In today’s Money Weekend…ASX 200 going nowhere fast…beware the false break…be prepared for volatility…and more…

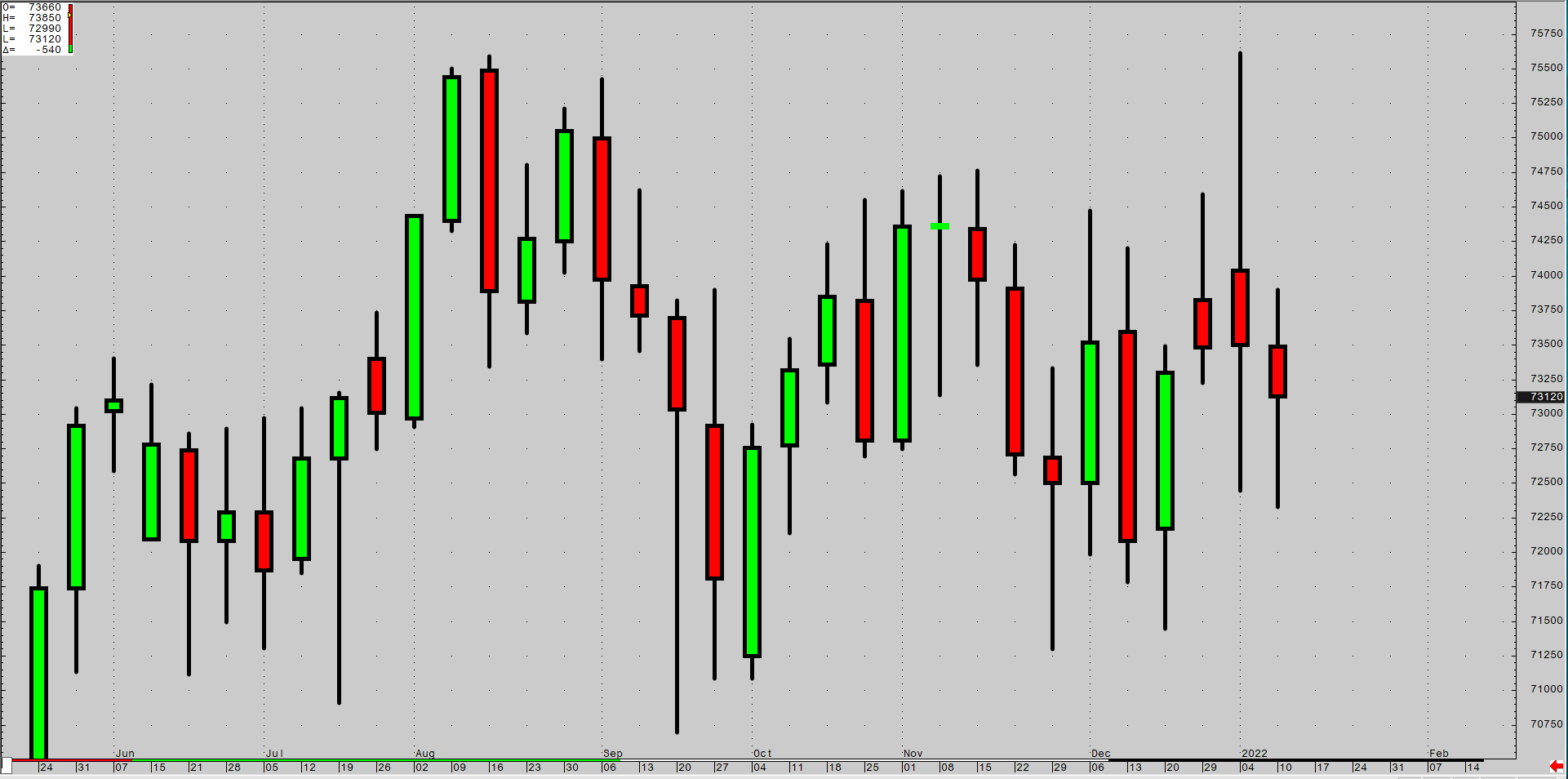

The ASX 200 has been stuck in a tight range for eight months. That’s a long time for a trader.

ASX 200 going nowhere fast

|

|

| Source: CQG Integrated Client |

As a market commentator, it starts to wear pretty thin when you have to keep coming up with comments to make about a market that goes up one day and down the next.

As a trader, you have to be conscious of the fact that the market isn’t handing out any easy money.

My best mate is a full-time trader and he’s taken off down the coast with his windsurfing gear.

That sounds like the best spot to be at the moment, rather than staring at the screens hoping your stock will move more than one cent.

There are a few hot sectors that are continuing to trend, but if you’re not in them already, you have probably missed the boat.

We have had some big news over the last few weeks that increases the odds we will see more volatile trading ahead while the markets grapple with the fact we are now in an inflationary environment with rising interest rates.

The news last week that the Fed is considering lowering the size of their balance sheet by allowing the bonds they own to roll off without reinvesting the proceeds caught the market off guard.

No wonder the yield curve bucked like a bronco with the long end of the yield curve spiking higher.

How the long end of the US yield curve moves over the next few months is the thing you need to watch. That is what will shape the path of equities this year, in my view.

If rates rise nice and slowly then equities will probably take it in their stride and slowly digest each rise without throwing the toys out of the pram.

But if, as I suspect, we see the 10-year bond yield rise sharply once the 1.8% level is breached, I reckon stocks will struggle to maintain current levels.

We all know that tech stocks are currently under a bit of selling pressure.

ASX Information Technology Index

|

|

| Source: CQG Integrated Client |

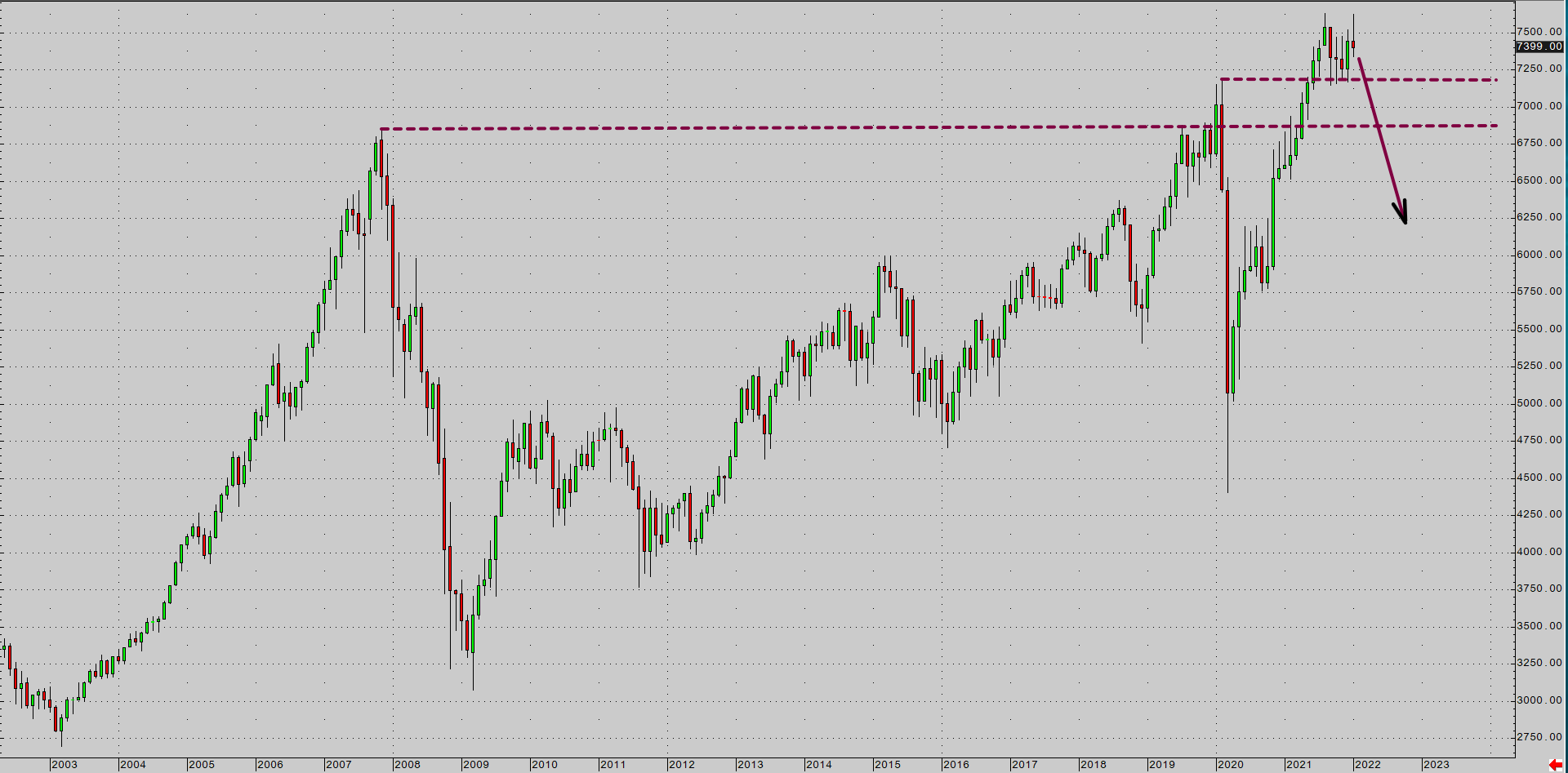

The chart above is a weekly chart. You can see that a double top occurred in August last year and after a few months of sideways action, the IT index is keeling over with the selling pressure accelerating over the last few weeks.

The collapse of Afterpay Ltd [ASX:APT] is a big part of that story, of course, but there are plenty of other tech stocks that are finally starting to leave the orbit of the former planet Pluto and head back to Earth.

I reckon there is still plenty of hot air in many of them so there could more downside to come.

The eight months of sideways motion in the ASX 200 could be tracing out a topping formation. I have pointed out in the past that the level to watch in the ASX 200 is around the 7,000–7,100 level (currently 7,390).

Things can look dangerous quite quickly below there.

Beware the false break

|

|

| Source: CQG Integrated Client |

When a market has been going sideways for many months, the odds increase that when the range does snap, the move can be quite explosive.

It’s like shaking up a Coke bottle. The longer you sit there shaking it up, the more Coke you’re going to wear on your face when you finally take the lid off.

The fact that the long period of sideways motion has occurred just above two incredibly important technical levels (2007 and 2020 highs) increases the odds even further that if the breakout of the range is to the downside, the selling pressure could increase dramatically.

Think of it in terms of mean reversion.

The great bulk of trading that has occurred over the past two decades has been lower than here. The market loves to constantly move over old ground shaking out any weak hands.

If we do see a sell-off, there will be many traders and investors who will take fright and dump their positions as prices head back below their original entry price.

So the further it falls, the more selling pressure increases.

That doesn’t mean the market won’t be a lot higher than here in the next year or so. It just means the setup is ripe that another leg lower could set off a chain reaction that will see prices fall further and faster than many expect.

The Fed has been pumping the markets higher at every opportunity for decades. They didn’t expect the onset of COVID to force them into a corner once again to pump printed money into the economy for another few years.

It looks like this bout of money printing is the straw that broke the camel’s back with inflation.

All of the noise coming out of the Fed is that they are taking the spike in inflation seriously and are determined not to allow it to get out of control.

When the Fed changes their tune, it pays to sit up and take notice. Don’t worry about what the market is doing this minute, just focus on the fact that the Fed is now playing a different game and that game isn’t conducive to explosive rallies.

Until we work out how the market can handle rising rates, we need to batten down the hatches and be prepared for volatility.

Regards,

|

Murray Dawes,

Editor, Money Weekend

PS: Watch the latest episode of my series ‘The Closing Bell’ on YouTube. Click here or the thumbnail below to view it.