Penfolds owner Treasury Wine Estates [ASX:TWE] has pulled out the chequebook for a large expansion into the high-end US wine market by purchasing Daou Vineyards.

The move sees TWE expand its luxury wine brands into the most extensive wine market in the world at a time when it has seen underperformance in other markets due to economic headwinds.

The company’s shares are on trading halt until Friday, 3 November, but last traded at $12.10 per share. TWE has been underperforming in the second half of this year, with its shares down 6.6% in the past 12 months as consumers’ preferences move to cheaper brands.

TWE owns over 11,300 hectares of vineyards and an international wine portfolio, including Penfolds, Beringer, Lindermans, Wolf Blass, Rosemount and more.

The move today continues their ‘premiumisation’ strategy, which the company says is supported by long-term wine preference trends.

What does that strategy mean, and how is the future looking for the wine giant?

Source: TradingView

Premium market moves

Australia’s biggest wine company is making a concerted effort to move where the money is.

The $1.6 billion purchase of Daou Vineyards will have an upfront cost of US$900 million, plus an earn-out agreement of up to US$100 million if revenue targets are met through to the end of CY27.

To fund the purchase, TWE has announced an equity raise of $825 million at a 10.7% discount to the closing share price, pegged at AU$10.80 each.

The acquisition should wrap by the end of the calendar year and is forecasted for EBIT contribution ranging from $23–25 million in the latter half of 2024.

Speaking about the acquisition, CEO of Treasury Wines, Tim Ford, said:

‘The U.S. is the world’s largest wine market and we’re beyond thrilled to add DAOU to our portfolio, cementing our position as a global luxury wine leader. This is a transformative acquisition that accelerates the growth of our luxury portfolio globally and paves the way for new luxury consumer experiences.’

Daou Vineyards is a California-based luxury brand in the Paso Robles region. The winemakers are known for their Bordeaux-style reds that one prominent wine reviewer described:

‘Held opulent textures across the palate with flavours of red fruit, blueberry, and chocolate-covered raspberry.’

A less sophisticated wine enjoyer conversely described the wine as:

‘Very expensive and not anywhere as good as my basic grocery store $15 bottles of wine.’

Regardless of how you view the wine, the purchase shows TWE’s focus on premium, high-profit margin offerings as it pivots away from previous market challenges.

In its last two trading updates, the company has seen many of its brands underperform as wine drinking has trended down globally in recent years.

This has been particularly acute in the high end of the wine market as consumers have been favouring budget brand wines in the face of high interest rates and lowered disposable income.

In FY23, only the Penfolds division saw increasing sales revenue — with a 14% increase — while others saw double digit declines.

Despite these challenges, TWE says that its luxury portfolio has remained ‘resilient’ and has seen 15% growth in revenues across Asia (ex-China), Australia, and Europe.

The biggest factor for TWE in recent years has been the Chinese 218% tariff on wines, which was put in place in November 2020 at a low point in Australian-Chinese relations.

With a recent visit to Beijing by PM Albanese, China said it would commence a five-month review of the tariffs, which many saw as a clear sign of them being removed.

What will this removal mean for TWE, and what will this acquisition mean for their strategy moving forward?

Outlook for Treasury Wines

The purchase is clearly part of its broader strategy to lessen reliance on the Chinese market, which tariffs destroyed almost overnight.

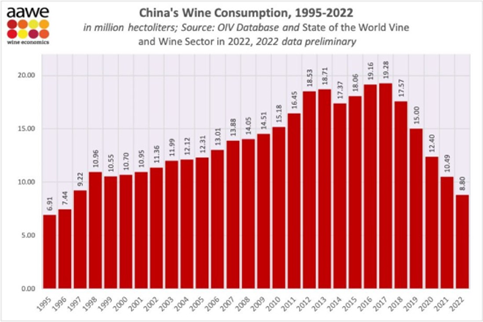

Australian winemakers currently hold a glut of around $1 billion of Shiraz and Merlot that would have in past years gone to China’s growing middle class, who became wine-obsessed in the 2010s.

This could be huge for TWE’s future sales, but it seems their longer strategy is outside of China.

For TWE, they may be looking beyond the tariffs as a broader slowdown in wine consumption can be seen in many global markets— the most significant being China— whose consumption plummeted through the pandemic era.

Source: Aawe

With further economic pain expected in China, these figures aren’t likely to recover soon.

TWE has shifted its sights towards the world’s largest wine market in the US, worth approximately US$33 billion annually.

The addition of Daou Vineyards will fill the niche of $20–40 wines within its portfolio, which was previously lacking and bolster its American Division to become standalone.

Whether the ‘premiumisation’ strategy of TWE bears fruit remains up for debate.

Consumption data shows older consumers are paying more for premium wine, while younger buyers are increasingly less engaged with wine and concepts of luxury brands.

With the addition of Daou, approximately 50% of the company’s revenue will now come from its luxury portfolio…so clearly, the company sees a solid pathway to future growth in the segment.

For now, the high end of the wine market may need some time on the shelf to mature.

Big changes for Money Morning

Tomorrow, when you come to our website, you’ll see some big changes.

We’re launching Fat Tail Daily tomorrow, bringing together all of our great editors under one roof.

It will still be all the great insight and perspective you’ve come to expect from our editors, but with a few more voices.

You’ll hear from our commodities expert, geologist James Cooper, our Editorial Director and value expert Greg Canavan, and our gold bug Brian Chu.

You’ll get the latest news on Tech and Crypto by me and Editor Ryan Dinse.

We’ll also bring in the shrewd thoughts of Callum Newman and Murray Dawes.

Fat Tail Daily will also house the macro commentary of our founder, Bill Bonner and the sharp Nick Hubble.

Phew, that’s a lot of smart cookies! But don’t fret; you can adjust your preferences to hear about only the markets that interest you.

If you are yet to become a subscriber, now would be a great time to do so…to ensure you never miss a single Fat Tail Daily update.

Regards,

Charlie Ormond

For Money Morning (one last time)

Comments