In today’s Money Morning…slow to start but there’s another Fortescue out there somewhere…copper’s pullback short-lived…‘super-hot’ inflation could flush out last remaining bits of cash…and more…

Almost like clockwork as the market started to wobble, the US passed more stimulus.

The $1.9 trillion bill should prop up the market for the time being.

There’s a subtext to this though, and it’s all about inflation.

And it’s not that big of a concern for US Treasury Secretary Janet Yellen…

As per coverage in Bloomberg, Yellen said inflation before the pandemic, ‘was too low rather than too high…if it turns out to be inflationary, there are tools to deal with that.’

This is nothing new from Yellen, and central bankers around the world are relentlessly signalling that they are happy for inflation to run ‘hot’.

But what if it runs super ‘hot’?

That’s the more intriguing question and today I’ll suggest that a combination of factors will play into the hands of ASX-listed resource companies.

There are two ways to navigate this environment, where cash gets flushed out into the market.

Slow to start but there’s another Fortescue out there somewhere

One of our small-cap resource picks in Exponential Stock Investor recently came out and trumpeted the fact that it had secured access to a drill rig.

So what?

Well I take this as a major sign that the mining sector in Australia is really starting to heat up.

They simply can’t get rigs out into the field fast enough.

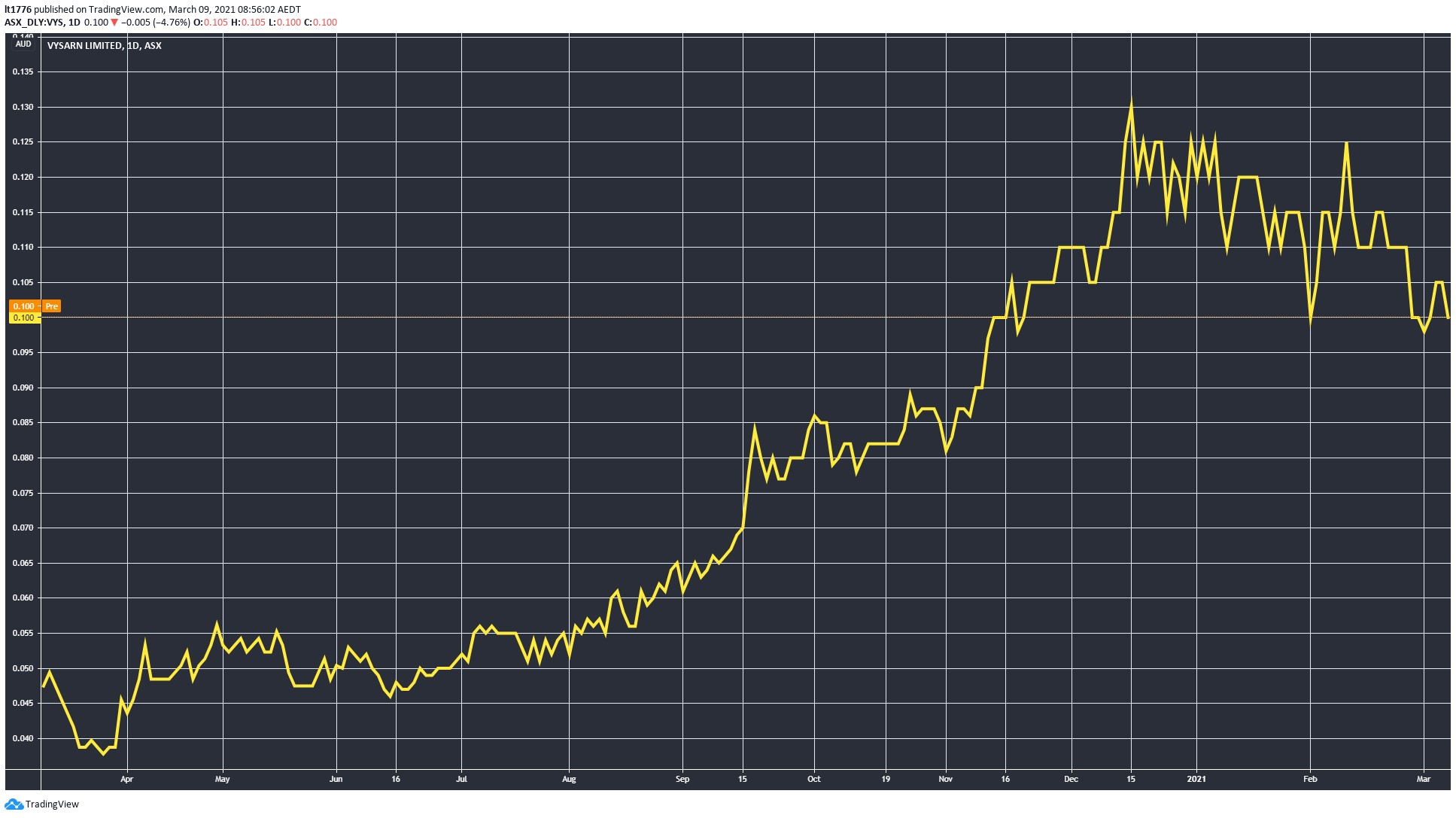

Check out this chart from small-cap drilling rig contractor Vysarn Ltd [ASX:VYS]:

|

|

| Source: Tradingview.com |

That’s a pretty strong move, and it underlines what’s happening all across Australia.

How to Capitalise on the Potential Commodity Boom in 2021. Learn More.

Now, I do know that a lot of small resource companies are moving slowly even though the prices of their resources are moving up.

But patience could be key here, and you may see one of these minnows eventually morph into a Fortescue Metals Group Ltd [ASX:FMG] giant in due course.

The key will be to focus on future-oriented resources too. Not just boring old iron ore.

Copper’s pullback short-lived

Copper is one of these future-oriented resources, and late in February the comments of one analyst caught my eye.

He said the following:

‘On a short-term basis, you want to let them come to you…It’s had this huge rally, and it’s getting quite overbought on a near-term basis.

