- The best stock in my personal portfolio lately is building products supplier James Hardie [ASX:JHX]. It’s up 23% since I got in back in March.

One of the tailwinds for JHX is that most of its earnings are from North America and not Australia.

The US housing market is better placed than the Aussie one currently…much to everyone’s surprise!

We’re now getting the news that explains why JHX has been rising in what’s otherwise a very tough market.

From Bloomberg:

‘A flurry of data showed surprising strength in several corners of the US economy, painting a picture of resilience and further delaying any likelihood of recession.

‘Purchases of new homes climbed to the fastest annual rate in more than a year, durable goods orders topped estimates and consumer confidence reached the highest level since the start of 2022, according to the Tuesday reports. Another release showed housing prices in the US rose for a third-straight month.’

I’m not tempted at all to bank the win so far here. There’s every reason to think JHX can keep running up over time.

Fundamentally, all the data I’ve seen says the US is short houses. Historically, US land values should keep rising until around 2026.

And then there’s confidence I can draw from the algorithm behind my Small-Cap Systems advisory. JHX as a stock is still exhibiting strong momentum on the market.

JHX is not a small-cap stock, where I usually specialise. But the algo scans the entire market, so I get a great sense of what’s moving at any given time.

My experience with trading the algorithm is that the best trades are where the signal and the fundamentals stack up together in a great, sweet spot.

Knowledge of the fundamentals is important, at least to me, to back the idea with money. JHX is a great example of that right now.

Notably, both brokers and fund managers are generally positive on the stock, from what I’ve seen, which should keep it supported on any market dips.

- JHX is my best-performing stock lately, but my best position is Bitcoin [BTC]! It’s up 85% this year. Nobody is more surprised than me.

I was buying in my SMSF last year based off no other reason than I wanted to dollar-cost average into it while it was depressed.

The history of bitcoin cycles said big drawdowns had happened before and proved opportunities to accumulate.

The decision I took then and there was to eschew trying to time the market, guess where it might go, or even follow developments in the crypto space. The volatility in crypto can send you zany otherwise.

I decided to allocate up to a certain level and live with the consequences.

It’s working so far, clearly. But I’m not here to crow about it, only to see what might be driving the price up.

It’s clearly not retail investors. The hype and gigantic speculation have been well and truly smashed out of the crypto space.

The best explanation I can find comes via Michael Howell at London firm CrossBorder Capital (and author of the book Capital Wars).

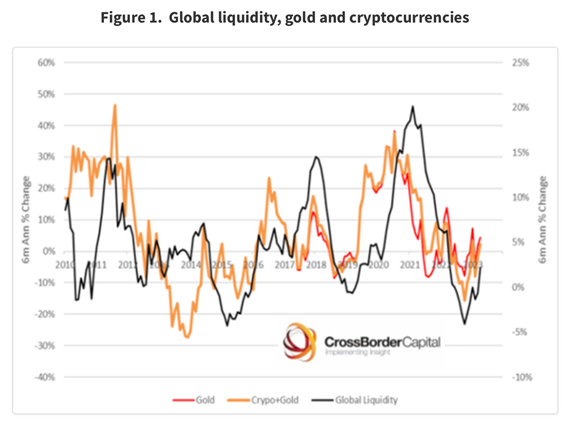

He tracks what he calls the Global Liquidity Cycle and says — contrary to general consensus — that liquidity is now rising again, and this is lifting up gold, the Nasdaq, and crypto.

Roger Montgomery shared the relevant chart over at his blog:

|

|

| Source: CrossBorder Capital via Roger Montgomery.com |

Can bitcoin keep going? I don’t see why not. The accounting behind most Western governments are not conducive to a balanced set of books.

Deficits should continue, and get bigger, for years as the baby boomers pressure health and pension systems.

A very good book to read on this, and prescient, is The Great Demographic Reversal.

The two big trends identified — falling worker-to-retiree ratios across the West, and the loss of endless, cheap Chinese labour — are baked into the cake.

They make ongoing monetary inflation look like a slam dunk and give monetary hedges like gold and bitcoin an environment to thrive.

That seems to be the case happening right in front of us too.

Bitcoin is a very speculative asset, so it’s not for everyone.

But you can see that this liquidity knowledge could have led you to the Nasdaq as well this year…which has risen strongly against expectations.

It could also have taken you to the Aussie gold sector late last year, which rallied very strongly after a tough two years.

Readers of my advisory Australian Small-Cap Investigator got a riotous 60% ride in gold speccy Bellevue Gold [ASX:BGL] before we took the win in March after jumping on board in mid-November.

It’d be great if all my ideas ran up like that, and that fast.

Gold stocks should likely rally again at some point.

It’s a tough market out there right now, and not every position will work like these.

But I hope the above three examples show there are always potentially winning ideas out there!

Best wishes,

|

Callum Newman,

Editor, Money Morning

PS: By the way, follow me on Twitter for regular market updates and links from me. Just follow this link!