Today we’re unpacking the poorly understood world of commodity inventories.

We’ll look at the critical role they play in maintaining market stability and why it could come unstuck in the years to come.

But first…what are inventories?

Simply put, it refers to the stockpiles held at various commodity exchanges.

Storehouses for industrial metals like nickel, copper and zinc.

These facilities act as an intermediary between supplier (the miner) and buyer (manufacturer).

The London Metal Exchange (LME) is one of the world’s oldest exchanges.

Now, the LME doesn’t own or operate warehouses…it doesn’t own the physical inventories either.

It acts as an authority that allows warehouses to store LME-registered brands of metal.

While the LME’s role has diminished over time, it still offers useful data for tracking global stock levels.

It releases a daily stockpile record for common industrial metals including copper, zinc, nickel, lead.

All the information is freely available and you can access the data in chart form.

It offers a glimpse of where the market might head over the medium term.

Now, declining inventories CAN signal future supply problems.

That can result in higher commodity prices if the root cause is structural…

That’s what I believe is happening in today’s market. A key problem we’ll attempt to unpack today.

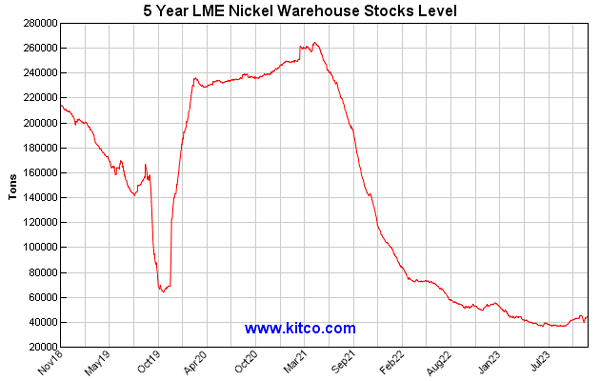

But first, check out the LME inventories for nickel, below:

|

| Source: Kitco |

As you can see, stock levels are well down in 2023.

But have declining inventories resulted in higher prices?

Absolutely not!

Nickel has fallen around 40% over the last 12 months, or around US$10,000 per tonne.

| |

| Source: Trading Economics |

So, what gives? Have the fundamental rules of supply and demand flipped?

Well, in some ways yes.

Thanks to a period of record-breaking rate rises, markets have become distorted.

Today’s global economy is one in which many miners are bleeding cash.

From rising cost of capital, diesel charges and staff shortages, pulling a tonne of ore out of the ground, processing it, and converting it to profit has never been harder!

In an attempt address these challenges miners are rushing metal onto the market, rapidly converting stock into cash.

This masks the impact of low inventories.

Buyers can still access raw materials.

While miners continue to rush metal onto the market, supply remains balanced.

But this is not sustainable.

As it stands, current stockpiles are unlikely to absorb supply shocks or any meaningful increase in demand.

In other words, when supply is tight, a jolt to the system could have a very destabilising effect.

Perhaps inducing a positive feedback loop…where we see a run of panic buying forcing inventories lower still.

It’s critical to understand that a tight market makes the system incredibly vulnerable to disruption.

But where could a destabilising event come from?

On the demand side, China remains the most likely contender.

Government stimulus has the effect of pushing more buyers onto the market.

But this could arrive alongside supply disruption…mine shutdowns, strike at a major operation, geopolitical tensions…any number of short-term catalysts COULD undermine metal markets.

Take the Cobre Panama mine…an operation supplying around 1% of global copper supply.

Protestors recently forced its owner, First Quantum Minerals, to shut down operations.

But according to analysts at Macquarie, permanent closure could move the copper market into deficit as early as next year.

A global deficit arising from the closure of just one operation!

That’s why we say the system is vulnerable to disruption.

Watch out for the catalyst event

While supply continues to walk an extremely tight rope, investors SHOULD be positioning for a possible re-pricing event.

We have a clear structural set-up that could move commodity prices higher in the years to come.

So, what happens when a catalyst sets off disruption in this tight market?

Recall, March 2022, Russia’s invasion of Ukraine.

A devastating breakdown in diplomacy that also set-off fireworks on the LME trading floor…

In just THREE days nickel shot up 270%!

The world’s largest and oldest metals market terminated billions of dollars of nickel trades following chaotic price action and suspended trading for the first time since 1988.

Events like this expose vulnerability.

While investors have stayed clear of resource stocks in 2023, it seems the major miners understand what’s at stake.

Mergers and acquisitions have been rampant over the last 18 months.

Yet, M&A activity adds nothing to future supply. It simply changes the ownership structure of an asset.

It’s why this problem is set to linger…most professionals agree that it takes at least 15 years to move a deposit from discovery to production.

But the countdown hasn’t started yet…

Explorers and developers are key to meeting future supply and addressing low inventories.

Until we see meaningful investment in brownfield development or greenfield discovery, the 15-year time lag continues to push further into the future.

It’s why COMMODITIES are set to become a defining investment theme over the coming decade.

And it’s why I believe we remain in the early phase of a secular bull market.

Until next time,

|

James Cooper,

Editor, Fat Tail Daily

Comments