Given the unfolding drama between the US and Ukraine, I thought I’d address one of the key issues in this high-stakes wrangling: Rare Earth metals, also known as REEs.

As you might have heard, the Trump Administration wants access to Ukraine’s supposedly ‘vast’ critical mineral reserves, including REEs.

This article from ABC News gives you the nuts and bolts of what’s happening:

‘Trump wants half of Ukraine’s rare earth minerals — so what are they, and why does he want them?’

You can read the full piece here.

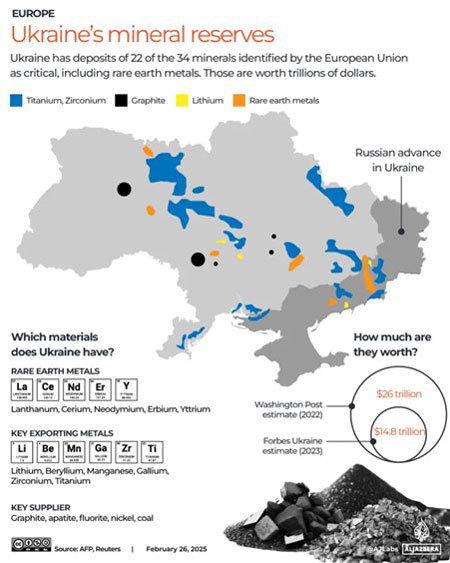

According to the article, UN data shows that 5 per cent of the world’s global reserves of critical minerals are in Ukraine.

But something doesn’t add up here…does Ukraine actually hold these alleged reserves?

Mining Memo’s Take

I’ve given REEs a lot of airtime over the last few years.

As you might know, China dominates global REE supply, which could threaten US tech and defence manufacturing if those supply chains are cut.

That’s why the US is keen to find alternatives.

But from what I can tell, the media is peddling a false narrative on Ukraine’s supposedly vast supply of critical minerals, including REEs.

I recently looked up a report by the US Geological Survey (USGS) on Ukraine’s mining sector. Importantly, it was published BEFORE the war kicked off in 2022.

The USGS study confirms that Ukraine was the third-largest producer of rutile and the world’s sixth-largest producer of ilmenite, iron ore, and graphite. Other important commodities included kaolin, manganese, and magnesium.

But there’s no mention of Rare Earths in the USGS report!

Yet, despite the lack of evidence from the world’s authority on global mineral reserves, the media is unanimously spruiking Ukraine’s REE potential.

Check this out from the Washington Post:

| |

| Source: Reuters |

According to this news outlet, Ukraine’s critical metal reserves are worth a staggering $26 trillion…which equates to the entire GDP of the US economy!

I’m calling BS on this whole ridiculous narrative.

There’s an agenda at play here, and I’ll leave that to the conspiracy theorist to figure out.

In terms of hard facts and science, Ukraine does not have anything near the vast reserves that are being publicised by the media.

Nor does it have meaningful REE reserves.

So, where’s this information coming from?

According to the Washinton Post, the ‘data’ was pulled from an organisation called the ‘Centre for International Relations and Sustainable Development (CIRSD).’

This is a public policy ‘think tank’ organisation registered in Belgrade and New York.

Who knows what this organisation’s purpose or motive is?

But I doubt they have any understanding of drilling, geology or evaluating mineral reserves.

Yet, it seems this is one of the primary sources backing Ukraine’s claims of vast critical metal reserves, including REEs.

Again, this doesn’t smell right.

Australia’s resource minister, Madaline King, was spot on last week telling the US President he should look to Australia to secure its REE supply chain.

Australia has companies like Lynas [ASX:LYC], which already extracts and processes Rare Earth metals — one of the only suppliers outside China.

Plus, Australia has a bunch of developers in the pipeline closing in on production within the next five years.

Combined, they will quickly meet the demand for Western suppliers IF the Chinese cut supply.

But suppose the think tank I mentioned earlier was right, and Ukraine DOES hold vast reserves of REEs despite a total lack of evidence.

Well, it’ll be decades before these reserves can be mined.

Once the war ends, these hypothetical deposits will take years to drill out, complete metallurgical test work and build complex processing plants.

By then, operators in Australia, Brazil, and Canada will already be in full production.

The whole issue is a farce, and once again, the media is peddling a false narrative.

If you want access to real and actionable investment insights, why not join me at Diggers & Drillers here.

Until next time.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments