Friday saw a huge spike in uranium stocks after Cameco [TSX:CCO] lowered production guidance.

They lowered 2025 production guidance to 14–15 million pounds from 18 million pounds.

That was enough to inspire an across the board jump in uranium stocks which is a good sign that the market is close to being in balance again.

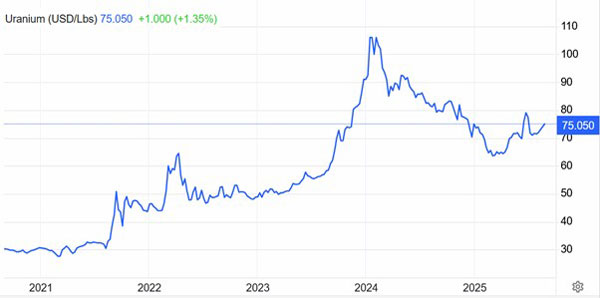

The uranium price has been creeping higher over the last month after a serious correction occurred in 2024.

But the long-term chart is still trending up.

Next leg up in uranium begins

| |

| Source: TradingEconomics.com |

If uranium can head above US$80/lb in the short-term, it could start running hard.

Callum and I have a look at a few of the stocks that are looking interesting in the uranium sector.

We also discuss markets in general as the bull market steps up another gear.

Earnings season has had a few stocks implode on bad results, but there have also been some star performers.

Retail stocks have been a bright spot with Harvey Norman [ASX:HVN], AP Eagers [ASX:APE], Temple and Webster [ASX:TPW], Nick Scali [ASX:NCK], and Lovisa Holdings [ASX:LOV] all impressing the market.

So it looks like the consumer is opening their wallets again as interest rates start to fall.

It is a good sign that the bull market is evolving and can continue to run.

So grab a cup of tea and a Tim Tam, sit back and enjoy another instalment of Closing Bell. Be sure to give us a ‘like’ on the YouTube version and leave us a comment if you want us to look at a stock for you.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments