The BetaShares Australian Equities Strong Bear Hedge Fund [ASX:BBOZ] is a managed investment fund with units trading on the ASX. It is a bear fund, meaning its aim is to help investors profit from or protect against a declining market.

For instance, with the All Ords shedding .41% at time of writing, BBOZ has gained 1.94% today.

What does BBOZ do?

Essentially the fund is comprised of cash and futures positions which take short positions in the market to profit from a fall.

A 1% fall in the Australian stock market on a given day can generally be expected to deliver a 2–2.75% increase in the value of the Fund (and vice versa).

BBOZ and the All Ords

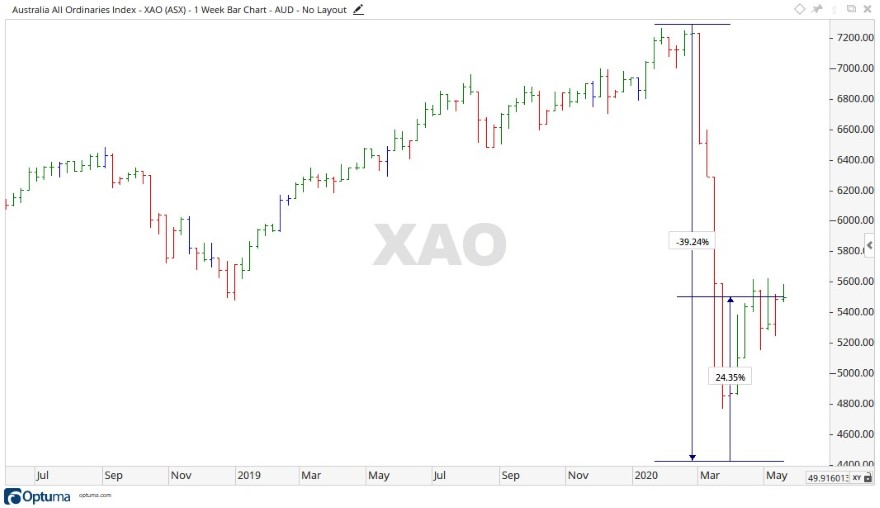

The Australian All Ordinaries [XAO] took an absolute hammering from the end of February, falling to the March low, over 39% from its high.

Recovering 24.35% recently, the All Ords correlates to losses for BBOZ.

BBOZ rose 151.25% from the end of February before falling back 43.67% to its last close.

In short, when the All Ords falls, the fund rises and vice versa.

Source: Optuma

Source: Optuma

Two make one

When the two are put side by side, some direct comparisons can form a clearer picture of what’s happening in the market.

The All Ords is currently finding resistance struggling to move up past the level of 5,578 points.

With weaker trading volume the move up could be looking weak, as discussed in my recent market wrap article.

For the move to gain credence, it would need to power through the 5,800-point mark.

Comparing this to BBOZ, you can see on the chart that the BBOZ unit price had fallen to the $11.10 level and moved sideways, again much like the All Ords, this was on decreasing trading volume, signalling that the move down may be running out of steam.

Should the All Ords take the plunge down, this will push BBOZ up.

Source: Optuma

It’s two sides of the coin.

Here at Money Morning, we aim to give readers unique insights from across the market to help them make more informed investing decisions. Money Morning is a unique publication, that you can get direct to your inbox seven days a week. If that sounds like something you’re interested in, then click here to learn more.

Regards

Carl Wittkopp,

For Money Morning

Comments