Today, we continue with our top trends for 2022 as part of our ongoing series, “Our Top Nine Investment Trends to Watch in 2022”

In this series we are going to cover our top 9 investment ideas:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply enter your email below and have them sent directly to your inbox.

And this time, we’re talking about…

Trend #8 Watch out for gold

Inflation isn’t wholesale bad news. Rising inflation is a potential boon for gold.

Discussion about rising inflation and looming interest rate hikes cannot neglect mentioning the metal with a 6,000-year history.

So…could 2022 be the year gold makes a move?

In the latest inflation data released by the Australian Bureau of Statistics, Australia’s annual CPI inflation hit 3% in the September 2021 quarter, with automotive fuel hitting a record level due to soaring oil prices.

Importantly, both trimmed mean and weighted median inflation recorded their first annual movements above 2% since September 2015:

Source: ABS

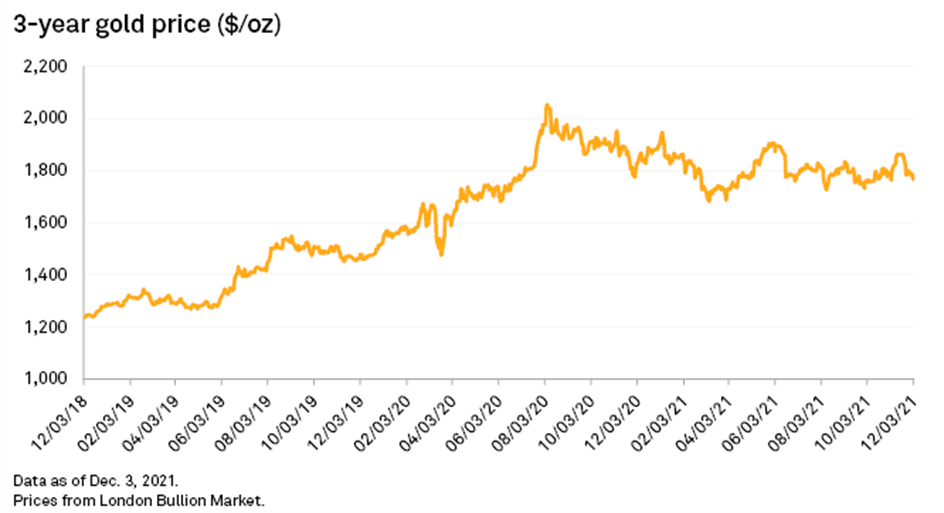

In the meantime, however, the gold price flatlined.

Source: S&P Global Market Intelligence

But as fears of runaway inflation rise, will defensive investors turn to gold as their safe haven in 2022?

As we’ve written elsewhere, one of the most widely held beliefs about gold is that it’s a sound inflation hedge.

Gold does have a history of maintaining its value in tough economic times.

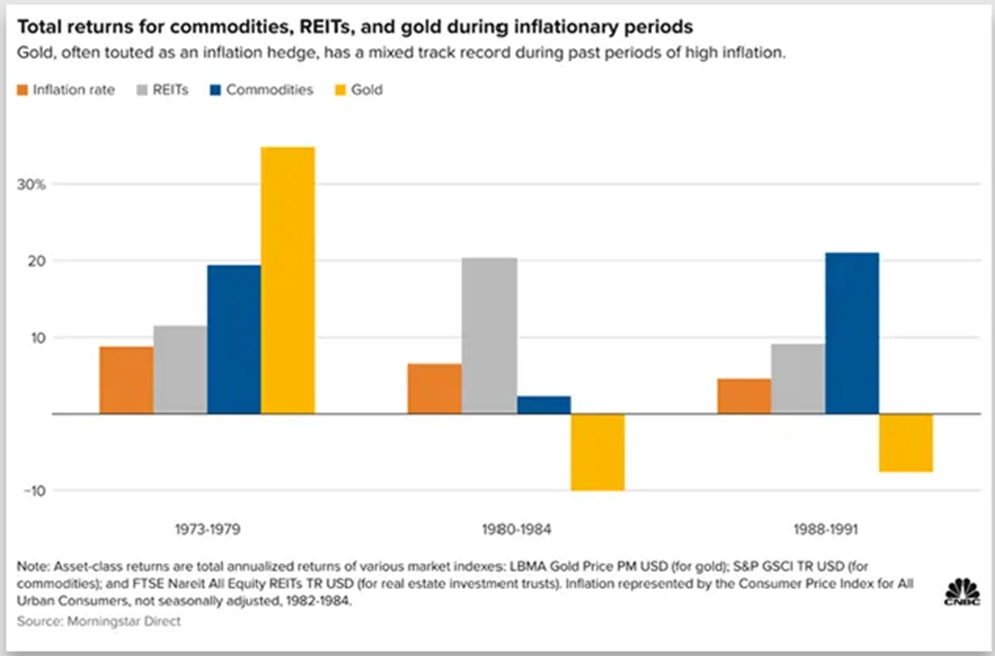

For instance, during the inflationary period of 1973–79, gold outperformed commodities, real estate investment trusts, and beat inflation.

But gold’s inflation-hedging capacity is not absolute.

As the chart below shows, gold has, at times, underperformed during inflationary periods, especially in 1980–84 and 1988–91.

Source: CNBC

So the matter isn’t as simple as ‘rising inflation = rising gold’ for investors in 2022.

Nuance comes into play.

But…with current inflation rates at their highest yet, our resident gold analyst Brian Chu believes we could be on the cusp of a gold bull market.

As Brian Chu himself said in December 2021:

‘It seems the prevailing narrative of the Federal Reserve struggling to keep inflation under control and fear of the new Omicron variant are keeping investors jittery.

‘Gold normally thrives in uncertainty, but the glut of liquidity in this market has morphed it into something different.

‘I don’t believe that gold is going to fade into the sunset, that people will stop wanting gold, or that companies will stop mining and exploring.

‘In fact, I think in the coming years, there will be a greater demand for it.

‘Just so you know, central banks are still buying gold quietly.

‘News came out last month of Singapore’s central bank adding to their stash for the first time since 2000. The bank purchased 26.35 tonnes, bringing their total holdings to more than 150 tonnes.

‘If there’s one thing that central banks do get right, it’s protecting themselves from the mistakes they make.’

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.