Santiago Nasar didn’t sleep much the night before his murder.

He had spent the night at the town’s wedding of the year and had gone to bed late. He had big plans for the next day, so after sleeping for an hour or so, he got up at 5:30am.

What Santiago didn’t know was that just hours after the marriage, the groom had returned the bride, Angela Vicario, to her family in disgrace. Or that Angela, pressured by her mother and brothers to name her first lover, had pointed the finger at Santiago.

Was he actually the culprit? No one knows for sure. Many think Angela was protecting someone else.

But anyway, to avenge their sister’s honour, the Vicario brothers decided to kill Santiago…and spent the whole night telling the town.

So, by the time Santiago woke up and was having breakfast, everyone knew…everyone except Santiago.

In fact, all through that morning, no one tells him, and no one does anything to stop the brothers either.

So Santiago dies that day, in front of his house, as the whole town watches.

‘There had never been a death more foretold’, writes Colombian author Gabriel Garcia Marquez in the novel Chronicle of a Death Foretold.

Believe it or not, the whole thing is based on a true story.

A few things I read yesterday reminded me of it.

There’s never been a recession more foreseen

Happy New Year and welcome back! I hope you enjoyed a wonderful holiday with your loved ones.

If you’ve been reading the papers, you know there’s a lot of recession talk out there.

‘It may be one of the most anticipated recessions of all time, but that doesn’t mean it won’t hurt,’ writes Bloomberg.

For one of its first articles of the year, Bloomberg called more than 500 Wall Street strategists to gather their thoughts on what could happen in 2023.

As they noted, ‘upbeat forecasts are hard to find’.

‘As the Federal Reserve ramps up its most aggressive tightening campaign in decades, the consensus view is that a recession, albeit mild, will hit both sides of the Atlantic with a high bar for any dovish policy pivot, even if inflation has peaked.’

It’s not the only warning out there.

The International Monetary Fund is also expecting ‘a very difficult year’, as Managing Director Kristalina Georgieva said:

‘The three big economies — the US, EU and China — are all slowing down simultaneously.

‘We expect one-third of the world economy to be in recession. Even countries that are not in recession, it would feel like recession for hundreds of millions of people.’

I have to say, all these alarms of a recession have made me a bit sceptical, if everyone is thinking the same and all. History has shown time and time again that anything can happen, especially in the financial world.

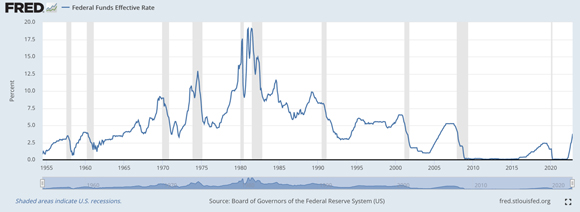

Still, it’s true that this has been one of the most aggressive tightenings from the US Fed in history…and that the effects will take time to ripple through the economy.

And it’s also true that when the Fed raises rates, it’s usually followed by a recession shortly after, as you can see below (the greyed areas show the periods of recession):

|

|

| Source: St Louis Fed |

In other words, while the Fed may look like it’s in control of the economy, the odds of them hiking rates just enough to slow inflation but not cause a recession aren’t very good.

And some of the other possible scenarios could play out well for one commodity.

Gold could rally in 2023

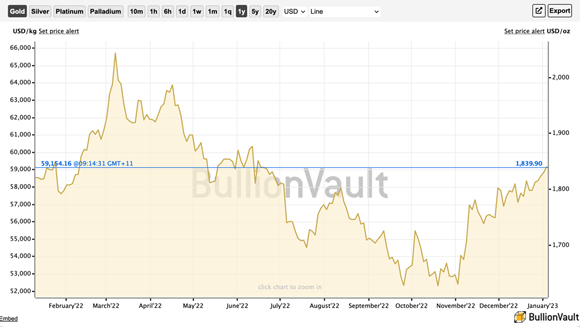

Gold was a mixed bag in 2022.

It rallied at the beginning of the year to more than US$2,000 an ounce, but then declined under pressure from higher interest rates.

Prices then started to increase at the end of the year as it looked like inflation started to slow and the Fed could slow rate increases:

|

|

| Source: BullionVault |

It then ended the year close to where it started.

Now, if the Fed stops rising rates or pivots…if the Fed tightens too much, causing a mild or a ‘not-so-mild’ recession…or even the chance of inflation rising out of control, all could play out well for gold.

All in all, gold does well with uncertainty, and with uncertainty looking to continue, gold could do well this year.

All the best,

|

Selva Freigedo,

For Money Morning