in early trade, breaching the $10 per share mark.

The lithium stock retraced in afternoon trade, however, but was still up 2%. Vulcan shares were exchanging hands for $9.45 at time of writing.

Source: Tradingview.com

Vulcan’s offtake with world’s largest battery producer

The agreement between Vulcan and LGES is for five years, with commercial delivery set for 2025.

The terms leave room for the agreement to be extended by a further five years.

Under the offtake, LGES will buy 5,000 metric tonnes of battery-grade lithium hydroxide in the first year.

This will ramp up to 10,000 metric tonnes per year during the subsequent years of the supply term.

For context, in a February 2021 equity raise presentation, VUL said its Upper Rhine Valley lithium project has the potential to produce 40,000 tonnes of lithium hydroxide annually.

The LGES offtake, therefore, would be significant — representing a quarter of VUL’s production capacity from the second year onwards of the agreement.

Pricing of VUL’s lithium hydroxide will be based on market prices, with the commercial supply period to commence on 1 January 2025.

For the offtake to remain valid, what conditions must be met?

The conditions precedent to start commercial delivery includes the execution of a definitive formal offtake agreement on materially the same terms by the end of November 2021, the successful start of commercial operations, and full product qualification.

Three Ways to Invest in the Renewable Energy Boom

‘In line with our strategy’

Vulcan Energy Managing Director Dr Francis Wedin provided the following commentary:

‘This is the first binding lithium offtake term sheet for the Zero Carbon Lithium™ Project, so it is fitting that it is with the largest EV battery producer in the world.

‘LGES’s operations are of course global, but it is already producing batteries in Europe.

‘The agreement is in line with our strategy to work with Tier One battery and automotive companies in the European market. We look forward to a long and productive relationship with LGES.’

VUL ASX: What Next?

At first glance, today’s announcement seems very positive.

This is Vulcan’s first binding lithium offtake agreement for its flagship lithium project.

The agreement is with the world’s largest EV battery producer.

And the offtake is large — about a quarter of Vulcan’s potential production capacity.

So the pullback in VUL shares after the morning’s initial 9% surge could suggest some investors cashed out and took profits.

The retracing could also suggest investors are waiting to see if VUL and LGES strike a definitive formal offtake agreement by the end of November 2021.

Finally, it is interesting to note the lack of detail on the pricing of Vulcan’s lithium hydroxide.

Vulcan simply said LGES would purchase its product based on prevailing market prices. But there was no mention if Vulcan would apply a premium given its project’s green ESG credentials.

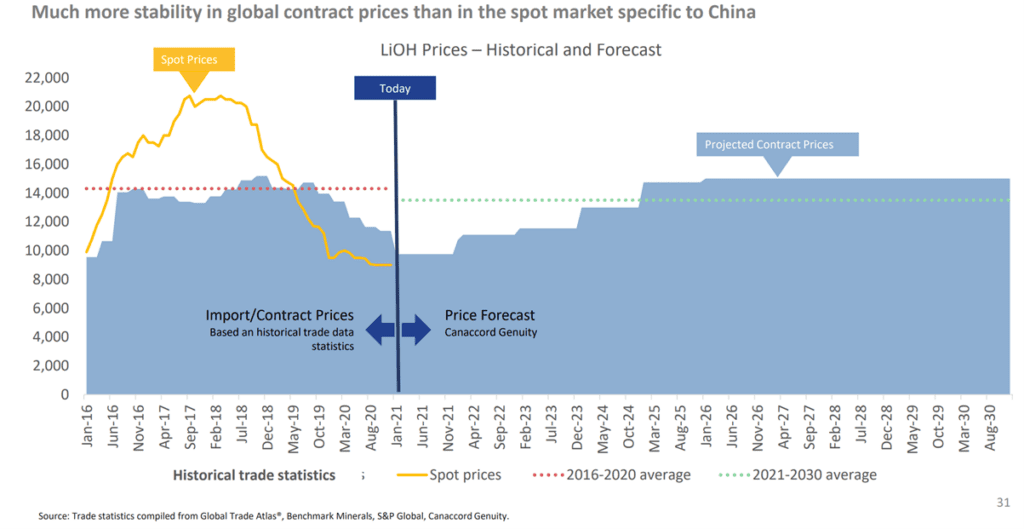

And since the offtake’s commercial delivery is slated for 2025, what prices can VUL’s lithium hydroxide fetch on the market then?

Vulcan’s investor presentation earlier this year suggested lithium prices would rise into 2025, plateauing somewhat after 2026.

All up, while today’s announcement was positive, investors are likely to monitor how the negotiations with LGES progress regarding the definitive formal agreement and whether further details emerge about pricing.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend reading Money Morning’s free 2021 lithium report.

If you’re keen for more reading, this report on energy disruption is also a great resource. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here