Overnight, US markets got another reality check.

The recent optimism has been sucked out of US stocks, and the ASX is looking set to follow suit. In other words, recent gains are reverting into the red.

But the bigger bloodbath may in fact be in bonds…

US 10-year and 30-year yields just hit fresh highs following the release of the Fed’s most recent minutes…a reaction to the ongoing fear that Powell and co may have a few more hikes left in them yet.

As a result, anyone looking for ‘safe’ assets to invest in is running out of options.

That is except for the one tried-and-true hedge against a downturn…gold.

This precious metal has long been coveted for this reason. Because when stock markets are going haywire, gold can usually offer at least some semblance of security.

However, there is more to gold than just hedging.

As our resident expert on the precious metal, Brian Chu, will tell you, gold markets have plenty of intricacy at work right now. That’s why today I want to look at two factors that could send the price of gold soaring higher…

The central bank hoarding continues

It’s no secret that, globally speaking, tensions are rising.

Russia’s invasion of Ukraine may be the most obvious example, but it certainly isn’t the only one. Ever since the pandemic, we’ve seen old ideals of open trade begin to stall and falter.

Governments are now increasingly focused internally or within their regional blocs. Moves that suggest globalisation may, in fact, be the biggest victim of COVID.

Russia simply gave one more reason than most to draw more ire. And while there are arguments to be made of the effectiveness of the sanctions placed on Russia, it’s the intent that sends a real message.

That’s why, this year, we’re seeing more buying of physical gold from central banks. As Invesco’s head of official institutions, Rod Ringrow, tells the Financial Times:

‘Up until this year, central banks were willing to buy or sell gold through ETFs and gold swaps…

‘This year it’s been much more physical gold and the desire to hold gold in country rather than overseas with other central banks…it’s part of the reaction to the freezing of the Bank of Russia’s reserves,’

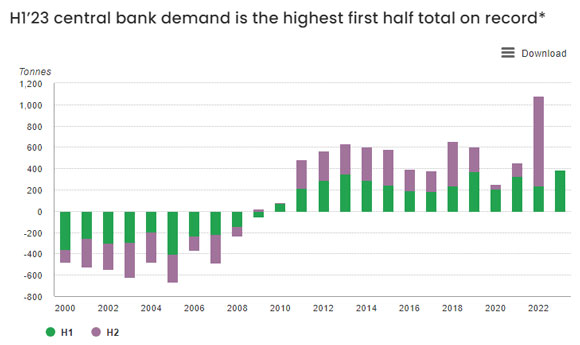

As a result, demand for the first half of 2023 is at its highest level in decades:

|

|

| Source: World Gold Council |

We’ll have to wait and see if the second half can repeat the huge surge (purple bar) we saw last year. But for now, at least, the stage is set for strong gold price resilience in the face of this central bank demand.

But they’re not the only ones…

A love for gold

Looking at the consumer market for gold, it’s also no secret that Asian demand is key.

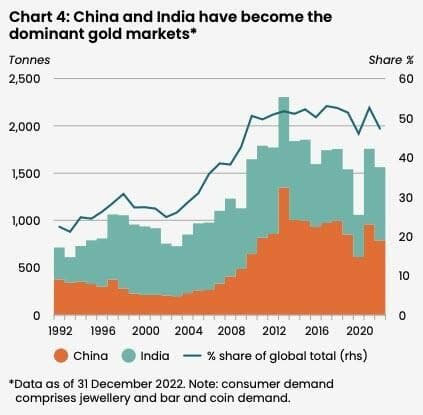

30 years ago, when the World Gold Council first published its demand trends report, Asia accounted for 45% of the global total. Today, that figure is now closer to 60%!

There are many cultural reasons for this that you can look up for yourself if you wish. But the main point from an investment perspective is that China and India are spearheading this demand.

Together, these two nations account for just shy of half of global gold demand.

Just look at the following chart to see how this has come to be:

|

|

| Source: World Gold Council |

More importantly, though, as these two economies continue to boom, this demand will almost certainly boom too. The thirst for gold from China and India is unlikely to abate and should provide strong long-term demand to prop up prices.

Which is why, especially in the current market climate, gold is a good place to invest.

But you need to know the intricacies of this market to get the most out of it…

After all, you could buy physical gold bullion, an ETF, producers, or explorers.

Each carries its own varying levels of risk and reward.

That’s why Brian is telling his subscribers right now about how to navigate these tricky times. Because as he explains in his latest ‘Blood Gold’ theme, sometimes a wrong bet can cost you more than just your money…

Check out the full story here for yourself.

I guarantee you’ll be shocked at what he has to say.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning