In today’s Money Morning…you can set your watch to this price action…more time, less crazy…global, self-sovereign money…and more…

The Nasdaq and S&P 500 both closed at all-time highs overnight.

Market bears are in a state of utter confusion.

My take?

Go with the flow, but keep one eye on the exit — that should always be your plan in any market, really.

Too many people are arrogant in markets. They think they should be able to dictate what comes next.

So, when it goes against them, they can’t work it out.

Confusion reigns!

Anyway, that’s not what I want to talk about today.

But in the vein of tough questions, let’s get back on topic with a riddle:

‘This thing all things devour;

‘Birds, beast, trees, flowers;

‘Gnaws iron, bites steel;

‘Grinds hard stones to meal;

‘Slays kings, ruins town;

‘And beats high mountain down.’

What is it?

Answer at the end…

You can set your watch to this price action

Ever since me and my mate Sam Volkering launched what I reckon was probably Australia’s first cryptocurrency advice service — at least one with a financial licence! — we’ve always added two notes of caution:

- Crypto values are very volatile, and…

- Never invest what you can’t afford to lose.

Today, I still stand by these two warnings. It’s a risky and ever-changing space that requires a lot of time and effort to really understand.

And yet, if you take a step back and look at the price behaviour of the market leader, Bitcoin [BTC], you start to see something amazing.

PS: We reveal four little-known small-cap stocks that cannot be ignored…Download your free report now.

An extreme level of predictability in its price over time.

In fact, you could say it’s running like clockwork…

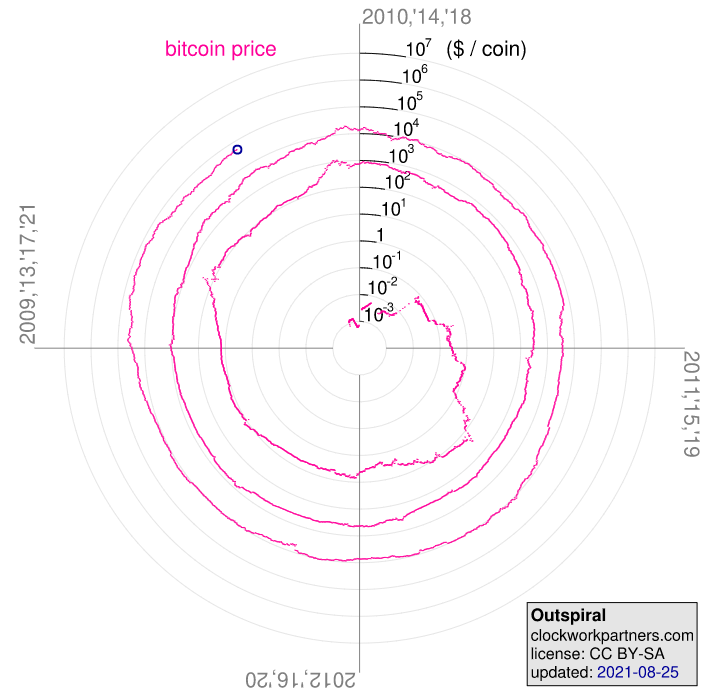

Check out this graphic:

|

|

| Source: Clockworkpartners.com |

This is a very strange but brilliant way of representing bitcoin’s price over time in US dollars.

Price is a logarithmic scale on the y-axis, and the angle of the line represents time (like a clock).

Simply put, you can see a relatively predictable trend. It shows the spiral of price moving further out over time.

The three circles that form represent the three ‘halving schedules’ — where the supply of newly minted bitcoin halved — we’ve had in bitcoin’s existence.

If this pattern continues, we could see the price of bitcoin hit US$100,000 (10^5) this cycle (next halving is estimated to occur around 21 February 2024) and US$1 million (10^6) before 2028.

What would break this pattern would be if these lines ever touched. That would signify a four-year cycle failed to maintain growth.

Interestingly, you can see this pattern play out in the inverse and spiral inwards when you price a commodity in terms of bitcoin instead of dollars.

