The last few years have thrown up a lot.

Lockdowns, new variants, vaccination efforts, supply chain woes, energy price surges, rising inflation.

Amid the tumult, how should investors approach 2022? What should they look out for? What themes are likely to influence stock markets this year?

Below, we discuss some of the biggest investment trends and themes we here at Fat Tail Investment Research see as likely to shape 2022 and beyond.

In this series we are going to cover our top 9 trends:

1. The great lithium disconnect

2. Decarbonisation — green switch activated

3. The future of payments

4. Quantum computing and Moore’s Law on steroids

5. Connected devices and memory

6. Decentralised finance — an ‘Amazon-in-1994’ moment

7. The influential ‘I’s

8. Watch out for gold

9. Stocks – Mind the lofty valuations

If you’re interested in dowload all 9 Trends in one document to read at your leisure, simply sign up below and have them sent directly to your inbox.

Trend #1 The great lithium disconnect

Lithium wars: whatever it takes

In December of 2021, giant automaker Volkswagen announced it will invest a further €17 billion to develop its electric vehicle (EV) fleet.

Volkswagen’s total EV spend has now risen to a substantial €52 billion, the largest such investment by any traditional manufacturer.

Money rarely lies. And following the traditional automakers’ money trail leads to EVs.

And an EV world is one hungry for lithium.

In 2020, 10 million EVs were sold globally.

But the International Energy Agency recently set a target for ‘at least 200 million EVs by 2030’.

The next decade will be a busy one!

Long term, the world where most of its cars are electric will be one using significantly more lithium than the world we are leaving behind — the waning age of the internal combustion engine.

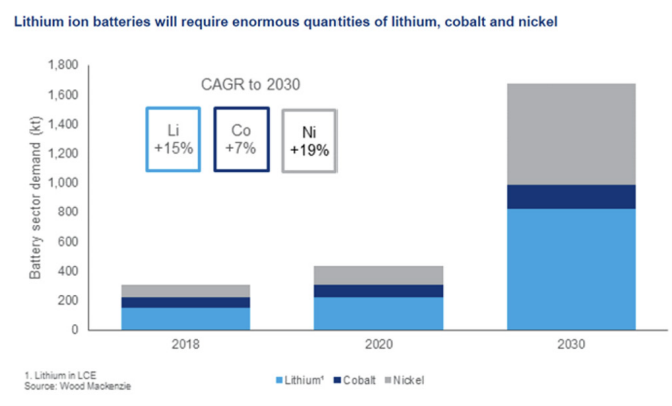

Source: Wood MacKenzie

And demand for EVs — and the corresponding rush to stock up on lithium and other needed elements like cobalt, copper, and nickel — could ramp up as soon as next year.

Why?

BloombergNEF projects the cost of a lithium-ion EV battery pack will fall below the magic threshold of US$100 per kilowatt-hour by 2023, if not earlier.

Why is this the magic number?

Should EV battery packs fall below that, EVs would reach price parity with traditional cars by the mid-2020s.

You can imagine the demand impact.

Faced with two equally priced cars, more people will likely be swayed to go with the one that’s

Why?

When the World Electric Vehicle Journal ran a survey in Australia in 2019, it found affordable prices were the biggest factor in encouraging EV uptake.

And in 2021, Energy Networks Australia published a consumer review, finding ‘there is clear evidence of latent demand for EVs conditional on price reductions both in Australia and globally.’

Source: Financial Times (EV brands set to compete with Tesla)

But affordability isn’t the only factor.

The adoption of EVs is also driven by regulation and governments proactively positioning for a greener future.

In November, Biden signed a US$1.2 trillion infrastructure bill that allocated US$7.5 billion to populate the US with 500,000 EV charging stations.

At the same time, the European Union proposed legislation to cut CO2 emissions from cars by 55% by 2030.

What’s a great way to reduce car emissions?

Encourage citizens to go electric.

