Pot stocks have fallen off the radar for a lot of investors.

Australian investors, in particular, have seen the cannabis investing trend go from boom to bust in a very short time. Just like some other recent fads like ‘buy now, pay later’, baby formula, and more.

From an outsider’s perspective, they no doubt look like a bubble. And to some degree, that is correct if you’re only looking at share price charts…

But the key difference between a true bubble and a fad is the long-term trajectory.

Cannabis as an investable market has not gone up in smoke. It has simply had a revaluation of expectations and time frames — much like any exciting new sector.

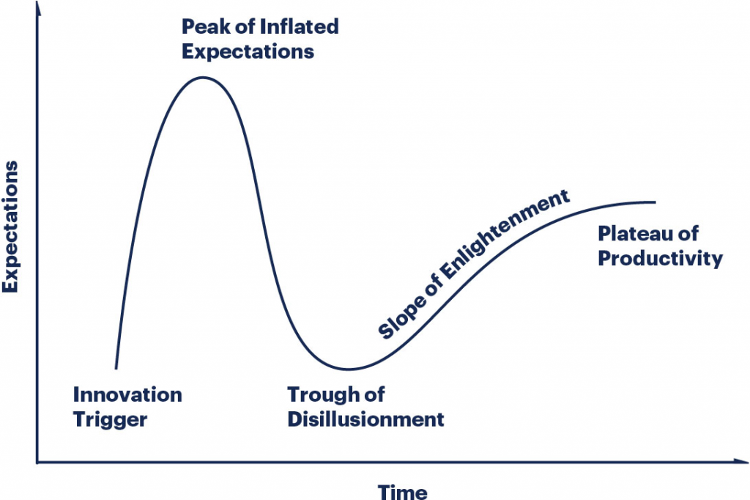

I always like to use the Gartner hype cycle to illustrate this point:

|

|

| Source: Market Watch |

Because, in my view, pot stocks are finally moving to the ‘slope of enlightenment’ stage…

The US is inching closer to cannabis tolerance

See, the Gartner chart shows how exciting new trends, like pot stocks, captivate people early. All that attention leads to the ‘peak of inflated expectations’, which for pot stocks was probably right around 2017/18.

In the years that followed, we’ve since seen the sector delve into the ‘trough of disillusionment’.

Pot stocks, at least in Australia, are largely down from their all-time highs. Some of the biggest names, like AusCann Group Holdings [ASX:AC8] and Cann Group [ASX:CAN], are a remnant of their former selves.

The reality is pot stocks just couldn’t maintain the momentum they needed for growth.

After all, when it comes to any highly regulated sector, sales are hard to make if the politicians don’t allow it.

In the US, though, this roadblock may soon be gone — a breakthrough that could open the floodgates for potentially the biggest recreational cannabis market in the world!

More than a year after the first discussions for a draft of a cannabis reform bill was introduced to the US Senate, the politician behind the push — Chuck Schumer — is ready to put the idea to his peers. And overnight, the first iteration of the US Cannabis Administration and Opportunity Act was put forward.

If passed, this bill will decriminalise much of the cannabis industry. It would not only remove any federal oversight for the prosecution of cannabis possession but allow states to set and govern their own rules.

In other words, it would force a discussion of cannabis legality on a state-by-state basis. The kind of discussion that would almost certainly lead to new market opportunities for pot stock producers in the US and abroad.

But, I’ll be frank in saying that no one is really expecting this first bill to pass with ease.

After all, cannabis is still a contentious issue for most people. It will likely take plenty of amendments and discussion in order to get the bill to the point that it could feasibly pass.

For pot stock investors, though, that discussion is just as important as any legislation…

A roadmap to resurgence

Whether people like it or not, the outlook for cannabis in the US is trending toward legalisation.

It seems more likely to be a matter of when, not if, a cannabis bill will pass. Because as Politico reports, even if Schumer’s first bill is shot down, it will pave the way for others:

‘But the legislation will shape the conversation around cannabis legalization going forward and portions of it are likely to find their way into other bills that could pass before the end of the year.’

For investors, this means that right now is likely the time to start accumulating a position. The battered pot stocks across US, Canadian, and even Australian markets are trading at bargain prices. And the sooner change comes to the American market, the sooner they will prosper.

As one Canaccord Genuity analyst recently told Bloomberg:

‘But even if the US fails to legalize cannabis this year, experts say that it will happen eventually, and that investors will be ready to flood the market when it does.

‘“We believe that large pools of institutional capital are still sitting on the sidelines waiting for additional clarity at the federal level prior to being able to commit capital to the sector, and although ultimate timing is still uncertain, we believe headlines continue to trend in the right direction,” Bottomley said.’

This is the key distinction to be aware of. Because it is not a matter of when the bill passes, it is about when the discourse around cannabis begins to shift that really matters.

Once that happens and the floodgates begin to open, the money will really pour in.

And if you want to get in on that action, then you should start seriously looking at pot stocks right now.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.