The monstrosity that is the annual Davos Conference dominated the headlines last week.

You know the one…

That meeting where the rich and powerful fly in on private jets and dine nightly on exotic banquets at a luxury Swiss resort, all while telling the rest of us to use less energy and eat bugs.

I’m no conspiracy nut, but you can’t help thinking 82-year-old Klaus Schwab, the founder of the World Economic Forum — known as Mr Davos — read about The Illuminati 50 years ago and thought, ‘Hey, that’s a good idea’.

I mean, under what democratic principle did we give these people any say in how to run our countries?

There’s a word for when big business and politics become too cosy with each other.

And that word is fascism.

In Mussolini’s Italy, government officials and corporate heads often held conferences to decide what ‘they’ would do with production over a given period.

Adam Smith, the father of free market economics, warned about this more than 300 years ago, stating:

‘People of the same trade seldom meet together that the conversation (doesn’t) end in a conspiracy against the public or some contrivance to raise prices.’

Davos is even worse than that.

Because you haven’t just got big business in the same room with each other, but power-hungry politicians too!

Anyway, I did my best to avoid this sham, but I did come across one very telling snippet.

To me, it actually showed not how powerful these people are but instead how scared they are.

Let me explain…

Jamie Dimon is quaking in his suit

The snippet in question was this one.

In it, head of JPMorgan, Jamie Dimon — a long-time crypto critic — can be seen uncomfortably shuffling in his seat as the hosts of CNBC ask him about Bitcoin [BTC].

He calls it a ‘fraud’ and a ‘Ponzi scheme’ that’s ‘going to zero’.

But you can tell he doesn’t want to talk about it at all.

Full credit to the CNBC hosts here, though. They gently push him to explain his position, and this is where it unravels…

First, he admits blockchain technology is real and useful; that JPMorgan even uses it!

He then makes an outrageous and frankly stupid claim about bitcoin’s scarcity.

When he gets pinned down on that lie, he makes a stupid joke about Satoshi — the anonymous founder/s of Bitcoin.

To anyone who knows the first thing about Bitcoin, this was as telling an interview as you’ll see.

Because either Jamie Dimon is ignorant of how Bitcoin actually works — which is bullish for bitcoin — or he’s scared — which is even more bullish!

For example…

On his first point, Bitcoin is a blockchain — the world’s first one — so to call it a Ponzi but somehow say blockchain tech is good is some impressive mental gymnastics.

Maybe the real reason is this?

|

|

| Source: CNBC |

It seems to me that JPMorgan has worked out they can make more money from ‘crypto’ than they can from bitcoin.

On his second point about bitcoin’s in-built scarcity…

The fact is to change bitcoin’s code — and alter the 21 million hard cap — you would need the vast agreement of a decentralised network of tens of thousands of nodes that operate all around the world.

These nodes are run by ordinary people (I run one), and no central party can do anything about it.

That’s really what Dimon hates — and above all, fears.

Bitcoin is a network he can’t control. Bitcoin is money he has no advantage in. The Bitcoin Network removes the need for middlemen like him.

As lead analyst at Swan Capital, Sam Callahan, noted on Twitter:

|

|

| Source: Twitter |

Lastly…

On his joke about Satoshi?

Well, clearly, he was just trying to get out of the hole he was digging.

The long and short of it is I wouldn’t listen to the first thing this bloke has to say about Bitcoin. His only motivation is self-interest.

Too bad for him.

Because Bitcoin doesn’t care about the Jamie Dimons of the world…

Take a sensible position

Since I first got into Bitcoin nine years ago, I’ve heard plenty of criticisms from mainstream finance people.

Like with Dimon, what is often revealed by these criticisms isn’t a flaw in Bitcoin but usually a flaw in the person’s understanding of what Bitcoin is and how it operates.

Or, more often, a hidden agenda.

There are far better critiques of various aspects of Bitcoin actually found within the Bitcoin community.

And I’ll happily admit that the success of Bitcoin isn’t — and never has been — a sure thing.

Bitcoin is something new. Something that can’t easily be compared to anything that’s ever existed before it.

And that makes it hard to grasp…and value.

But in my opinion, there is value to it — immense value.

As my pinned tweet says on Twitter:

|

|

| Source: Twitter |

What that ultimate value is has always been the big unknown.

Some have tried…

Cathie Wood, head of Ark Invest, recently doubled down on her US$500k per bitcoin valuation within three years.

In the past, financial powerhouse Fidelity has shown a model that predicted a value of US$1 billion(!) per bitcoin by 2038.

Though this seems a bit much…even for me!

I myself put out a report with a relatively more conservative figure of US$1 million per bitcoin by 2030 based on a potential euro fiat collapse in Europe.

Of course, these predictions are all just thought experiments to a degree.

They’re useful ways to try and highlight some feature of Bitcoin.

The truth is, though, the future is always unknowable. And Bitcoin has some powerful players — like Dimon — who hate it with a passion.

What I can say with certainty, though, is that this asset is the very definition of an asymmetric investing opportunity.

That is, an asset with immense upside potential compared to its downside.

That kind of opportunity is rare. And in my opinion, worth some small percentage allocation in everyone’s portfolio.

Whether that’s 1%, 2%, 5%, or more depends on the individual, their risk tolerance, and understanding of Bitcoin.

But if you don’t have some exposure, then the fact is you’re short (betting against) potentially the most exponential investment of the coming decade.

That isn’t hyperbole.

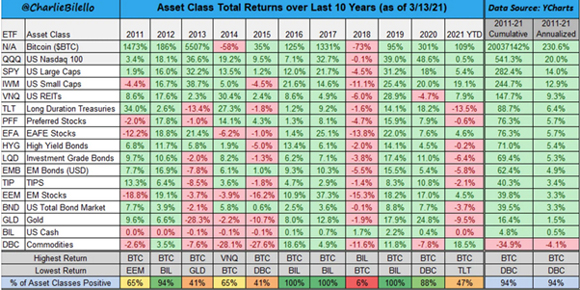

Bitcoin outperformed every single other asset class over the last decade by a very wide margin.

As you can see here:

|

|

| Source: Charlie Bilello |

This chart doesn’t show 2022, which was a big down year.

But interestingly, you can see the next three years after a big down year are usually positive for bitcoin.

Beyond the price, though, I also think that Bitcoin has many benefits for humanity — not least of which is stripping people like Jamie Dimon and the Davos elite of much of their power.

That’s a future I’m happy to back with both my time and my money…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Incidentally, bitcoin now has a higher network value than JPMorgan’s market cap. Perhaps that’s what really sticks in Dimon’s craw!