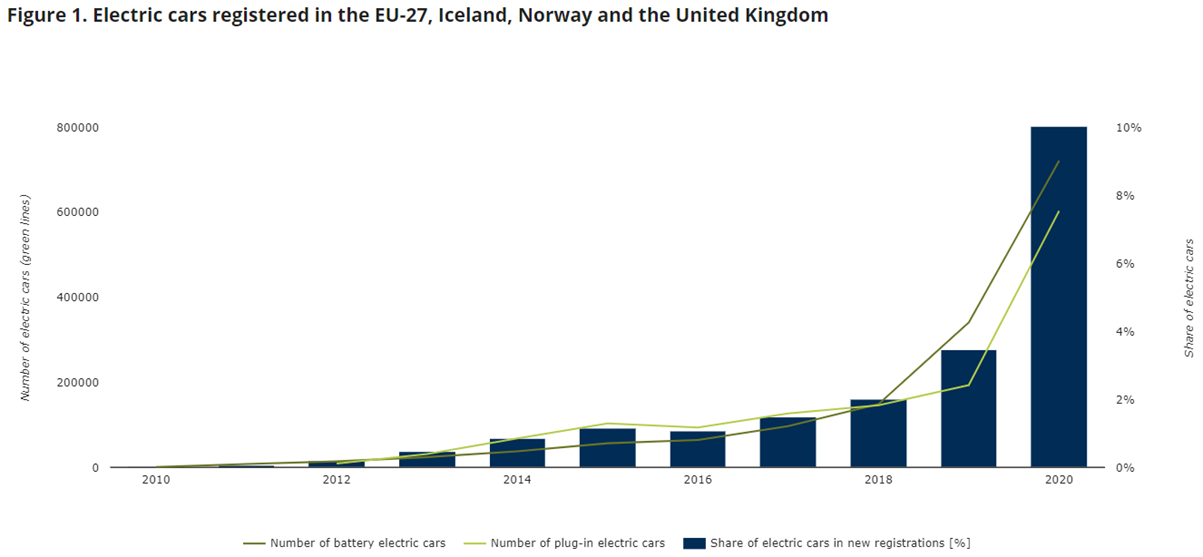

Source: European Environment Agency

As the Financial Times noted:

‘There was a direct correlation of when new European emissions rules came into force and when electric car sales really took off across the continent. What you expect going over the next few years is every time the rules tighten, those are the years in which you are likely to see a very big spike in electric vehicle sales.’

The EV switch isn’t prospective but firmly in the present, albeit patchy.

In 2020, the share of electric vehicles was 75% in Norway, 46% in Iceland, 33% in Sweden, and 28% in the Netherlands.

But the rush to electrify our car fleet left supply behind in 2021.

Lithium carbonate prices, for instance, soared over 300% in the 12 months to December 2021, according to oft-cited Benchmark Mineral Intelligence.

The market intelligence firm’s CEO — Simon Moores — dubbed the market situation as the great lithium disconnect.

‘Right now lithium demand is growing a three times the speed of lithium supply. That’s a big problem that needs to be solved.’

Now, if you’re interested in lithium stocks and the wider clean energy theme but not keen on sifting through feasibility studies and ore readings, we have a dedicated publication here at Fat Tail Investment Research that may be of service.

New Energy Investor shows how you can grab your stake in the great energy switchover as the world transitions out of fossil fuels and into cleaner, greener, renewable energy.

Helmed by James Allen in London and Selva Freigedo in Melbourne, New Energy Investor hunts for the best and brightest clean energy prospects on the market — often before many Australian investors get to hear about them.

As Selva recently wrote:

‘This isn’t the first time that lithium prices have rallied, they did the same during 2015–18. But that rally fizzled out as more producers entered the market and prices collapsed.

‘This time things are looking a bit different, though.

‘While there are more lithium mines coming our way, it takes a while for that supply to get onto the market.

‘Higher prices are also driving battery and EV makers to take on longer-term contracts to secure supplies.

‘And, of course, back in 2015 you didn’t have as many carmakers investing in EVs as governments set up targets to phase out petrol cars. Demand is only going to ramp up…

‘The Australian Government Department of Industry, Science, Energy and Resources (DISER) expects global demand for lithium to go from 305,000 in 2020 to 486,000 tonnes of lithium carbonate equivalent (LCE) this year…and that to increase to 724,000 tonnes by 2023.’

A bit about us — Fat Tail Investment Research

While themes and trends can come and go, one thing that doesn’t go out of fashion in the investing world is insightful analysis.

Information is the crucial ingredient in markets.

But information alone isn’t enough.

It’s the rational analysis of the information that separates a sound idea from a weak one.

Here at Fat Tail, our editors pride themselves on providing valuable insight by applying their industry experience and knowledge.

At Fat Tail, we value differences.

Disagreement isn’t censured but encouraged.

And we find our readers appreciate the range of thought and ideas of our editors.

At Fat Tail, we have bulls, we have bears, we have crypto advocates, and gold bugs.

At the heart of it, though, we have a team dedicated to the free exchange of ideas. Reason trumps agenda here.