My my, what goes around certainly comes around in markets.

Have you heard of something called the SKEW Index? I’ll explain it and why you should care.

The SKEW Index is a measure of what investors are paying for deep ‘out of the money’ options on the American share index, the S&P 500.

For these options to pay off, the market would need to move more than 1 or 2 standard deviations than normal.

An elevated SKEW Index is an indicator, according to casual theory, that a major market event is looming.

That’s because a rising SKEW means investors and market participants are prepared to pay more for the options that underly it.

Plenty of people take this as a signal that danger in the market is ‘flashing red’ or you should be at least ‘uncomfortable’.

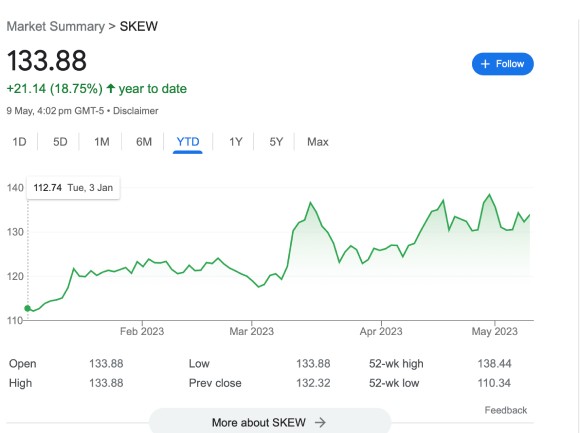

You can see via this graph that the SKEW has kicked up this year:

|

|

| Source: Yahoo Finance |

Let me pause here for a little history…

Back around June 2021, the SKEW Index hit all-time highs.

Here’s an example of the type of headline that went around at the time:

|

|

| Source: Financial Times |

I remember this quite clearly.

At the time, I recorded a conversation with veteran trader and author Gary Norden on the very topic.

We talked about why the SKEW Index was likely way up, and why that wasn’t necessarily a sign of impending market collapse.

And, true to our instincts, the SKEW later settled down and the market rattled along without too much drama in the immediate period after that chat.

Here we are again!

Now, here’s the thing…

Some even call the SKEW the ‘black swan’ index.

The idea, I guess, is that the insiders in the market are preparing for the big one before the herd catches on.

No dice, I’m afraid.

By definition, a black swan event is not predictable. You cannot prepare for it.

All an elevated SKEW Index tells us is that market participants are preparing for something, but certainly not a black swan event.

We don’t need to overthink things here.

Let’s look back over the last six months.

For all the huffing and puffing, US stocks bottomed out in October 2022 and are up about 16% since.

We’ve just been through quarterly earnings reports, regional US banking issues, and have the US Government debt ceiling debate in play.

It makes sense that, if you’re a US money manager for example, you might buy some protection for your portfolio as we go through this uncertain and volatile period.

It’s not because you think there’s high odds that the world is going to collapse — it’s insurance just in case it does, or at least the market gets the wobbles.

You can do that by buying ‘out of the money’ options.

But you do have to buy them off someone else.

The market makers who take your trade are not stupid, either.

They can see the uncertainty and potential volatility. They raise the price of the options to compensate themselves for the risk.

The SKEW Index rises as a result of these perfectly reasonable and logical actions.

At no stage does a potential black swan event come into it.

See today’s Bloomberg report for what’s more likely:

‘Goldman Sachs urged investors to cushion themselves against increased volatility as Wall Street quants dive back into US stocks.

‘The approaching debt-ceiling deadline and concerns about financial system stability could also be triggers for increased market unpredictability, bank analysts wrote. “We like buying option hedges.”’

Again, this is perfectly reasonable and rational behaviour considering the issues swirling around the market.

But here’s the thing that you and I need to know and can take comfort from.

The very fact that investors are cautious and hedging their risk makes a total market meltdown less likely.

Markets — historically anyway — collapse when investors are blindsided and, usually, highly leveraged.

That makes the market vulnerable to relentless selling as investors quickly cut and run.

Paradoxically, I take comfort from the fact that the SKEW is elevated.

We know from other market observations that US fund managers have a high cash allocation right now as well.

They’re defensive.

To me, that says I can enter the market an acquire a stock I like without worrying about a general market meltdown.

That’s not to say I can’t get the stock wrong, or a market meltdown is guaranteed not to happen.

It just pulls the odds closer to my favour.

This is the essence of contrarian investing.

Being greedy when others are fearful — and buying hedges — demands you do the opposite of the crowd.

That looks like right now to me. Go here to take advantage of it.

Best wishes,

|

Callum Newman,

Editor, Money Morning