Five years ago, the world faced one of the most devastating economic disasters of modern history. At the end of January 2020, an unknown virus broke out in Wuhan, China.

A month later, reports of people infected worldwide proliferated. Fear of an epidemic, or worse still, a pandemic, gripped the world.

Not taking chances, many governments heeded the advice of the health and medical bureaucrats to close their borders and lock down the population.

There is a view now that many of these policies were debacles, even shams, namely:

Medical directives of face masks, social distancing and drug mandates.

Governments borrowed heavily from central banks to pay households and businesses to stay closed.

One of the key beneficiaries of this reckless money printing was gold, and precious metals assets.

This sets the scene for what I’m going to share with you today…

Every investor has a goal: to profit in the markets.

But to achieve that goal, you need to understand the ‘system’ that gold operates in…

To master the market, study the dynamics

First is that the US dollar is the world’s de-facto ‘money’. We measure everything relative to that. Our Aussie dollar is compared to the US dollar to gauge its value in the global markets.

That flows to the US Dollar Index [DXY], which measures the value of the US dollar against the key global currencies. A higher US Dollar Index means a strong US dollar. For the same price quoted in US dollar terms, it now costs more.

These two points imply the US dollar is an unstable measure. As I explained in detail in this article two weeks ago, you’re using an elastic band as a ruler.

But don’t expect financial pundits to explain this when they report the financial market news. They just read out the figures, report the trends and explore what’s causing these moves.

Knowing this insight helps you get ahead. I’ll explain how with examples in the coming weeks.

Next, we move to the third must-know. This is specific to gold.

Gold and the US Dollar Index usually move in opposite directions, as you can see the trend over the last two decades:

| |

| Source: GoldHub Australia |

Why is this important?

Unlock the future with the past

If you’re investing in a cyclical asset like gold you need to know the timing and dynamics of the market to succeed.

Something bigger is always underpinning the movements than the sector or individual companies. Far beyond what the technical and momentum indicators, price and value ratios, financial reports and broker analysis can provide.

Herein lies the key to what divides the immensely successful gold and precious metal asset investors from the rest.

The biggest gains don’t come from investing in and out of the bumps in the prices within the gold price cycle.

They come from capturing the rhythm of the cycle, buying gold and precious metal ETFs and different types of gold stocks when they’re low, and selling them as they rise to eventually become overvalued.

This takes me to why I’m so confident that the gold cycle is only getting started.

Reckless money printing from 2020 set the stage for gold’s surge during this period. That central bank liquidity also went into US stocks, bitcoin and precious metals.

Even with central banks raising interest rates in 2022-23, gold delivered positive gains in Australian dollars every year.

Once the rate hikes ended in mid-2023, gold’s rally gained momentum. The price increased 12.6% in 2023 and 38.2% in 2024.

This propelled gold stocks to rally hard last year and even breaking new records last October.

| |

| Source: Refinitiv Eikon |

What gives this rally momentum is that the US deficit is now so big they’re at levels you’d see in a war or recession.

God forbids either of those come anytime soon because the US deficit, already huge, would become incomprehensible.

The pandemic gave them an excuse last time. Five years on, the world is still reeling from the impact. Governments and central banks still use that as a pretext to engage in their borrowing-to-spend cycle.

And this trend is happening everywhere. We’re no exception.

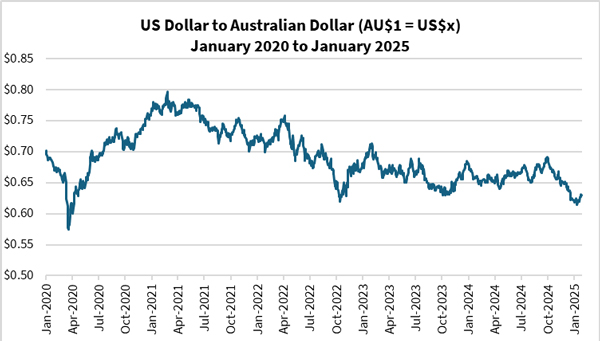

That’s why our dollar is trading at levels last seen in 2022:

| |

| Source: Refinitiv Eikon |

Either way, you can almost take it to the bank (pun intended) that no government wants to change this course, not until they run into a brick wall. That’s why central banks will play along and keep pumping out currencies to finance government deficits.

So I expect gold to go higher – a lot higher – by 2030.

Even though gold stocks have rallied significantly, expect more to come.

But you want to buy the right companies. There are over 150 to choose from and many of these could lose you money. Investing is gold stocks is high risk. That’s why I’m here to guide you.

Learn more by clicking here.

Join me next week in this series as I explore how the euphoria in gold and gold stocks in 2020 continued into 2021, and what lessons we can learn from reading the cycle correctly.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments