Ventia Services Group [ASX:VNT] shares are up by 1.20% today, trading at 3.5 cents after announcing it has secured a five-year services contract with the Department of Defence (DoD).

Shares of VNT have been on a steady rise this past year — rising by 22.11% in 12 months after the company secured contracts with Transurban Group [ASX:TCL], Auckland City Council and the significant fibre upgrade with NBN Co.

The infrastructure services provider has a market cap of $2.5 billion with approximately 35,000 staff operating across Australia and NZ.

So, what does the latest contract mean for its share price?

Ventia Secures five-year contract with DoD

Ventia, an Australian-based infrastructure services company, has secured a five-year services contract with the DoD. The new Defence Maintenance Contract is expected to deliver revenue of approximately $393 million to Ventia over the next five years, with a possible contract extension of a further five years.

The contract includes repair and maintenance of some of Australia’s newest and most advanced equipment including surveillance systems, marine craft, light armoured vehicles, and protected mobility vehicles.

It also includes the operation of a 24/7 nationwide vehicle and equipment recovery service.

Ventia’s Group Executive, Derek Osborn said this award is a testament to the strong partnership and shared forward thinking between Ventia and the Commonwealth.

Osborn remarked:

‘Our track record of delivering diverse maintenance services, our expertise in workforce management and demonstrated strong performance as a long-term Commonwealth partner were key elements in the award of this contract,

‘We’re proud of the collaborative partnership we have with Defence and are delighted to continue redefining service excellence on this important contract.’

The services with the DoD will commence on 1 December 2023.

Ventia promising outlook

The news today further cements Ventia as a major player in Australasian markets.

With several big contracts under its belt, Ventia is now turning a profit after seeing $100 million in losses in 2021.

Ventia has seen slow progress to this point, but in the past five years, it’s seen its earnings growth rate rise to 28.3% — above the industry standard of 20.6%.

Future growth depends on how Ventia manages its relationships and contracts with the Australasian market. This is as we move into the cyber realm where the company’s prospects can hinge on high-profile breaches and hacks of this critical infrastructure.

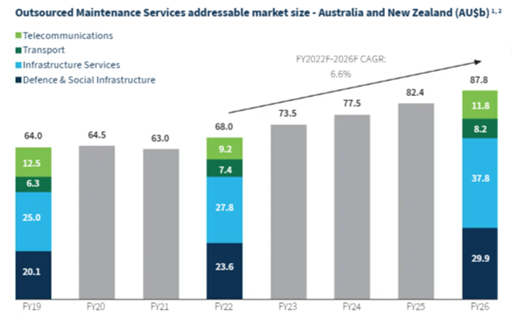

Source: Ventia

The newly created National Office of Cyber Security (NOCS) in Australia announced yesterday the appointment of its first head coordinator — highlighting the Government’s commitment to ensuring the steady breaches of private Australian information are curbed.

Investors should also look closely as the company manages the large chunk of debt that it ran up getting to this point — with a debt-to-equity ratio of 143% holding $745 million in debt built up largely over 2020–21.

The company told managers last year that it was ‘imperative to minimise costs’ as it tried to get a handle on the debt.

Ventia has told investors to expect 7–10% growth in NPATA this year.

Are there better growth opportunities out there in today’s market?

Tik Stocks — viral trends expected in 2024

With cost-of-living and inflation increases, political conflict and the energy crisis taking enough of the attention, you might be thinking…is it worth taking any risks?

But think about this — unassuming small cap Stemcell United [ASX:SCU] skyrocketed 8,284% in two days when it decided it would chase down a medicinal cannabis opportunity.

Cann Group [ASX:CAN] began at 30 cents and ballooned to $4 in a manner of months in another viral explosion.

This is why our experts bring you Tik-Stocks, a cousin to ‘meme stocks’ predicted to be the next big thing…and how to use them.

If you would like to know more about Tik-Stocks, click here.

Regards,

Kiryll Prakapenka

For Money Morning