There’s an old investing legend that says a young Warren Buffett once spent a summer counting rail cars.

The idea was that if he could measure the level of freight activity in real time then he’d know how the economy was travelling before the market did.

I’ve no idea if this tale is true or not.

But I do know an older Warren Buffett put a lot of stock in rail traffic as a measure of economic activity.

He called it his ‘desert island indicator.’

It’s what I call a ‘bellwether’ indicator. A piece of information that leads or indicates a new trend.

Today, I want to show you two classic bellwethers, and one new one.

The first two are interesting to note, but it’s the new one that shows an imminent investing opportunity for you right now.

This digital bellwether could be pointing to an industry set to surge out of the gates in 2024.

Let me explain…

Two classic bellwethers

I often look at the stock charts of two major companies to do much the same as the young Buffett was trying to do.

The first company is the massive farming and construction equipment manufacturer Caterpillar [NYSE:CAT].

As a global company, the trend of their stock price usually reflects future infrastructure spending plans around the world.

I mean, if you’re going to build bridges, roads, and other big-ticket items, you’re going to need the equipment to do it.

With that in mind, check out the one-year chart:

|

|

| Source: Yahoo Finance |

It’s basically been a year of sideways action.

But when you zoom out a bit, you can see that the surge in July/August this year saw the stock hitting new all-time highs.

In other words, things are ticking along fairly well here, despite a small six-month down trend.

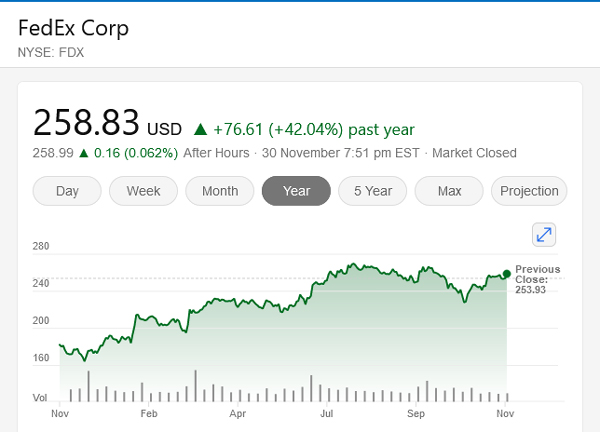

The second bellwether stock I often look at is global logistics giant FedEx Corp [NYSE:FDX].

They’re one of the largest logistics companies in the world with active operations in more than 220 countries.

So it works a bit like Buffett’s train freight indicator.

Check out the one-year chart here:

|

|

| Source: Yahoo Finance |

As you can see, this one has been on a tear, up 42% from 12 months ago.

Like the stock price of Caterpillar, it suggests that the overall economy is travelling pretty well right now.

However…

While the first six months of the year were positive, in both stocks you can also see the second half of the year has been in a minor downtrend.

Of course, this could just be a pause for breath. But it could also be the start of a trend change.

You won’t know which it is until it happens unfortunately.

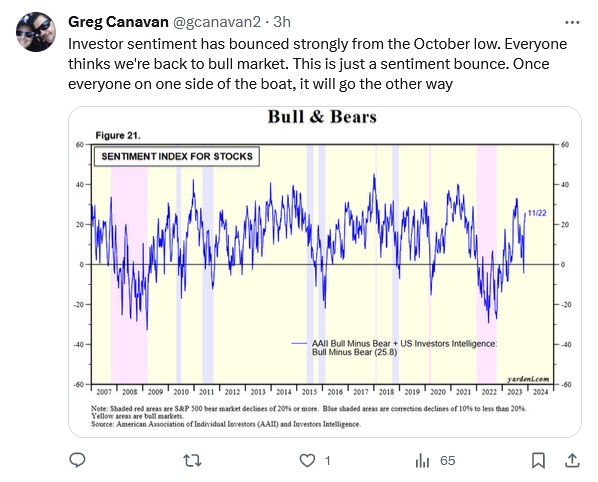

As my colleague Greg Canavan tweeted, you need to a be a little cautious right now, if not overly bearish.

|

|

| Source: x.com |

That may be true in the short term, but I think you should still have a bullish bias over the medium term right now.

Which brings me to the newest — and in my opinion — most exciting bellwether stock…

Watch the Salesforce Economy carefully

Customer Retention Management (CRM) software provider Salesforce Inc [NYSE:CRM] is one of the success stories of the past two decades.

The stock listed in 2004 at US$3.95 per share.

Today it’s trading at US$251 per share. A 63x gain in value.

Salesforce owns a whopping 33% share of the CRM market, which is almost triple its nearest competitor.

The company have used this reach to expand their influence within many fortune 500 companies.

They’ve innovated and brought out products that make customer retention easier and efficient in all sorts of industries.

A report from IDC in 2021 said that the ‘Salesforce economy’ would produce US$1.6 trillion in revenue by 2026, 3.5 times what they were in 2020.

And a more recent report from September this year found that the Salesforce economy , powered by AI, will create a net gain of 11.6 million jobs by 2028.

People now refer to ‘the Salesforce economy’ as an important metric to measure overall economic health.

As you can see this is a company with massive reach.

And it’s why their result from last week were so interesting.

You see, the company smashed through earnings expectations, driven mostly by strength in their MuleSoft (a software product that connects applications, data, and devices for business) and their cloud segment.

The market liked what they heard:

|

|

| Source: Yahoo Finance |

The stock leaped 9.53% on the day and the chart looks like it’s shaping up for a solid upwards run.

But here’s the deeper thing to understand…

This stock isn’t a software play; it’s a big data play.

As such, it’s a proxy measure of investment and growth of the big data economy around the world — much like Caterpillar and FedEx do for the physical economy.

As their CEO noted on the results call:

‘Most importantly, we’re bringing CRM, data, AI and trust together in a single, integrated platform, leading our customers into a new era of incredible productivity and growth.’

In my opinion, it’s this sector that’s about to go ‘full bull’ in 2024…

Companies are investing in big data — big time

We saw it with the Nvidia results a few weeks back.

And we now see it again with the Salesforce results last week.

The fact is…

Money continues to pour into big data stocks as companies around the world seek to leverage the productivity gains from using data efficiently.

And I’m talking EVERY company in the world here.

They’re all investing in AI, in cloud computing, in getting the right software partners, and in executing as fast as possible

Because, make no mistake, the race is on to see who can work out this new future first.

We don’t know who will win out in the end of that race but we know who is winning right now.

So far, the clear early winners are the companies that are helping to make it happen.

And although this market is already running hot, it’s still where smart investors should be looking to invest right now.

2024 is set to be a breakout year for the right data plays as AI driven efficiencies and new business models start to hit the market.

And at that point, the opportunity will be on those that are making this new future work best.

But right now, in my opinion, you don’t need to make such guesses. You can simply invest in the ‘big data shovel sellers’ to ride this trend through this first phase.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital