In today’s Money Weekend…the invasion of Ukraine has thrown a curveball at markets…resilient in the face of conflict…the time to buy will return…and more…

Hello, Ryan here filling in for Murray while he enjoys some well-deserved time off.

When it comes to markets at the moment, though, there is no time for relaxing.

The invasion of Ukraine has thrown a curveball at markets, suggesting that investors clearly didn’t expect Putin to actually start a potential war.

However, if you’ve been following Money Weekend recently, you would have been warned.

Murray has been talking about looming volatility for a while now. That’s why he was so bullish on gold last week, noting that the break above US$1,880 was a strong sign of more gains to come.

As he noted:

‘Now that it has broken above that level, I’d like to see the buying gather steam and the gold price to head to US$1,975–2,025 over the next month or so.’

A week later, and it looks like that target could be met in a matter of days, not months.

So in that sense, gold really is the standout asset to be in right now.

But that doesn’t mean you should give up on stocks just yet, either.

Because while the ASX was certainly pummelled this week, things may turn around quicker than you think…

Resilient in the face of conflict

The ASX endured such a strong sell-off — a reaction that wasn’t really about the potential consequence of war, but more about the surprise of the invasion itself.

Uncertainty is what the market fears most — not the actual conflict.

Because while war is undeniably terrible, at least it is somewhat predictable. Analysts and investors can evaluate and gauge how the economies of the world will be impacted by Russia’s assault on Ukraine.

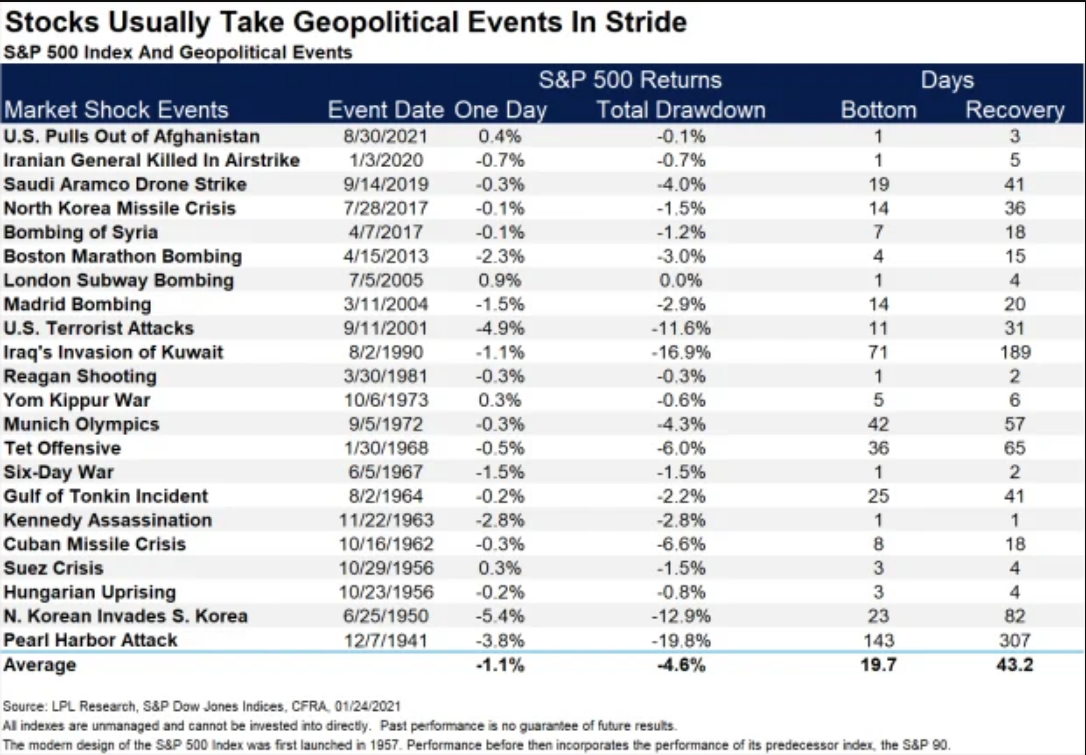

Indeed, as this data shared in the AFR shows, markets are pretty resilient when it comes to conflict nowadays:

|

|

| Source: Australian Financial Review/LPL Research |

As you can see, while the short-term pain can be noteworthy, it often doesn’t take long to recover.

Granted, there are still outliers — such as the Kuwait invasion. Meaning that there is still a possibility for the situation in Ukraine to drag on.

It will all depend on what sort of developments we see, and how well markets can account for them.

The time to buy will return

The other thing to keep in mind here is that Ukraine is probably still less important to markets than the Fed — at least if we’re taking a bigger picture perspective.

Again, that could change if things spiral totally out of control in Europe, but that seems unlikely right now.

More importantly, I’d be keeping a close eye on how Ukraine now also influences the Fed. Because as Cleveland Fed President Loretta Mester commented overnight:

‘The implications of the unfolding situation in Ukraine for the medium-run economic outlook in the U.S. will also be a consideration in determining the appropriate pace at which to remove accommodation.’

To me, that sounds a whole lot like the central bankers may be a little more hesitant to lift rates. It’s a decision that could continue to let inflation run rampant in the US.

I think we’re even seeing the US market price some of that sentiment in. Because compared to the local market, many US stocks brushed off news of the invasion. CNBC showcased the dramatic turnaround on Thursday (US time) perfectly:

‘The S&P 500 rose 1.5% to 4,288.70 after dropping more than 2.6% earlier in the session. The Dow Jones Industrial Average added 92.07 points to 33,223.83, erasing an 859-point decline. The Nasdaq Composite ended the session 3.3% higher at 13,473.59, after being down nearly 3.5% at one point in the session.

‘Investors bought the dip on some of the biggest tech names during Thursday’s volatile session. Amazon, Netflix, Alphabet and Microsoft all closed higher — erasing sharp declines from earlier in the day. Netflix rose 6.1%, and Microsoft added 5.1%. Alphabet and Meta Platforms popped 4% and 4.6%, respectively.’

Markets are clearly seeing the silver lining in all of this — a fact that investors like yourself need to seriously consider.

The short-term threats should definitely still be front of mind, but the long-term outlook may not be nearly as bad as the news suggests.

Just something to keep in mind for the days and weeks ahead.

Regards,

|

Ryan Clarkson-Ledward,

For Money Weekend

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.