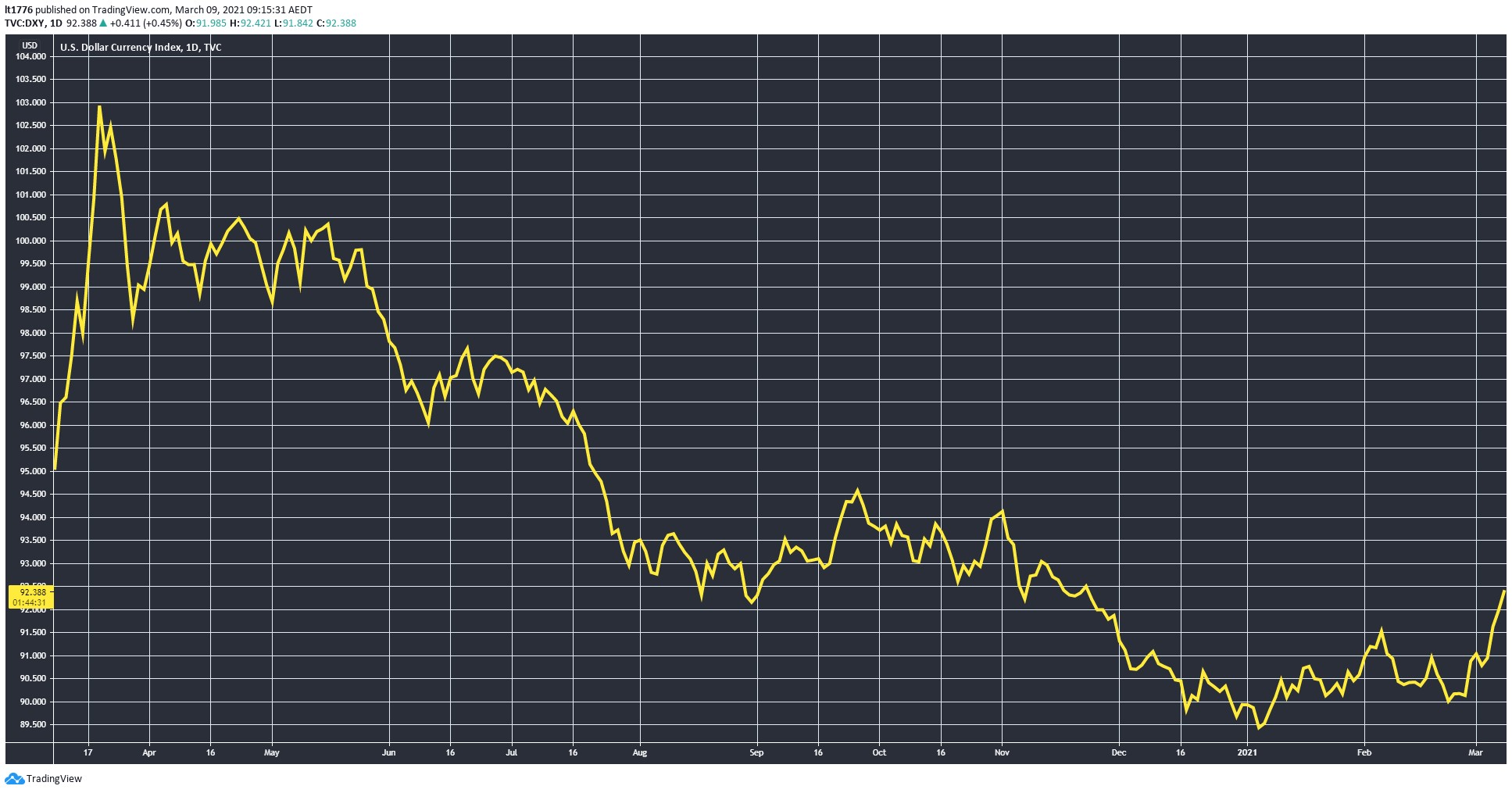

‘I think, therefore, it’s getting ripe for a pullback, which would be normal and healthy…Another concern is the dollar, which is a very crowded trade on the short side. If that rallies at all here in the near term, that could be another excuse for commodities to come in.’

He also pointed to this chart:

|

|

| Source: CNBC |

And sure enough, copper pulled back over the next few weeks.

The analyst also said this though: ‘Love [commodities] long term and I think any pullback will provide a great buying opportunity.’

I agree wholeheartedly, and part of my reasoning is what’s happening with currencies.

The copper pullback happened just as the US Dollar Index [DXY] rallied a bit as you can see below:

|

|

| Source: Tradingview.com |

I had a suspicion that the bottom was in for the USD, but the broad theme of currency devaluation should continue to play a role in the commodities space.

That is, when currency is becoming worthless, it makes sense to hold assets that are tangible.

Beyond that, the bond yield story which we covered last week underlines the inflationary narrative as well.

Even on top of that, tech demand is likely understated even in bullish scenarios.

And all of this before a mammoth US infrastructure bill gets passed, which is in the pipeline.

So, cue the mad rush into commodities, which is increasingly part of mainstream commentary.

Here are two options for investing in this environment.

‘Super-hot’ inflation could flush out last remaining bits of cash — two options

There’s a lot of cash sloshing around the market right now, but there would still be a fair bit of cash on the sidelines.

With a ‘super-hot’ inflationary scenario where inflation pushes past 4% in Australia or the US, for example, that would make your real interest rate thoroughly negative.

Meaning you can either watch your savings bleed out over the subsequent few years or reluctantly start to put money in the market.

Navigating this will be tricky as the market seesaws — meaning you need to get the portfolio right.

While our preferred method of dealing with this super-hot scenario at Exponential Stock Investor is to back carefully selected resource companies, there is another way.

It involves solid fundamental analysis combined with technical analysis on companies that the market seems to have mispriced.

You can learn all about how our Editorial Director Greg Canavan goes about picking stocks right here.

If you think the move towards value stocks is on, this is exactly the service for you.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments