In today’s Money Morning…Trump’s bitcoin comments are no surprise given de-dollarisation efforts…many ways to exit fiat, and all are compelling…this isn’t a far-fetched scenario…and more…

|

Trump, the man who makes lightning rods look nonconductive, had a bit of an outburst on Bitcoin [BTC] recently.

This is what he said:

‘I don’t like it because it’s another currency competing against the dollar…I want the dollar to be the currency of the world.’

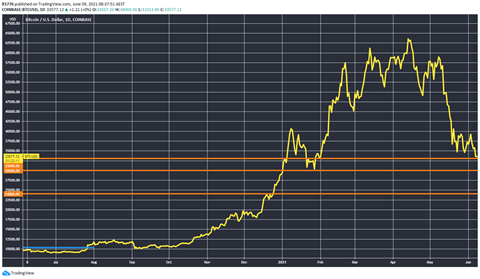

Trump’s comments on the cryptocurrency resulted in what I’d call a ‘minor sell-off’, causing the bitcoin price to get within a hair of support at US$33,000, which you can see below:

|

|

| Source: Tradingview.com |

Should the fear, uncertainty, and doubt (FUD) continue, US$30,000 would be the next natural line to defend, and if that’s breached the bottom could really fall out.

Taking the price of bitcoin all the way down to US$24,000.

Is this the start of a new crypto winter? What about gold?

Let’s break it down.

Trump’s bitcoin comments are no surprise given de-dollarisation efforts

Far from marking the dawn of a crypto winter, Trump’s declaration is a buy signal if you can fit the jigsaw together.

The headline could’ve read: ‘Ultra-nationalist former US President Trump declares favourite country’s currency the best thing ever and all other currencies rubbish’.

Yawn.

Of course Trump would say this. ‘America First’ means ‘US Dollar First’.

And as bitcoin is a borderless currency, this means it could eventually break down the nation-state over a long enough time frame.

It’s also important to know that the USD underpins a huge amount of third world countries’ economies, which is part of the reason El Salvador just moved to make BTC legal tender.

Highlighting a recent Reuters report about Russia cycling out of USD reserves, Greg Canavan and Ryan Dinse of New Money Investor said the following to subscribers:

‘There’s definitely some substance behind rational nation states questioning the viability of their US dollar reserves, with that debt-addled country seemingly willing to print out infinite dollars…

‘[Blockchain inherently enhances] financial inclusiveness. The fact is the current financial system has excluded huge swathes of the global population. Mostly in third-world countries.

‘Blockchain infrastructure — the new rails of the financial world — are a whole lot more efficient at bringing these people into a financial system.’

In turn, de-dollarisation could accelerate a shift to a far older form of money — gold.

This was a largely ignored article out of S&P Global Intelligence with huge implications:

‘The Indonesian government’s plan to launch a blockchain-based, precious metals-backed payments and savings platform outside the banking system will likely drive financial inclusion further in a country where about 51% of adults, or 95 million citizens, are unbanked.’

Tokenised gold and silver, precious metals-backed blockchain banking, call it what you will.

But the long-term case for exiting fiat is starting to really solidify.

Many ways to exit fiat, and all are compelling

Gold, bitcoin, or DeFi cryptos that generate interest — all of them are compelling investments.

Or better yet, combine all three of these things.

You could buy some bitcoin, swap that for a DeFi coin that facilitates loans, all backed by gold or silver, and get a slice of the ‘exit fiat’ layer cake.

Whatever you do, standing still isn’t really an option anymore.

As much as I respect the ‘stay in cash’ ultra-bear mentality, it just doesn’t seem right when central banks are opening the floodgates.

The reasoning is this:

- If a crash does come, central banks only know one way of fixing the problem, so…

- Modern Monetary Theory, helicopter money, QE will just accelerate, meaning

- Fiat will go down the drain even more, in turn…

- Gold, bitcoin, and DeFi become even more enticing

- CBDCs are launched, while corporate digital currencies also chip in

- Governments around the world are then forced to pick a side in an environment where ‘techno monetary competition’ is the norm

- The governments that harness innovation the fastest win the race to establish a trusted system, while governments that use ham-handed tactics to force adoption fall by the wayside.

This isn’t a far-fetched scenario.

Central banks are intoxicated with an ever-expanding playbook and holding out for a ‘moment of clarity’ where they somehow realise their sins against savers and those in cash is a mentality that’s straight out of Samuel Beckett’s Waiting for Godot.

So, if any of what I’ve just outlined registers for you, be sure to watch the latest briefing from Greg Canavan and Ryan Dinse on the future of money.

It’s a compelling watch, and in it they share some tricks and hacks for navigating the impending changes in the world of money.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.