He’s the conservative politician that right wing America loves.

The Presidential platform is this: cut taxes, balance the budget and boost the military. It doesn’t make sense… but voters love the sound of it!

How is the President going to get the US deficit under control?

Max Boot writes…

‘Americans are told this happen ‘by eliminating, “waste, extravagance, abuse and outright fraud”, while waiting for an economic boom.’

Are we talking about Donald Trump and the Department of Government Efficiency?

No, as it happens. We’re talking about Ronald Reagan after his election in 1980 (I’m currently reading his latest bio).

Sounds familiar, doesn’t it?

Trump even pinched Reagan’s line: ‘make America great again’.

Why do we care about this? What’s it got to do with today?

Let me share with you some ideas on that.

All week we’ve been on a mission.

We’re unpicking a recent presentation on the AI supercycle and how it might play out over the next decade.

Let’s look back for a moment…

US markets boomed under Reagan’s tenure. The S&P 500 rose 250% between 1980 and 1988.

Many give Reagan the credit for the boom. They shouldn’t

It’s clear that Reagan had good timing to run the USA when he did.

He was in power when what really mattered began – the personal computer boom.

Think of the birth of Microsoft and Apple, and how it all eventually transformed business and everyday life.

Reagan had more luck…

Former economic headwinds like sky high inflation and a raging oil price came down under his term too.

He had nothing to do with those either. Markets did.

Reagan also had few economic ideas to offer. He was notorious for his lack of interest in policy and detail.

Apparently, UK PM Margaret Thatcher once pointed at her head, (referencing his) and said to her aide: “There’s nothing there.”

Reagan was originally an actor, after all.

Reagan’s genius – in terms of his popularity and image – was his ability to look and sound Presidential.

He wrapped himself in the flag and the patriotic idea of a US resurgence and victory in the Cold War.

Reagan told right leaning voters what they wanted to hear. Markets did the hard stuff and made it looked like his policies “worked”.

And today?

We hear an awful lot about President Trump and his various rantings, ravings, and whatnot.

Most of it, like Reagan, is…

A distraction from what’s REALLY driving the markets

It’s not hard to see where the big economic push lies.

See this slide from hedge fund Coatue…

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

| |

| Source: Coatue |

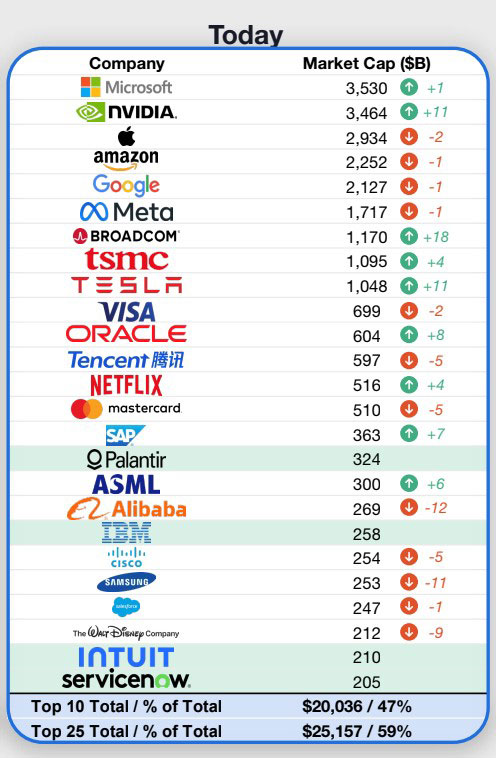

It shows the leading tech companies. These are the beating heart of the AI supercycle we’re now in.

On Monday we saw how this could transform the outlook for stocks like the Commonwealth Bank.

On Tuesday we saw how this could ignite an “AI flywheel” that takes down labour costs and inflation and drives up productivity and growth.

And today we’ll speculate that a new class of AI winners is going to emerge, in a thousand different ways.

That’s not to say you can’t make money in the classic plays like Nvidia or Tesla.

But the hedge fund Coatue has other ideas, some of which they float here…

| |

| Source: Coatue |

I can’t guarantee they’ll be right. But I sure reckon they probably will be.

This is an exciting idea for you and I as investors.

There’s another wave of firms that could soar higher as the AI supercycle plays out

AI was always going to rip through the markets no matter who won the election.

Of course, Trump will be quite happy, like all politicians, to take the credit for outcomes he has very little to do with.

However, I will admit one thing. Trump can juice the journey in a big way with tax cuts and lower interest rates.

It’s highly likely he’ll get both. His “big beautiful” bill is making its way through the US legislative process.

And Trump is hounding Fed chair Jerome Powell to get rate cuts in. Trump might fire him or make his life impossible if it doesn’t happen.

Between tech and Trump, all I can think is….what a combination.

We could be setting up for a new, massive surge in stocks over the next 3 years.

The big indexes may not capture this well, either.

The big US firms – at $3 trillion Nvidia dwarfs anything Australia offers – are so enormous that they obscure the smaller firms.

Don’t miss out on the opportunities here.

AI will be in play a decade from now, and thirty years from now, in the same way the position of US tech today goes back to innovations and investments made decades ago.

Nvidia began in 1993.

It’s an exciting time to be involved. Get what you need to know here.

Best wishes,

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

Australian Dollar

| |

| Source: Tradingview |

As the US dollar plummets, the Australian dollar springs back to life.

Last month saw a monthly buy pivot confirmed in the Australian dollar from a major buy zone.

The monthly MACD has also kicked into positive momentum, so a more bullish outlook is taking shape.

The long-term trend in the Aussie remains down, so we may still see some weakness going forward, but I reckon it is now a case of buying the dips rather than selling the rallies.

The point of control of the major wave I’m making calculations off sits at 68 cents. That is a solid target on the next leg up in the Aussie.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments