Editor’s note: In today’s video I discuss the XEC Index and the charts of a few companies in the index. For context, I also discuss recent market manipulation by SoftBank and JPMorgan. Click the thumbnail below to view.

There’s a certain purity to small-caps.

I must tell you they are risky and volatile.

But at the same time, you may get less of the SoftBank/JPMorgan behaviour in the smaller end of town.

In case you haven’t heard, the huge NASDAQ rally was in part due to an ‘options whale’.

Which was later revealed to be SoftBank, a huge Japanese multinational conglomerate.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

A pattern of behaviour based on incentives

As per a Financial Times article earlier this month:

‘SoftBank is the “Nasdaq whale” that has bought billions of dollars’ worth of US equity derivatives in a series of trades that stoked the fevered rally in big tech stocks before a sharp pullback…

‘“These are some of the biggest trades I’ve seen in 20 years of doing this,” said one derivatives-focused US hedge fund manager. “The flow is huge.” The surge in purchases of call options — derivatives that give the user the right to buy a stock at a pre-agreed price — has been the talk of Wall Street, as the sheer size of the trades appears to have exacerbated a “melt-up” in many big technology stocks over the past few months.

‘In August alone, Tesla’s share price shot up 74 per cent, while Apple gained 21 per cent, Google’s parent Alphabet rose 10 per cent and Amazon 9 per cent. One person familiar with SoftBank’s trades said it was “gobbling up” options on a scale that was even making some people within the organisation nervous. “People are caught with their pants down, massively short. This can continue. The whale is still hungry.”’

As for JPMorgan’s behaviour — it’s probably even more concerning.

Earlier today, the huge American firm settled for nearly $1 billion (emphasis added):

‘JPMorgan will pay $436.4 million in fines, $311.7 million in restitution and more than $172 million in disgorgement, the Commodity Futures Trading Commission (CFTC) said on Tuesday, the biggest-ever settlement imposed by the derivatives regulator.

‘Between 2008 and 2016, JPMorgan engaged in a pattern of manipulation in the precious metals futures and U.S. Treasury futures market, the CFTC said. Traders would place orders on one side of the market which they never intended to execute, to create a false impression of buy or sell interest that would raise or depress prices, according to the settlement.

‘This manipulative practice, which is designed to create the illusion of demand, or lack thereof, is known as “spoofing.”

‘Some of the trades were made on JPMorgan’s own account, while on occasions traders manipulated the market to facilitate trades by hedge fund clients, the CFTC said. The bank failed to identify, investigate, and stop the behavior, even after a new surveillance system flagged issues in 2014, the agency said.’

So, whether it’s SoftBank, JPMorgan, Enron, if you go back a bit further, doesn’t really matter.

This is par for the course in the finance world.

A little slap on the wrist usually ensues.

And this is why small-caps have their appeal compared to large-caps.

More money on the table, means more incentive to manipulate, coerce, or generally engage in underhanded tactics.

I’m not saying ‘dodgies’ don’t happen in the small-cap world.

For example, governance and director remuneration can be a major source of frustration to small-cap investors.

But what I am saying is that whether it’s central banks’ ultra-low rates, SoftBank/JPMorgan behaviour, or just outright insider trading, there is always going to be some form of conspiracy against your money.

Which brings me to the chart I promised you in the title of this article.

Two ways to look at this small-cap chart

Here’s the chart:

|

|

| Source: Tradingview.com |

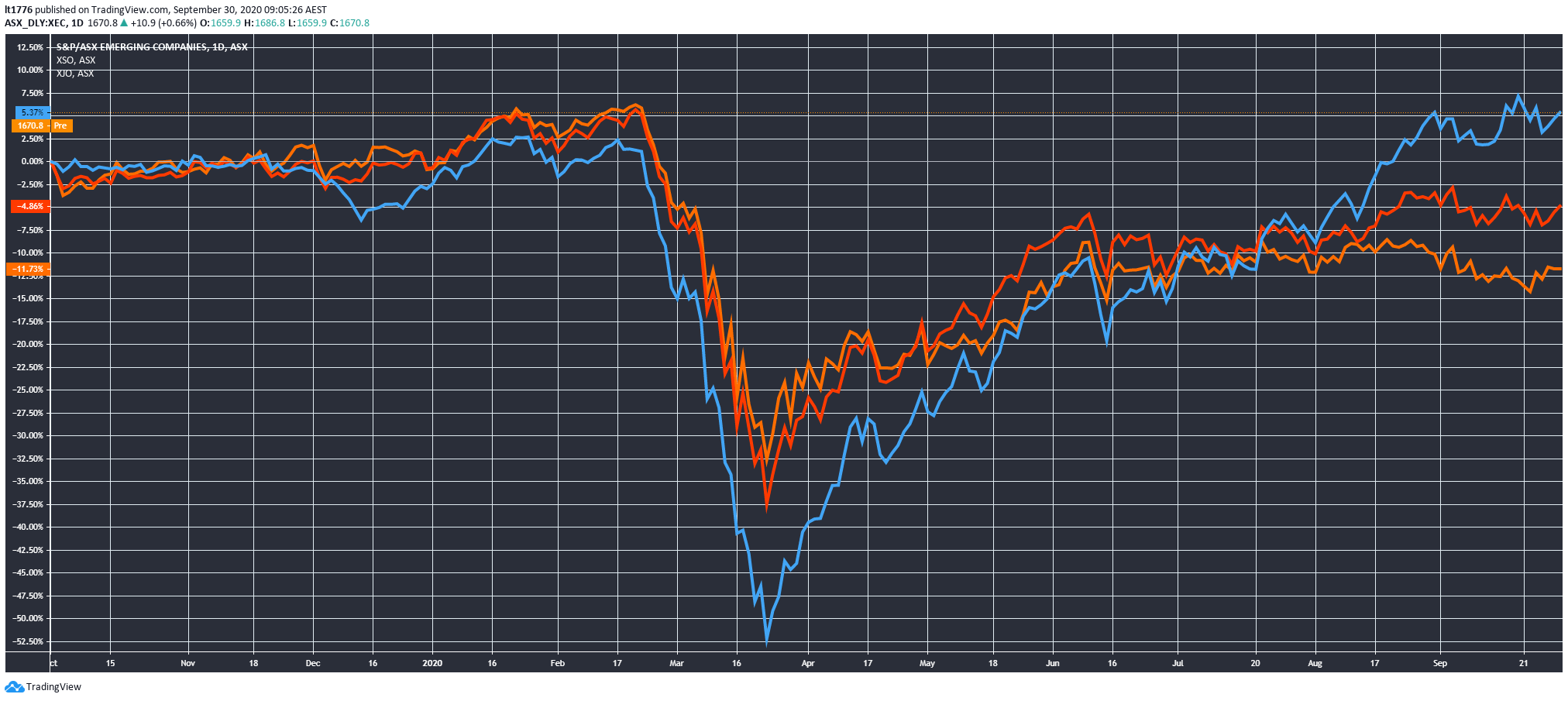

This is the S&P/ASX Emerging Companies Index [XEC] (blue line) versus the S&P/ASX Small Ordinaries [XSO] (red line) versus the S&P/ASX 200 [XJO] (orange line).

What is XEC?

And why is it up 5.36% in a year when the rest of the market got creamed?

XEC, ‘is the premier benchmark to measure the performance of microcap stocks in the Australian equity market.’

The selection of the index is done, ‘based on their rank in a predefined total market capitalization range and minimum liquidity hurdle. Constituents are float-adjusted market capitalization weighted.’

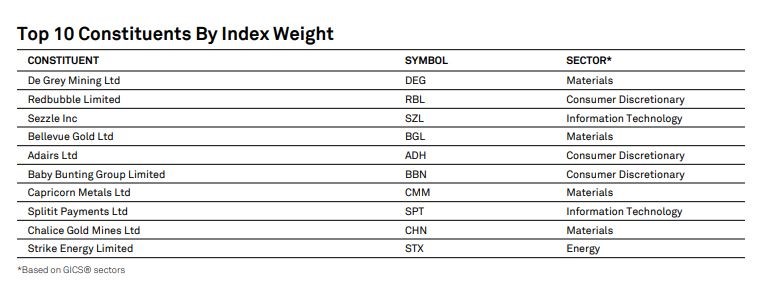

Here are the top 10 companies in the index:

|

|

| Source: Spglobal.com |

There’s a smattering of recent small-cap stars in there, like Redbubble Ltd [ASX:RBL] and De Grey Mining Ltd [ASX:DEG].

The S&P website refers to these companies as microcaps.

There are no hard and fast rules about what’s a microcap, small-cap, mid-cap, or large-cap.

But these two companies are definitely not microcaps — at least anymore.

And I won’t tell you which ones, but some of the companies on this top 10 list we’ve actually recommended to subscribers.

Early.

The outperformance of XEC can be viewed one of two ways.

One way to look at it, is retail investor speculation.

Or alternatively, these are genuinely exciting companies that are rightfully making waves in a sea of financial relics.

New ideas, new products, vast untapped resources, or just simply, better run companies.

‘Return of the Stock Picker’

Now, XEC underperformed the other two indices in the lead up to the crash.

But there’s a new generation of companies coming out of the woodwork that you need to be aware of.

Passive investing and ETFs may disappoint in this environment.

Now more than ever you need a practiced hand, selecting the most exciting small-caps.

It’s the ‘Return of the Stock Picker’.

You’ll hear more on this theme in the coming weeks.

We hope you stick around.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: We believe these rapid fire market opportunities are a fantastic way to grow your wealth. Which is why you’ll find us talking about the big trends that can uncover them. If that is something up your investment alley, then click here to learn more.

Comments