Three things I’m thinking about today…

1. Today’s missive kicks off with a VERY handy point just out from the Wilson Group.

Let me set the scene…

Shares dived into early April. You know this. Part of why is due to the action happening over in US “Treasuries”.

These are US government bonds.

Every asset in the world is priced off this market, in one way or another.

Here’s why you and I care.

When US yields start to gyrate in a big way, investors get nervous. Very nervous.

The whole credit system of the global economy is built on US government debt, which has been spewing forth for forty years.

Now…

Rising yields mean that bond prices are falling.

And it was only a few weeks ago that bonds were dropping hard as the share market tanked, as well.

One explanation was foreign holders dumping US assets in reaction to Trump’s tariff agenda.

Was it true?

Not according to the Wilson team. Here’s why.

They write…

“Our modelling suggests that volatility in U.S. Treasury bond yields has much more to do with negative swap spreads than the perceived riskiness of the U.S. relative to the rest of the world.

“To be sure, we could see in the short-term more volatility in markets as more investors embrace the “end of U.S. exceptionalism” narrative.

“But we think that ultimately, U.S. policy makers have the tools to manage their bond market and currency.

“We do not see the present uncertainty as a reason to panic. Rather, we think it is creating some wonderful medium-term opportunities.”

This is an important point. If Trump or the Fed lost control of the US dollar and/or bond market, mayhem would result.

If the Wilson team are right, Trump can negotiate his way out of the current chaotic outlook. He can walk back pretty much everything.

Implied in all this is that the current dip in the share market is a buying opportunity. The bull market isn’t over.

It may or not be right. Time will tell. There’s always risk of more downside. But I suspect they are correct.

2. Here’s another point. We all like to point to the massive US debt.

However, I will agree with Treasury Secretary Scott Bessent on one thing.

The US government has big assets as well as big liabilities. We tend to forget that when we obsess over the US$36 trillion black hole of US debt.

What’s big enough to help out here? You might be surprised to know that most of the American West is federal land.

One estimate a decade ago put the value at US$100 trillion. It’s probably double that now.

Vast tracts could be sold off to reduce the national debt. That’s one idea.

My colleague Jim Rickards has an even bigger one – and better odds of happening.

Every American is a theoretical millionaire because of a national “trust fund” few appreciate.

You can see what he says on Wednesday, April 30. Be sure to check your inbox for more details.

This is important too…

Part of the fragility in financial markets is the notion that Trump is driving the rickety US economy into the abyss.

Anything that counters this view gives you and I both a sounder sleep at night – and a chance of making a buck in shares for a potential rebound.

3. My latest issue for Australian Small Cap Investigator went out last night….

I’m pumped for this idea.

Certain shares were smashed in the big sell off recently.

I see an opportune time to pick this one up cheap and sit on it for 12 months. Under a best case scenario it could easily double in 2 years.

I’m not saying it’s without risk. But the beauty of right now is a lot of bad news is battered into share prices. It’s part of why markets are rising again – at least for the moment.

Back on April 7 – the day the ASX fell 6% at the open – I wrote:

“History says buying in these down moments can lead to fantastic long term returns.”

My favourite small cap idea of this year wasn’t immune to the big sell off. It got clobbered alongside the market too.

That said, if you bought it under pressure on April 7 you’d be up 30% right now. Easy to write, very hard to do.

However, long term, there’s still so much potential.

We’re just back to where we started. You can still get all the details here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

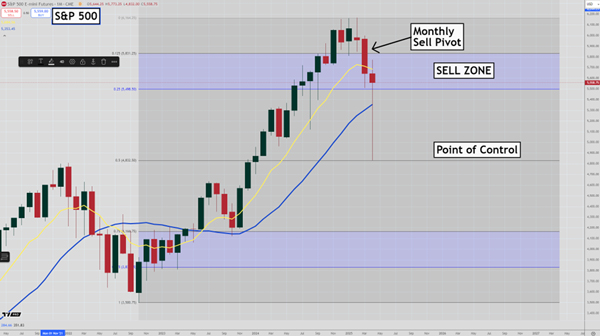

Murray’s Chart of the Day

– S&P 500

|

Source: Tradingview |

After the excitement of the past month markets have gone into a holding pattern.

Volatility has died down for the moment because the overriding view is total confusion.

Trade between China and the US is grinding to a halt. But will a string of bad data be enough for both sides to come to the table and make a deal.

What about the 90 day hold on other tariffs. What is going to happen there?

The lower the market goes the more Trump gets spooked. So should we get bullish on that or wait for things to crash again and more news to come out telling us what the hell is going on?

It’s at times like this that technical analysis can come to your aid.

By having a clear model of market behaviour you can step back from the confusion and lay out clear lines in the sand to guide your decision making.

I am just as confused as anyone else about what is coming next.

But I have set out what I need to see to change my view one way or the other.

The picture above is a monthly chart of the S&P 500.

It shows the rally from 2022 to 2025.

By analysing that major wave we can work out what is happening from a technical perspective.

The recent correction hit the midpoint of the wave exactly and has bounced into the sell zone.

If we are going to see another wave lower the odds are high that it will start from this area.

Also, you can see that a monthly sell pivot was confirmed in March.

Until we see a monthly buy pivot confirmed I reckon it pays to tread carefully.

The long-term trend remains up because the 10-month EMA is above the 20-month SMA. So the big picture is still constructive and perhaps we will see a buy signal soon that means it will be game on again.

But while prices remain in the sell zone of the wave and the most recent pivot is a negative one, I don’t need to chase the market and will remain wary that another wave of selling could be coming soon.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments