Today, we look at two companies whose share prices have just gone ballistic: Etherstack PLC [ASX:ESK] and Alterity Therapeutics Ltd [ASX:ATH].

We will examine what triggered the ESK and ATH share price rises.

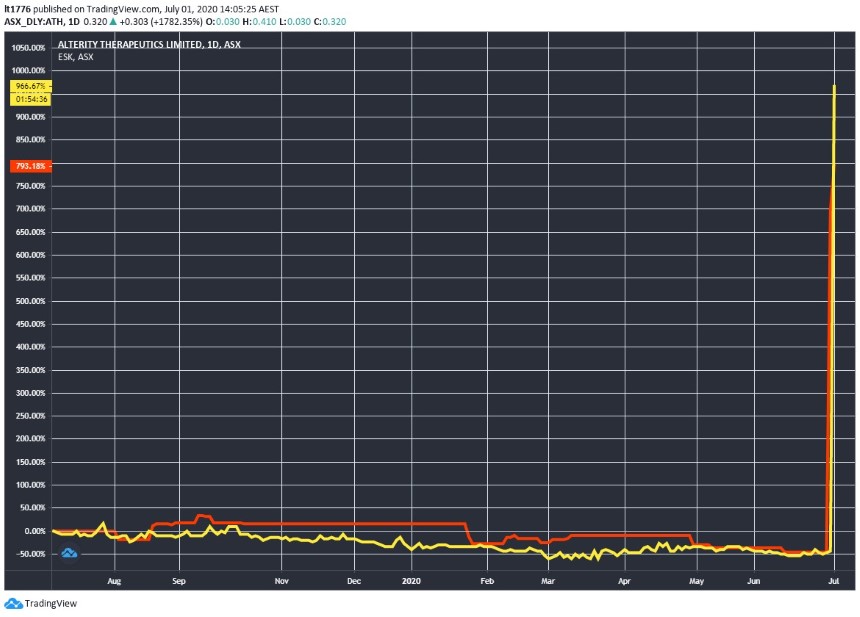

Here is the chart for both companies’ shares:

Source: tradingview.com

Pretty much vertical.

Here are the details on what triggered these moves.

ESK share price flies up on Tuesday

Shares of ESK were up as much as 1,358% by the end of the day in reaction to an announcement about a deal with Samsung.

At time of writing, ESK shares are trading at $1.855.

Etherstack bills itself as ‘the world’s leading licensor of wireless technologies for the LMR [land mobile radio] industry.’

The deal with Samsung, referred to as a Global Teaming Agreement, is to embed Etherstack’s digital LMR tech in a ‘Mission Critical Push To Talk (MCPTT) over LTE solutions to telecommunications carriers and governments across the globe.’

The deal is for two years, with the ability to extend it for a further two years.

As a result of the deal, ESK’s market cap ballooned to upwards of $200 million.

You would think the deal would materially impact revenue given the massive re-rate.

Let’s take a look at ESK’s most recent quarterly update for the period ending 31 March:

- US$1.302 million in receipts, down from USD$1.516 million in the December 2019 quarter

- It went through US$52,000 in operating activities

- It had US$474,000 in cash

So a picture emerges of a company that was ticking along but not setting the world alight.

All of that has changed now, and it will be very interesting to see what kind of revenue ESK will derive from the Samsung deal.

ATH share price follows in ESK’s footsteps, with wild increase on Wednesday

Alterity Therapeutics outdid ESK on Wednesday, with the ATH share price up 1,782.35%, trading at 32 cents at time of writing.

The announcement that triggered the move was with regard to its ATH434 drug for the treatment of multiple system atrophy (MSA), a Parkinsonian disorder.

MSA is a particularly nasty degenerative neurological disorder that goes after your body’s involuntary functions.

Alterity said it has received guidance from the US FDA on the development pathway for ATH434.

This means Phase 2 studies are in the pipeline.

There are no approved treatments for MSA, according to Alterity — so there appears to be a clear opportunity for ATH434, should it be successful.

What does the ESK and ATH share price explosion tell us?

Long-term holders of these companies are likely ecstatic after a lengthy bout of sideways/down trading for both companies.

Small-caps can deliver immense returns, but are not without significant risk.

The Australian biotech industry is growing — and a highly educated workforce underpins the growth.

Meanwhile, the tech industry is increasingly extending beyond fintech, as ESK’s remarkable rise shows.

If you are looking for more small-cap stocks that could go exponential like ESK and ATH, be sure to grab this free report. You may not have heard of the four companies covered in the report — but it may not be long before they become household names. You can download that report here.

Regards,

Lachlann Tierney,

For Money Morning

Comments