The ASX was a sea of red yesterday. There’s no hiding the fact the market is under some pressure in the short term.

Is it inflation? Rates? The economy? We can go mad trying to divine the short-term swings.

Indeed….

We can rationalise any move in the market. But who really knows? Maybe two planets in outer space are getting closer…or further apart.

It might be better to say that what is… just…is.

That said, I’m looking back fondly at January. The market was ripping higher at that point.

Stocks were on the move!

Today, most stocks on the market are back into a grind.

Take heart!

Most shares might be going sideways. But some are still ripping higher.

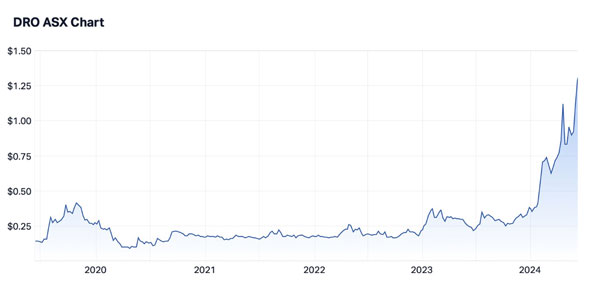

There’s no clearer standout than one of my small cap recommendations – DroneShield [ASX:DRO].

Look at how DroneShield has skyrocketed since the start of the year.

Check out this beauty…

| |

| Source: Market Index |

The ASX200 is up 2% since January 2.

Droneshield is up 254%. My subscribers have had the opportunity to ride – so far – about half that move since I put out this presentation.

We could call the first phase of the current DroneShield rally ‘reversion to the mean’.

Let’s put this in some perspective…

The small cap sector got hammered for two years – late 2021 to late 2023.

Like all bear markets, it took down the good, the bad and the indifferent.

DroneShield was no exception.

And yet, with a bit of historical perspective, anyone could see that, by the end of 2023, DroneShield was ten years old.

A lot of blood, sweat and tears – and investor money – was poured into the company at that point. The price didn’t show it…but the products and distribution were in place.

At the end of 2023, investors – those paying attention, anyway – knew this.

And what did Mr Market do? He discounted all that…and threw DRO into the bargain bin!

This is when it can be timely to channel the wisdom of Warren Buffett…

‘Mr. Market is your servant, not your guide.’

If you did nothing but watch the price action, you’d assume over 2022 and 2023 that DRO was a basket case.

After all, why else would investors dump it?

It’s not that they didn’t like DroneShield. It’s just the 2021-2023 bear market scared them even more.

High inflation, high rates – you know the factors hitting the market at the time.

These are not kind to companies, like DroneShield, that are not yet profitable and rely on investor support.

In a bear market, investor support gives away like a French resistance line.

And so it came to pass that DroneShield’s shares fell to 25 cents each at the depth of the gloom late last year.

Today they’re $1.30 each, within the space of 12 months.

What exactly has happened to turn this dynamic around so fast?

First, we had the ‘reversion to the mean’ move earlier in the year.

DroneShield went from being undervalued…to fairly valued.

Investors were happy to give it another $100 million earlier in the year to fulfill its ambition – no small sum.

Why?

DroneShield looks like it’s on the march to much, much higher revenue growth. The market can sniff big contracts up ahead.

After all, DRO sells to the “defence” industry – where government usually picks up the tab.

Government budgets are not like consumers. They are not under pressure. They don’t worry about swapping steak for mincemeat.

Most bureaucrats would be shocked if they were ever fired.

A precondition would mean someone held them accountable on a cost versus benefit basis. That’s not a feature of any Western government – at least, as far I know.

DroneShield can potentially sell worldwide. It has every chance of not just cashing in on the Aussie taxpayer…but the US and UK one as well.

Why do we care?

From DroneShield alone we can divine that the market WILL chase certain stocks, regardless of action in the wider market.

These stocks must be growing revenue. They must not rely on the Aussie domestic economy.

Is there another one that springs to mind?

As it so happens – yes.

GQG Partners [ASX:GQG] is a recommendation I made last year. It’s up about 80% since.

You can see it marching up here lately…

| |

| Source: Market Index |

GQG is a fund manager. Back in November it had US$112 billion under management.

This month it said that figure is now US$150 billion.

That means its asset base is up 33% in about 6 months. That’s a tidy rate of growth in anyone’s book.

GQG charges half a percentage point for every dollar under management.

The more dollars it can aggregate, the more it earns. That’s a dynamic the market can go along with.

Right now, GQG is trading on a Price to Earnings ratio of 11 for its 2025 earnings.

In other words, even after the big rally, the share price can keep going…because the business can keep going.

Here’s something else I noted yesterday….

While most stocks were down yesterday, both GQG and DRO were up.

Not by much, admittedly, but green nonetheless.

What does this tell us?

Well, to me, it says that buyers are happy to step in and support the stock even when the wider market is getting a drubbing.

That tells me you can act with a certain amount of confidence…as long as you can find the right business.

There are no guarantees in this world. Perhaps the market nosedives tomorrow.

Perhaps DRO can’t fulfill the high expectations now built into its share price. Perhaps GQG stops growing funds under management.

All I will point out today is that it’s a mistake to think that all stocks are having a dud year if you tee off the general market.

Remember this wisdom…

“Mr. Market is your servant, not your guide.”

Now…are you prepared to actively hunt down the next potential bargain left lying, unloved, in some dusty corner of the market?

I know I am. My latest issue is going to tell my subscribers all about it. If you’re keen to find out more, get started here. It will be out after the market closes today.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments