A character in Hunter S Thompson’s Fear and Loathing in Las Vegas remarked:

‘When the going gets weird, the weird turn pro.’

Markets, and perhaps society more generally, are certainly getting weirder by the day.

A rapper (Kanye West) is planning to launch a US presidential bid in an effort to capture the weird vote.

The proposed launch of Facebook’s Libra is forcing central banks’ hands as the world scrambles to release more ‘weird money’ into the system.

Meanwhile, as economies buckle under the strain of lockdown, many major indices continue to weirdly edge up.

It’s not as strange as you may think, though.

Celebrity candidates are regularly part of the US election landscape (Schwarzenegger, Ronald Reagan).

In times of immense economic hardship, the temptation to tinker with monetary policy grows (US leaving the Gold Standard in the ’70s).

And the GFC was a prime example of how monetary and fiscal stimulus can force markets higher in an economic downturn.

If all of this seems weird, it’s just because we are getting all of it at once.

But what should you, the individual investor, do in these strange times?

Drown out the noise

It may sound hackneyed, but don’t invest on headlines.

One of the stocks we tipped in our Exponential Stock Investor service made it into the pages of the Australian Financial Review.

Suddenly its share price went through the roof — and I even had a close friend tell me that her father was weighing up an investment.

By the time it’s in a major masthead though, it’s usually too late.

The goal is to beat the headlines to the punch.

The other thing to be wary of, especially with certain blue chip stocks, is that claims that they represent ‘value’ can be wide off the mark.

Take for instance the argument that shares in the Big Four banks ‘have never been cheaper.’

Or headlines that claim it is now their ‘chance to shine.’

Yes, from a charting perspective Big Four bank stocks like the leader, Commonwealth Bank of Australia [ASX:CBA], are at levels not seen in a long time.

You can see the March low for CBA shares corresponded to a share price last seen in September 2012:

|

|

| Source: tradingview.com |

And the current price of CBA shares is still hovering around the period when the Banking Royal Commission was on.

But does this mean that they represent great ‘buy and hold’ companies for the next 10 years?

Pushing back against this in the immediate future are two things.

The first hurdle, is what happens when the pause on mortgage payments stops.

Some 37.5% of households are under mortgage stress according to the latest Digital Finance Analytics (DFA) data.

Then the second hurdle in September, is the ‘cliff’ or proposed cut-off for the JobSeeker and JobKeeper bonus payments.

If you think of Big Four bank shares as a kind of catchment for macroeconomic sentiment, then what happens in the next three to four months could be crucial.

Further down the track is the threat of fintechs — a regular topic here at Money Morning.

All of this adds up to a more bearish picture for the Big Four than some commentary and headlines would have you believe.

Identify change early

Some trends are easy to spot early.

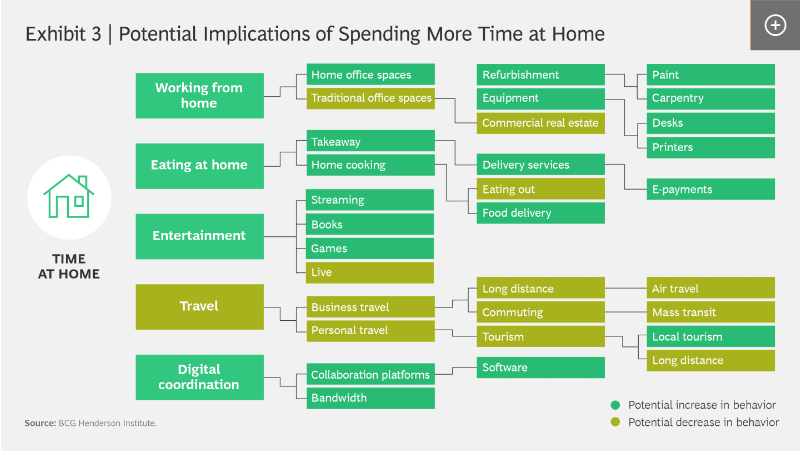

A couple of months ago my colleague Ryan Dinse shared this chart:

|

|

| Source: BCG Henderson Institute |

In hindsight it all looks so obvious.

People would work from home, commercial real estate would be hit hard, connectivity like 5G would be back on the agenda.

The list goes on…

Travel companies would be smashed along with hospitality, and e-commerce would thrive.

But there are other trends that emerged as well that are growing in importance as the pandemic continues.

Cyber security is now a major focus in Australia, for example, with the government recently earmarking $1.35 billion in spending on beefing up the country’s defences.

Another left-field trend that might not be on investors’ radar?

The rise of mining companies and the prospect of another commodities boom.

It just goes to show what kind of investment opportunities are out there if you can spot change early.

Think ahead, plan accordingly

Ryan Dinse and I stress this to our subscribers regularly.

If you can think three to five years ahead, or at least a minimum of two years ahead, you are in with a chance of beating the market.

The big funds and those that run them are duty-bound to focus on returns in a 12-month window.

They have shareholders and CEOs to please, and their performance is thought of in this time frame.

But if you drown out the noise, identify change early, and have a longer investment horizon, then you give yourself a major leg up.

So, no matter how weird markets get, it’s up to you if you want to turn pro.

Regards,

Lachlann Tierney,

For Money Morning

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Comments