In today’s Money Weekend…Evergrande default…inflation up, bonds up. Huh?…gold correction over?…and more…

Will China’s Evergrande default?

We could be about to find out.

18–19 October (this Monday and Tuesday) is the deadline for when the property developer could formally be declared in default if it hasn’t fronted up to bondholders.

Evergrande isn’t alone.

A wave of Chinese developers are also staring down the barrel of payment deadlines between now and Christmas.

China’s credit markets are on the precipice.

At some point the authorities will step in to do something.

But will we see Chinese equities implode first?

And what are the wider ramifications here for the Australian economy and your investments?

My friend and Head of Research for Fat Tail Investment Research, Greg Canavan, has just released an in-depth report on this.

It’s great timing, and I really urge you to read it as soon as you can by clicking here.

As Greg says:

‘The only question is whether investors will receive some sort of bailout or not.

‘In the past, “bailouts” have been in the form of state-directed lending growth. That is, when debt goes bad, just create more of the stuff to paper over the cracks.

‘But that’s not going to happen this time around…’

This is a breaking story, with huge potential implications.

You would do well to get ahead of this, this weekend. You can do so by reading Greg’s report and studying the investment strategy he’s laying out for his readers. You can gain access by clicking here.

But it’s not only the Evergrande situation that the market is contemplating at the moment.

Inflation up, bonds up. Huh?

The big news during the week was the market reaction to the hot CPI figures and the Fed minutes that showed that taper is definitely coming soon.

I have been harping on about the US 10-year bond yields and the need for caution as they approached the highs reached earlier this year.

My view is that a breakout above 1.8% in US 10-year bond yields will see a sharp move higher in yields towards 2.2%.

But I need to see yields heading above 1.8% for that scenario to kick in.

I had expected hot inflation numbers to force the Fed’s hand to start tapering and possibly raise rates earlier than the market expects.

With a huge US fiscal stimulus coming that will be paid for by issuing yet more bonds, a Fed that will be lowering its purchases of bonds with printed money and inflation running hot, I thought it was odds on that the US 10-year bond yield would shoot through 1.8%.

But the opposite happened! The yield curve flattened after the hot CPI figures came out and the Fed confirmed that taper was coming soon.

Short rates went up and long-term rates fell.

What on Earth is going on?

When something happens in the market that is the complete opposite of what you thought should happen, it pays to sit up and take notice.

Either it is a short-term dummy and soon enough the 10 years will start selling off again and the 1.8% region will be threatened, or the market is sending a strong signal about what lays ahead as the Fed changes tack.

The first observation is that if inflation runs hot and, 10-year bonds yield only 1.5%, there is plenty of capital destruction that will happen over the next few years.

Negative rates may increase further and if inflation surprises to the upside the level of negative rates could be quite shocking.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Gold correction over?

Gold of course should do very well in an environment like that.

Gold spiked higher on Wednesday and held those levels in the next session. It will be interesting to see how gold trades over the next few weeks.

We have been in a 14-month-long correction in gold, and gold stocks are badly beaten up despite the fact they are spitting out cash left, right, and centre.

I have been fearful of the potential for US bonds to get smashed, which would have hit gold prices as real rates increased.

But the counterintuitive move in bonds this week has me thinking gold is a no brainer.

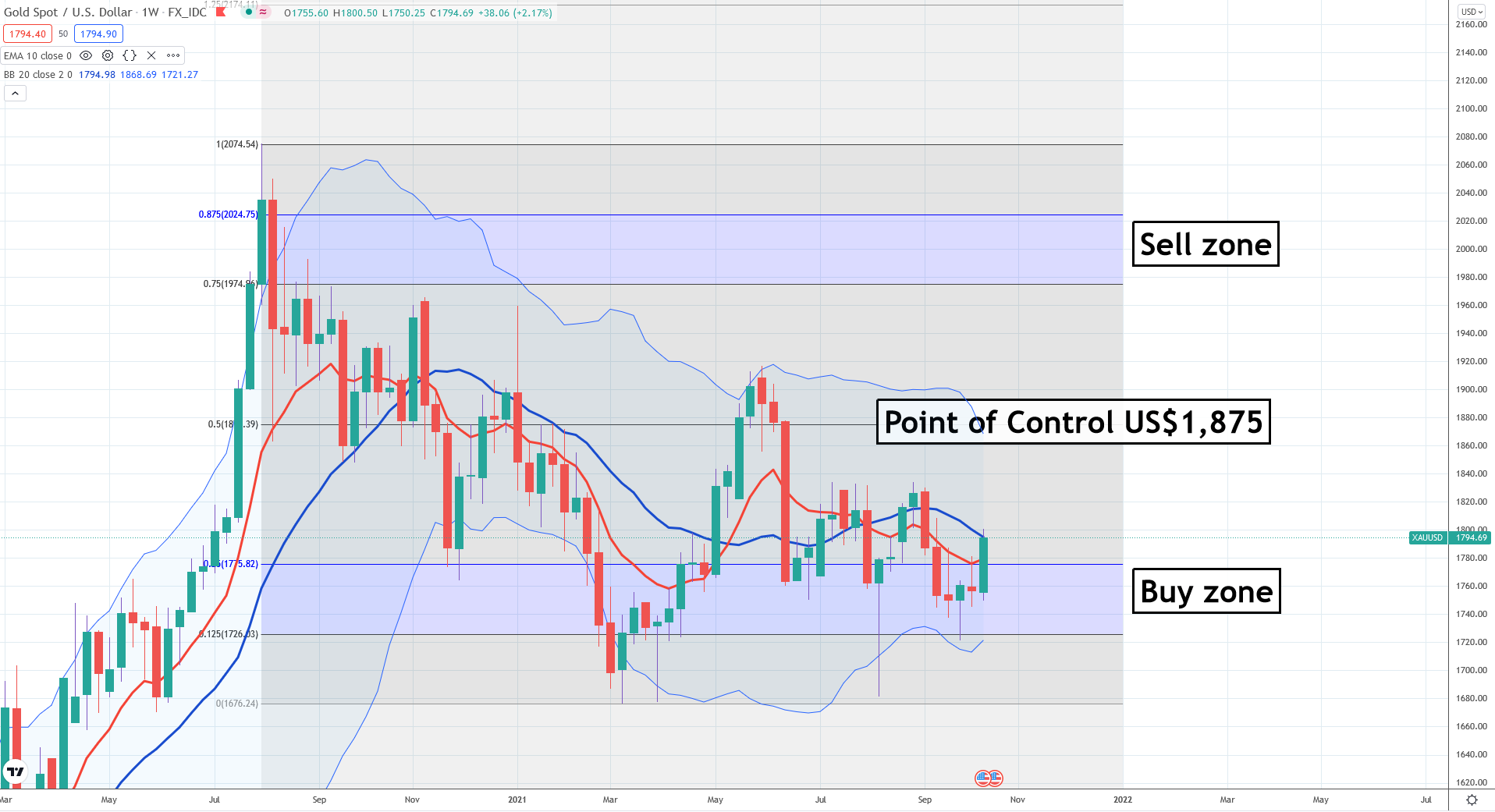

The technical set-up in gold (currently US$1,796) is saying that if prices can head above US$1,834, we should see a sharp spike to US$1,875, which is the point of control of the range created since the correction began.

Gold about to spike?

|

|

| Source: Tradingview.com |

That could happen next week.

This all hinges on the US 10 years playing nice and continuing to rally.

I took the plunge and sent out a buy alert on six gold stocks this week.

I will repeat part of the buy alert here for you because I think it’s relevant to this discussion.

‘Chinese PPI has just broken through 10% and is still rising. Commodities have taken off like a rocket again over the past week, with copper and zinc the standouts, but the move in uranium and lithium is also noteworthy.

‘Inflationary pressures from rising commodity prices may take time to filter through as producers soak up some of the costs via falling margins, but at some point, they have to cry uncle and start passing the costs through into higher prices.

‘Owner equivalent rent (OER), an important part of US CPI figures, jumped noticeably in the last set of figures released this week, and there are expectations that series should continue to spike higher, lagging the spike in property prices.

‘The supply bottlenecks that are causing some of the inflationary pressures should ultimately play out by causing demand destruction and as bottlenecks ease some of the inflationary pressures should also ease.

‘But with the US close to embarking on a nation-building stimulus package that will cause more demand for scarce resources, perhaps we are in the early stages of the melt-up in commodity prices, which will add to inflationary pressures down the track.

‘With 10-year bonds in the US yielding 1.5% and current CPI floating around 5%, that is a lot of capital destruction over the next few years if inflation figures remain elevated.

‘The market seems to be saying that the economy can’t handle even a slight rise in interest rates from here. But the Fed has to take away the punch bowl and they know it.’

As far as I’m concerned, the markets just got a whole lot more interesting as we head towards the end of the year.

Keeping one eye on the Chinese credit markets and another on the US yield curve as the Fed embarks on the monumental task of weaning its patient off life support will be fascinating to watch as long as you have the right positions on.

Continue below to watch my Closing Bell video where I go into more detail about the current state of play and show you three stocks that stand to benefit.

Regards,

|

Murray Dawes,

For Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.