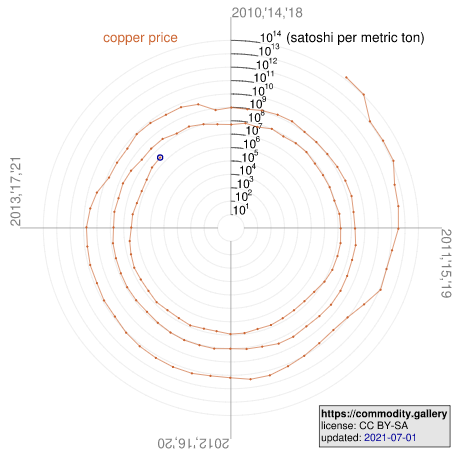

Here’s the copper price in bitcoin over time for example:

|

|

| Source: Clockworkpartners.com |

Basically, this shows the price of copper getting cheaper when priced in BTC (it spirals inwards not outwards this time).

So much for inflation in a Bitcoin world!

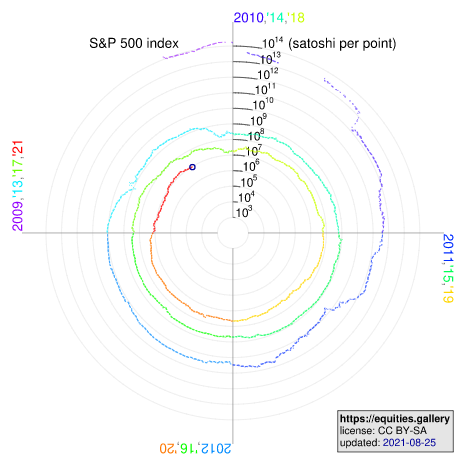

Even the high stock market ‘bubble’ is getting cheaper when priced in bitcoin.

|

|

| Source: Clockworkpartners.com |

Now, think about all this and you’ll realise what we’re seeing in all asset markets right now.

We’re not seeing bubbles in valuations as some think.

No, instead we’re seeing a decline in value of the money in our pockets. It’s buying less and less of what we need.

Bitcoin, on the other hand, is buying more and more.

I think it’s the only life raft you’ve got to escape from the sinking ship of fiat money…

More time, less crazy

Now, I’ve never shied away from the fact that I thought the crypto movement was going to upend the world of traditional finance.

Every single asset class will be consumed by it.

Even what we consider money itself.

This idea seemed crazy back in 2013/14 when I first got into bitcoin.

It was mocked by the professional finance sector all the way through the 2018/19 crypto winter.

Today, it’s still an ‘out there’ idea but it’s probably not considered as crazy these days. Well, probably just a little…

This psychological shift is due to the relentless persistence of bitcoin as an asset.

It’s not died like many predicted it would.

It wasn’t some flash in the pan ‘tulip’ bubble.

It’s not gone to zero.

It’s still here and it’s seeping further into everyday life, every single day.

For example, it was reported earlier this year that hundreds of banks are enrolled in a program to integrate bitcoin trading and custody solutions.

As reported in CNBC:

‘Hundreds of banks are already enrolled in the program, according to Patrick Sells, head of bank solutions at NYDIG. While the firm is in discussions with some of the biggest U.S. banks, many of the lenders that have agreed to participate are smaller institutions like Suncrest, a California-based community bank with seven branches.

‘“What we’re doing is making it simple for everyday Americans and corporations to be able to buy bitcoin through their existing bank relationships,” Sells said. “If I’m using my mobile application to do all of my banking, now I have the ability to buy, sell and hold bitcoin.”’

It’s amazing to me that we’re at this point now, considering the pushback bitcoin has always got from the banking industry.

Do they now see the writing on the wall?

And some financial services are going even further in embracing bitcoin…

Global, self-sovereign money

Jack Dorsey’s Square Inc announced late last week that they’re looking to develop a fully decentralised Bitcoin exchange.

He tweeted:

‘We’ve determined @ TBD54566975’s direction: help us build an open platform to create a decentralized exchange for #Bitcoin’

‘TBD’ is an unnamed unit of Square with Mike Brock as project leader.

Brock explained more:

‘We believe Bitcoin will be the native currency of the internet. While there are many projects to help make the internet more decentralized, our focus is solely on a sound global monetary system for all. But including all requires a few pieces we think are missing.’

Don’t underestimate how big this is.

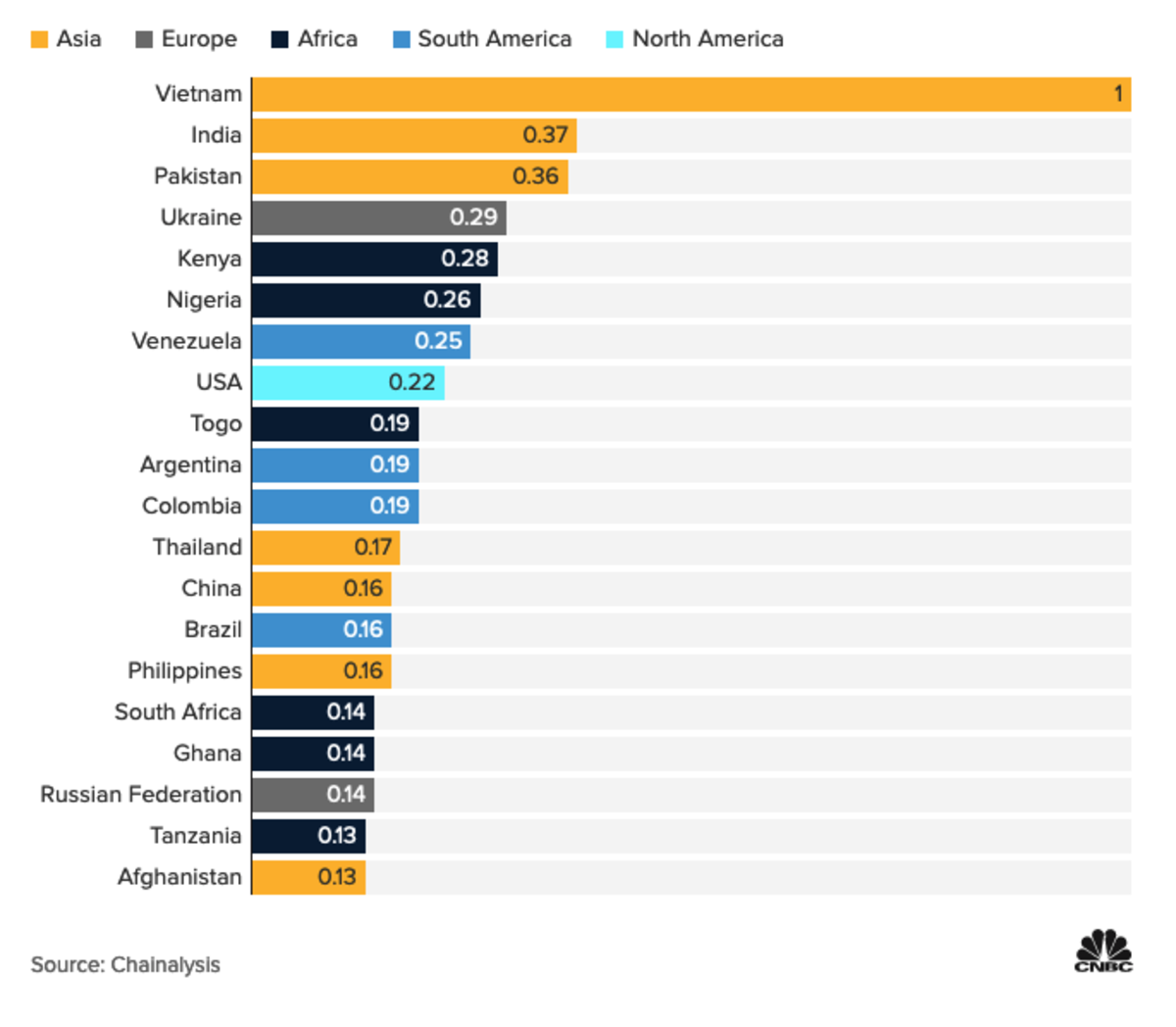

And in case you think this is just some type of ‘kumbaya’ virtue signalling, it’s important to realise how important bitcoin already is to people in a lot of emerging countries.

This chart shows bitcoin adoption as ranked by analytics firm Chainalysis:

|

|

| Source: CNBC |

Sometimes we forget our financial privilege.

Our banking institutions are more stable than most.

We generally don’t need to worry about our savings being confiscated or our currency smashed.

Other countries do.

And not just third world places.

It happened to citizens of Cyprus, a member of the Eurozone, in the aftermath of the 2008 GFC.

47.5% of all bank deposits over 100,000 euros were seized in 2013!

So don’t think it can’t happen here.

Being able to self-custody your wealth could literally be a lifesaver.

Lastly…

You’ve probably guessed the answer to the riddle at the start.

It’s ‘time’.

But for the world of finance, it might just be ‘Bitcoin’ too.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.