In today’s Money Morning…two signals to watch…check out the Aussie compared to the US dollar…the big question…and more…

There’s an old saying in markets that says, ‘If you’re going to panic, panic early.’

‘Up the escalator, down the elevator’ is another one.

The point of both aphorisms being, it’s often better to get out of a position on the first signs of danger, rather than holding on in blind hope.

Because it’s when the price falls further and everyone starts to panic, that you see the real bloodbath.

Are we at that point today?

I should say upfront this piece isn’t some doomsaying prediction you get from the usual perma-bears.

But you don’t need to be a perma-bear to exercise a bit of caution every now and again.

In fact, a smart investor will avoid any such bias in their thinking. They’ll just observe the facts and plan for all eventualities.

Which brings me to some things to be wary of in today’s markets…

Two signals to watch

While a lot of drivel was written about the recent Federal Reserve meeting and their threat to raise rates (albeit in 2023), there was one market reaction I did take note of.

And it was a market close to all our hearts — namely, the Aussie dollar.

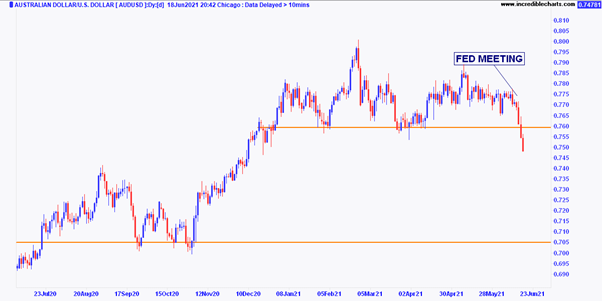

Check out the Aussie against the US dollar:

|

|

| Source: Incredible Charts |

You can see here how our dollar fell sharply for three consecutive days after the Fed meeting last Tuesday.

Such was the selling pressure, it cratered through a six-month support level and is sitting under 75 cents as I type.

Now you might not know this, but our little old Aussie dollar is the fifth most traded currency in the world.

It’s a position that’s at odds with the relative importance of our economy. We’re only the 15th biggest economy by GDP (economic output) and countries like Brazil and South Korea have larger economies.

But the reason we’re such a popular trading currency is that we’re a commodity-based economy. It’s the lion’s share of our exports.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Which means our currency is regarded as a good barometer for commodity demand — and in turn global economic growth.

Aussie dollar up, global growth good. Aussie dollar down, global growth bad.

So, the fact the Aussie tumbled so fast after the Fed meeting suggests markets are worried that the Fed’s actions — no matter how far in the future — could cause the global economy to contract.

That was signal number one last week…

The other sign of a more worried outlook came from the banking system itself.

Specifically, an obscure but important market called the reverse repo market.

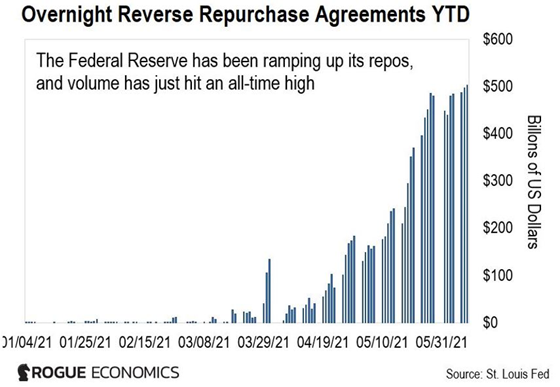

Check out the chart:

|

|

| Source: St Louis Fed |

My colleague Dan Denning recently explained what this market is and why this recent spike matters.

He told subscribers of The Bonner-Denning Letter:

‘For four straight days in a row last week, the volume of reverse repurchase agreements by the Federal Reserve (reverse repos) hit a record. Last Wednesday, it went over US$500 billion for the first time. And on Thursday, it was over US$530 billion.

‘The repo market is the plumbing of the financial system. Tens of billions of dollars — or lately, hundreds of billions — slosh and gurgle around within the bowels of the financial system.

‘It usually doesn’t make the news. Nothing catastrophic happens, generally.

‘But when the Fed takes in half a trillion dollars in cash from money market funds and gives those funds half a trillion dollars in Treasury bills in exchange, something fishy is going on.’

Without going too deep into the reeds on this, it basically means that banks have nothing better to do with their cheap cash than park it with the Fed.

Or more sinisterly, it could mean they don’t want to hold cash…or stock exposure…or property exposure…or anything but secure government treasury bonds.

That’s a pretty cautious decision given they could make better margins elsewhere.

Furthermore, this decision can have the knock-on effect of draining liquidity — money — out of the market too.

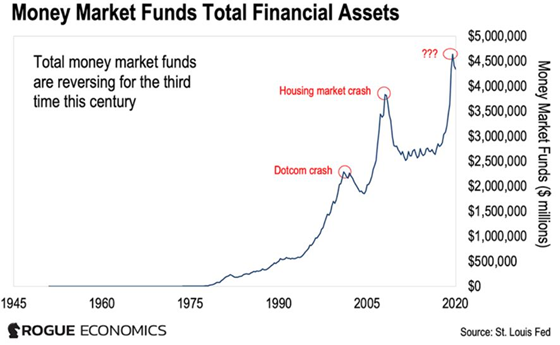

And when that happens…well, check out this chart:

|

|

| Source: St Louis Fed |

This reversal has historically coincided with some pretty steep market events.

Which brings me back to the point I made at the start…

The big question

So, should you exit the market today?

No, probably not.

But it is time to have a good plan in place. That could mean cashing in some profits or rejigging your portfolio a little.

Panic a little, not a lot.

My best guess is a wider crash will be avoided.

Because if the past year (and past decade, if truth be told) has taught us anything, it’s that central banks will prop up markets when needed.

That’s why what’s potentially more interesting — and profitable, if you can time it right — will be the Fed’s reaction to all this.

What will they do if markets do start to turn?

You can bet your bottom dollar that should things get too bad, they’ll get the chequebook back out again.

And if that happens, any market falls could be very short-lived.

That spells opportunity for a few timely trades.

For example, Bitcoin [BTC] and gold would be very good areas to look at if we get a short market panic, followed by Fed-induced recovery. Both assets benefit from low interest rates and continued money printing.

[You can sign up for a FREE event where I’ll show you exactly how I plan to profit from this here.]

Of course, if we do indeed get a tightening cycle — and I don’t think we will — the opposite is true too.

Whatever happens, I know I’ll be staying nimble in my own trading decisions over the next few months.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.