Australian road services and toll-route engineer Transurban Group [ASX:TCL] was see-sawing in shares from the early morning to afternoon, creeping around a 1% decrease after lunch time.

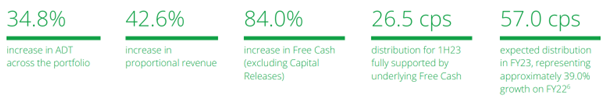

The bulk of the company’s news was good, as the group revealed record first-half earnings ($1.658 billion) gained through its road route and tolls services, with traffic congestion and rising toll fares both boosting performance.

Dividend guidance has been raised to 57 cents a share, up from the last upgrade of 53 cents.

In a separate announcement, the group’s CEO, Scott Charlton, was marked for departure by the end of the year after serving 11 years.

In the past full-year, TCL increased more than 9% in share price, and is up almost 7% in the last month.

Source: TradingView

Transurban’s first half results and upgraded dividends

The routes and roads group today revealed positive news in the delivery of record first-half earnings gained thanks to the comeback of traffic congestion and rising toll fares.

Revenue was particularly boosted by record traffic in Sydney and Brisbane, freight traffic and weekend travel, with proportional revenue toll income directly from Transurban’s toll roads hitting a record of $1.658 billion.

In relation to record revenue, EBITDA (earnings before interest, tax, depreciation, and amortisation) jumped 54% to the total of $1.238 billion.

The company attributed the influx of earnings to post-pandemic traffic and toll fares rising at high rates, one of the many impacts of continuing inflation.

These results brought about the rising of dividend guidance to 57 cents a share, up from the last upgrade of 53 cents.

The group claimed a resilient balance sheet, 97% of debt book hedged, and $3.6 billion in corporate liquidity as projects progress to plan and budget.

Out-going CEO Scott Charlton commented:

‘It is pleasing to see traffic for the half setting a new record for the business.

‘Around 68% of Transurban’s toll revenue is linked to CPI escalations, creating inbuilt inflation protection. Timing of escalations can be delayed depending on the asset, meaning that the flow through from recent higher inflation numbers has yet to be recognised across some of our markets.’

Source: TCL

Transurban’s other news

TCL announced a new agreement to partner with Canadian Investor CDPQ by way of a 50% stake in the A25 toll road in Montreal, Canada for CA$355 million (AU$382,725,500).

The group says this will create a partnership with one of the world’s largest infrastructure investors, one which already maintains existing transportation assets in the Montreal market.

Transurban also announced CEO and Executive Director, Scott Charlton, will leave the group at the end of the calendar year 2023 after leading the group for 11 years.

A succession plan in place, including an array of internal candidates, and a global search for his replacement. Charlton commented:

‘Now is the right time to transition the business to the next CEO and for me to pursue new opportunities.’

The company looks forward to high performance in traffic growth and high rates, as well as progress on key project milestones. On this, Charlton commented:

‘We are well-placed to deliver on growth in future cash flow.’

Australia’s next commodities boom

It’s prime time in the commodities market, and things are only just heating up.

Our expert, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom, and that ‘the gears are in motion’ for Australia and its stocks to benefit with big gains.

According to James, the next big mining boom is predicted to happen in the next few years, the question is, are you ready for it?

Don’t let the same people who got rich last time be the only ones for a second time!

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia