In today’s Money Morning…asset prices, inflation, and a sea of cash…the Fed’s inflation gamble…tune in tomorrow for all the details on just how ugly things could get…and more…

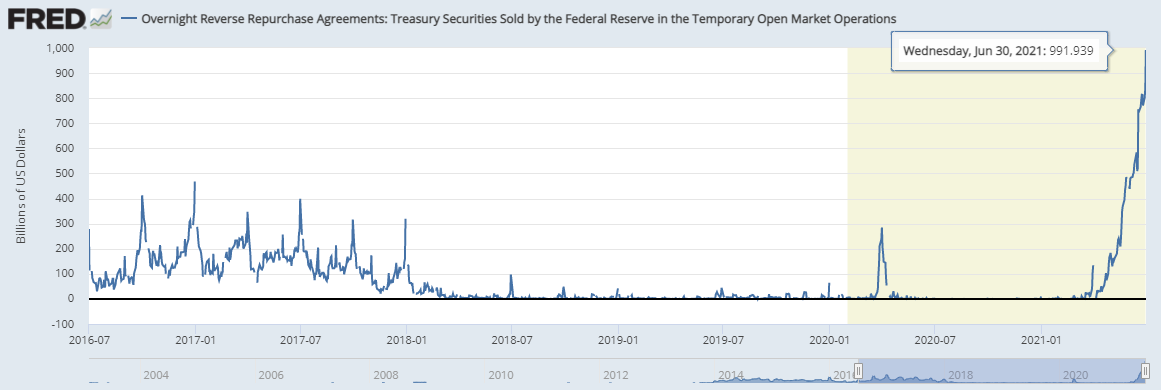

Last night, while you and I were sleeping, the US Federal Reserve sucked up US$991.939 billion in cash. A new record for the confusing and daunting reverse repo program undertaken by the central bank.

So what does that actually mean?

Well, today (and tomorrow) I’m going to try and explain it to you in some simple terms. As well as why I believe you should care about this obscure but growing area…

First of all, though, let’s dissect what a ‘reverse repo’ agreement even is.

‘Reverse repo’ — or reverse repurchasing (not repossession) — is a tool that the Fed has been using since 2013. A means for the central bank to orchestrate overnight agreements between itself and major depository institutions, like banks.

As for its purpose, the reverse repo program is designed to set a floor for interest on excess bank cash holdings, or reserves. In simpler terms, this overnight reverse repo market is designed to prop up short-term interest rates. Providing a relatively risk-free alternative for major financial institutions to park their cash.

The problem, though, is that this reverse repo market is now so popular that it is worth just shy of a trillion US dollars. Having grown substantially over the past few months:

|

|

| Source: St Louis Federal Reserve |

Asset prices, inflation, and a sea of cash

Now, to explain why this reverse repo has become so popular, we need to look at recent events.

Essentially, it all kicked off with the renewed quantitative easing (QE) from the Fed itself. A response to the coronavirus-induced market crash early last year. Resulting in a flood of cash into the US economy in order to stave off a major collapse.

And, as we’ve seen, a lot of this cash has found its way into financial markets like stocks. Sending share prices to record highs, and eye-popping valuations. In other words, inflating asset prices.

As a result, US banks and other deposit-taking institutions have grown wary of the risks in equities. Instead turning their attention to short-term and safer alternatives, such as money markets.

But, as demand for these money market assets increases, the interest they pay decreases. Edging closer to 0% returns, or even possibly turning negative.

A situation that would result in the banks paying someone else to hold their money!

The Fed, not wanting to go down this unusual and untested road, therefore had to intervene. Offering an alternative via its overnight reverse repo program. Recently setting the interest rate for this agreement at 0.05%.

And while that may seem like a trivial sum, when we’re talking about billions of dollars, it adds up fairly quickly. Especially as it is being paid out daily.

What makes this all so comical, though, is that the Fed has had to create this solution to solve a problem that it itself brought about.

The reverse repo (interest) rate was only raised to soak up all the excess cash provided by the Fed’s QE.

A mind-boggling workaround to try and curb the rampant inflation in asset prices that it is responsible for…

Three Innovative Fintech Stocks to Watch Now. Discover more.

The Fed’s inflation gamble

So what is the point of all this convoluted monetary policy?

Well, just like it has always been, the Fed’s goal is to try and stave off inflation while growing the US economy. As for whether it is achieving that…opinions are split.

Fortunately for the Fed, there is somewhat of a precedent though.

As the graph above shows, back in 2016 and 2017, the reverse repo market was also pretty popular. A symptom of the unwinding of the Fed’s previous QE foray, stemming from the ‘08 crash.

And, as the graph also shows, it basically petered out by early 2018 — resolving itself without much fanfare and without wreaking havoc on the US economy. Which, I would argue, is largely thanks to the stubbornly low inflation preceding this period.

That, I suspect, is why the Fed is confident this abundant reverse repo take-up will work again. Mopping up their own mess, while the US economy gets back on track again.

But as we’re now all painfully aware, the world is a much different place from 2018.

The global economy as we know it has undergone a major shift, having been forced to adapt to a pandemic-driven ‘new normal’. A situation that has not only required excessive intervention from central bankers, but also governments.

All of which has led to this distorted ‘everything rally’ as some call it.

A scenario where assets of almost any kind have boomed over the past 12 months or more. A type of inflation that isn’t necessarily great for the real economy. Especially now that it risks spilling over into consumer inflation — via CPI data — as well. Just like we’ve seen recently from US statistics.

Powell and his buddies aren’t worried though. No, as they’ve reassured everyone, this inflation is merely transitory. After all, they desperately need it to be.

Because if it isn’t, then the limbo between the reverse repo market and QE asset purchasing could blow up in their face. And if that were to happen, then stock markets could be in for a very wild ride.

Tune in tomorrow for all the details on just how ugly things could get, as well as what I see are your best options as an investor to potentially navigate it…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.